By John Helmer in Moscow

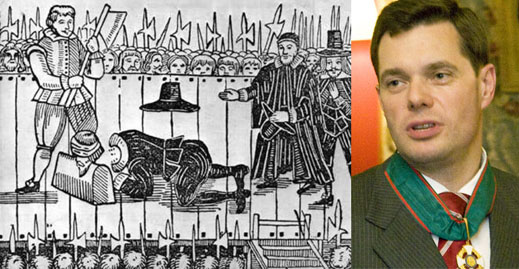

Severstal, the Russian steelmaker owned by Alexei Mordashov (pictured), sought today to play down a rating downgrade by Fitch, issued earlier this week. At the same time, the company has removed the head of its loss-making North American division; and announced that in Italy, where its Lucchini steel operations are also loss-making, Mordashov has been awarded the Italian state’s Order of Merit.

According to Fitch, it has reduced Severstal’s Issuer Default Rating from BB- to B+, and put the company on watch for possible further downgrades over the next six months. The reason, according to a release by the ratings agency, is “Fitch’s expectation that the current global recession will have a significant negative impact on Severstal’s operating performance and credit metrics….Fitch now does not expect that Severstal will be able to regain a “through-the-cycle” credit profile consistent with the ‘BB’ rating category within 18-24 months of the trough of the current recession.” Fitch also said there is “uncertainty regarding the outcome of negotiations with lenders in respect of potential covenant breaches under its various facilities.”

A source inside Severstal told CRU Steel News: “If you look at other similar ratings, you will see Severstal keeps at the general level of the sector”. The source noted that recently the company has shown positive results, as steel volumes have grown, adding: “the rating agencies are in doubt whether Severstal will be able to keep at that level further.”

Of particular concern, Fitch said in its public report on Severstal, is that “in Q109, Severstal’s North America division reported an EBITDA loss of USD243m (negative EBITDA margin of 25%) versus EBITDA of USD88m (EBITDA margin of 7.6%) for its Russian steel operations. ” Fitch said it projecting for the Severstal group as a whole “a 45% year-on-year fall in revenues and an EBITDA margin below 10%. As a result, net leverage is expected to deteriorate to around 6x-7x (FY08: 0.9x), and funds from operations interest coverage is forecast to fall to 1.5x-2x (FY08: 22.6x), both below the peer group average in the ‘BB’ rating category.”

In the two days since the rating announcement, Severstal’s share price first gained 4.6%, and then dropped 1.9%. In a report for investment clients on Thursday, Uralsib Bank advised clients to sell Severstal shares, along with fifth-ranked Russian steelmaker and miner, Mechel. The bank recommended buying Magnitogorsk Metallurgical Combine.

There has been no official response to the ratings downgrade by the company. However, Severstal announced that it has replaced the head of Severstal North America, Gregory Mason, with the chief financial officer of the company in Moscow, Sergei Kuznetsov. No reason was announced for the change. According to a statement from Mordashov, posted on the company website: “We thank Gregory for the contributions he has made to the development of Severstal’s international businesses, and we wish him well in the future.” Kuznetsov has been replaced as CFO by Alexei Kulichenko, who moves over to the group headquarters from the mining division, Severstal Resources.

According to a separate company announcement, Mordashov received the Order of Merit from the Italian Ambasador to Russia on July 15. The order, according to Severstal, is the highest award in Italy and is presented “for considerable services to the nation in the fields of literature, arts, and economics, as well as for social, philanthropic and humanitarian activities.”

Severstal bought the Lucchini company from Mordashov in October 2006, after lending him the cash eighteen months before, in April 2005, to buy it for himself. In the second transaction, Severstal paid Mordashov a premium of €182m to buy it back for the company.

The latest report of Lucchini’s performance was issued by Severstal in May, and was for the first quarter of this year. Lucchini’s earnings (Ebitda) were negative by $43 million, following a $1 million loss in the last quarter of 2008. Over the second quarter, Lucchini’s revenues dropped 32% to $455 million, and its production of crude steel fell 21%. Although Severstal’s reports indicate that it counts Lucchini’s assets at 18% of the total asset value of the group, the Italian operation contributed only 16% of group sales in the first quarter. Its losses ran to 19% of the group’s total losses.

The Italian state grades the Order of Merit into five ranks. There are 8,362 first-class holders, and 85,863 fifth-class holders. The Italian Embassy in Moscow confirms that Mordashov’s order was the third class, which has 13,973 holders.