By John Helmer, Moscow

@bears_with [1]

There is a right way and a wrong way to understand how the war against the West is being fought on the Russian home front.

The wrong way is to read the Anglo-American media, their stay-behind correspondents in Moscow, and their aggregators in Washington, DC.

The right way is to take a Russian beer. I mean, take the Russian beer business as an illustration of how the fightback is being fought – and how effectively.

For twenty years of Dances with Bears since 2002 [2], the Russian alcohol sector, and the beer industry in particular, have been reported closely in order to understand the way the country and its people are working. The history of Russian public finance is also the history of taxes [3] on drinking alcohol. Every element of the beer business – from the brewing itself to the bottle and can, advertising, investments, and the market strategies of the producers and the St Petersburg boozers — has been analyzed. Read the archive here [4].

Source: http://johnhelmer.org [5]

The tactics of the major international beer companies and of Russian oligarchs like Gennady Timchenko and Oleg Deripaska to seize the lion’s share of the profit from Russian drinking habits have been exposed for what they were – and still are.

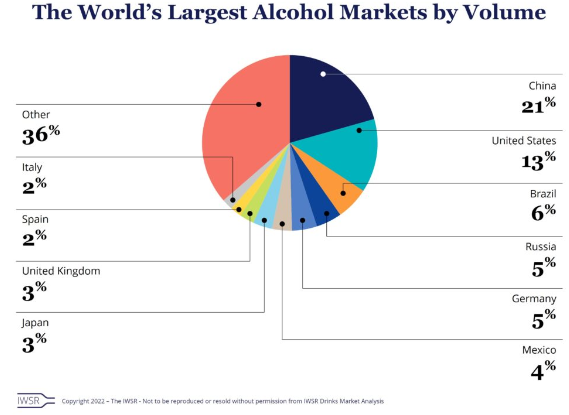

Russia is a leading beer market in Europe roughly equal in volume and value of consumption to Germany. In the world, it trails far behind China and the US, and just behind Brazil. In 2021 this is how the global market looked [6].

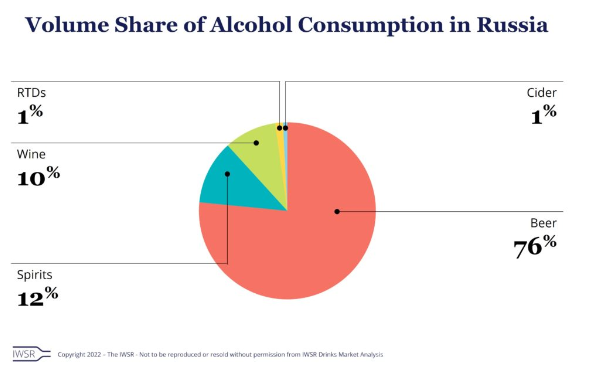

Inside Russia last year, as the pandemic effect wore off, beer dominated domestic consumption compared to vodka and wine.

Source: https://www.theiwsr.com// [7]

USDA Foreign Agricultural Service (FAS), report [8] for 2014-2015.

Before the war changed everything for everyone, the Russian beer market reports indicated that consumption was growing by comparison with spirits and wine. The summer of 2020 had been hot and stimulated thirst; the lockdowns and self-isolation caused by the virus also encouraged more beer drinking. Retailers and brewers in the business press reported an increase in the volume of one-time purchases of beer; the one-time beer drinkers then turned into regulars and began buying often for drinking more at home.

According to the Russian industry bible, Pivnoye Delo (“Beer Business”), when Covid-19 first arrived, there had been a polarization in the attitude of domestic consumers to alcohol. Although the number of people who were going dry was growing, home consumption of beer was also increasing as beer lovers consumed more. “But unlike other consumer goods, even when beer consumption unexpectedly revived in 2020, the increased demand was not accompanied by an increase in retail prices. It was twice as slow as the official inflation rate (+6.5%) published by the Central Bank. Economic analysts explained this price jump by an increase in consumer demand. However, due to the intensity of competition in the beer market, the beverage did not become more expensive.” Read the full report from last October here [9].

“The main role in fixing prices was played by the Carlsberg Group’s desire to restore volumes by means of promotion campaigns, as well as by the growth of market share of the private beer labels. Price growth resumed only in 2021.”

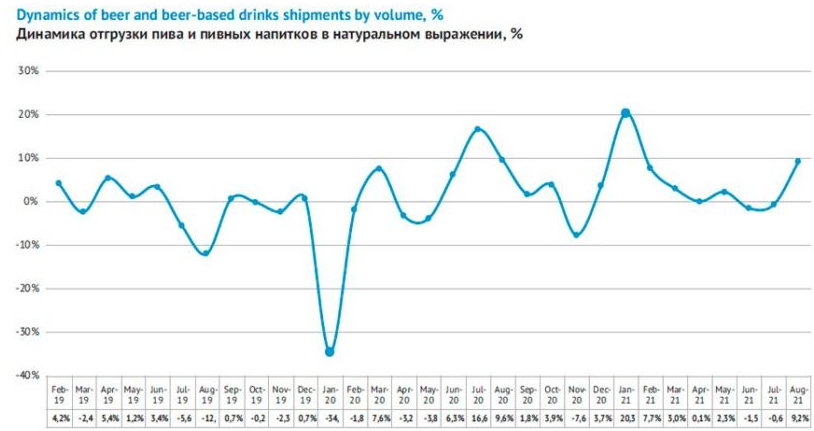

Brewery shipments and beer sales for June through August of 2020 reached a record level compared to the previous three years. They fell back seasonally, and resumed their growth in the summer of 2021.

Source: https://pivnoe-delo.info/ [9]

The dominant brewing companies in Russia have been AB InBev Efes, Carlsberg and Heineken. Together [10], they swallowed just over one-third of the Russian beer market. Carlsberg is Danish, Heineken Dutch, and AB InBev Efes is a combination of US, Belgian, Brazilian, and Turkish holdings [11].

By cutting their profit margins and keeping prices level last year, AB InBev and Carlsberg had been holding on to their market shares; Heineken tried to keep its profit margin and raised its price, so it lost market share. The share of sales for imported brands was growing. The industry was predicting for 2022 that sales would rise in money terms by up to 3%. Most of that, according to the published forecasts, would be due to price increases; they had started upwards in the last quarter of 2021 [12].

What happens next is the story of how the Russian beer business is fighting the war, managing cost price inflation, and combating the sanctions

stopping imports of raw materials like hops, aluminium strip for cans, and the well-known beer brands. This is explained in an interview by Oraz Durdyev (right), chief executive of AB InBev Efes, which was published this week in Gazeta.ru [13]. As is traditional in the Russian press, and necessary

in wartime, there is much meaning to be read between the lines. Note for example how Deripaska, the only Russian oligarch to have declared himself on the other side of the war, is attacked for his failure to invest in the domestic production of aluminium strip of the quality required for beer cans.

For the story of how Deripaska managed [14] that, selling his Samara rolling mills to Alcoa, and then trying to sell all of Rusal to the US corporation; faking his share price [15]; before getting Kremlin money to cover his debts and avoid nationalization after US sanctions, read this [15].

The following is an English translation of Durdyev’s original interview, with added illustrations.

Source: https://www.gazeta.ru/ [13]

The lead says: “’Price growth is inevitable’: Oraz Durdyev from AB InBev Efes explained what is happening in the beer market.” The intertviewer is Mikhail Kotlyar.

“What will beer producers do with foreign supplies of hops and labels? How will the labeling of products affect them? What will happen to the market after Heineken and Carlsberg leave? Why are craft brewers not competitors in the mass market, and why do people buy non-alcoholic beer?…

Question: Let’s try to formulate three trends of the new reality that has arrived for Russian brewers and not only after February 24?

Answer: For us, as for everyone on the market, that date was a surprise — new challenges have appeared. We also experienced all the price escalations and other difficulties faced by any business at that time. The first thing we seriously faced was logistical problems. China, in principle, has not fully recovered after the pandemic. This has a very negative impact on the cost of goods and services around the world. But after February 24, another effect played to a greater extent — there was a restriction on air transportation. Our business runs on wheels — we use mainly land transport and sea transportation — as, for example, in the case of Corona Extra, which is shipped from Mexico. However, there are also certain restrictions for maritime logistics; for example, the refusal of a number of the largest container lines to make deliveries to Russia.

So, in these conditions of limited air transportation, all those who used to use airplanes have come to sea and land transport. Now it is auto and rail transport that is optimal for shipments, for example, from China. Previously, there were difficulties directly in moving trucks between countries, and now new customers have been added who have been cut off from air transport.

And this overheated the market?

This has significantly raised the price of transporting products and raw materials from abroad; in February this has jumped fivefold for us.

How did this ultimately affect the production of beer?

It has turned out that we were faced, not only with an increase in the cost of transportation, but also with a decrease in the availability of this transportation. Even at the price that has increased several times over, we could not always find transport. That was three months ago. The factor was in effect for a month, maybe a month and a half. Now there is a different trend in logistics. After our carriers were limited in the distribution chain abroad, the price of road transportation began to decrease and the availability of transport within Russia significantly improved.

Why is this happening?

The domestic market turned out to be oversaturated, so the transport companies have had to reduce their price. This entails a loss of marginality for carriers, and spare parts, fuel, and maintenance become more expensive.

So transport that has become more expensive and less accessible is the first effect of the new reality. Is there a second one?

The second is raw materials, or what we think of as raw materials. The same hops in Russia are not growing in the quality and quantity necessary for industrial production. Our hops are completely imported, although all other raw materials are 100% localized. But we must understand that despite the fact that hops occupy an insignificant share in the cost price, it is impossible to brew beer without it. It’s an essential ingredient.

Russian hops cultivation is a specialty of Chuvashia. Read more: https://www.calvertjournal.com/ [16]

Where do you supply it from?

For hops, especially for our licensed brands, we use only certain proprietary varieties. Traditionally, we took it from the USA, Turkey, the Czech Republic, Germany. Although it is not included in the list of goods prohibited for import, after the introduction of new anti-Russian sanctions, the delivery logistics problems have faced the entire industry. We are currently working with the Ministry of Agriculture to revive the hop culture in Russia, which was actively developing in the USSR. It should have been done a long time ago.

Does Chuvashia seem to be actively reviving?

Everyone knows the example of Chuvashia. But their volumes, at best, will be enough for local producers. And these are not the varieties which large brewers can use, because the varieties are certified, they are patented. Beer from Chuvash hops is like making wine from a variety of Isabella grape [17].

How are import problems being solved now? It is clear that there are some reserves, but will they be enough until the end of the year?

All manufacturers are now looking for alternative ways of delivery and the establishment of safety stock to ensure the sustainability of their business. Absolutely everyone is stocking up, no one knows what will happen next.

This stockpiling can also be called one of the trends.

Absolutely.

Does it apply to the whole of Russia’s business in principle?

In general, for all categories. We are not an exception in this regard, but rather the rule. We are also trying to provide ourselves with packaging. Everyone is also struggling with this problem, trying to solve it for themselves. Some do it with great success; others with less. Only recently Tetra Pak reported the lack of paint for juice boxes. Of course, we don’t use Tetra Pak, but we also have problems. The paper used for the beer label has always come from abroad, and so, accordingly, it is now in fairly limited supply.

Is there really no replacement in the domestic market?

There are a great many things in Russia, there are very good raw materials. But the issue right now is in the processing industry, in companies which bring the final product to the end. It’s like this with an aluminium can. For example, there is Rusal, the absolute leader in aluminium refining, but we do not have the rolled metal. As a result, the aluminium raw materials go abroad; sheets are made of it there; then they are brought back, and the can is manufactured here. So long as there is no fully verticalized production system, full import substitution is out of the question, unfortunately.

How about the general principle of global cooperation?

Yes, and we have been following the path of globalization for a very long time — it is quite difficult to divorce the whole world in one day. We are part of this system. Probably, there are producers of beer labels in Russia as well. But the question is also in accessibility and quality. We have very high standards and requirements for everything: for the can, bottle, label. There are volumes of technical specifications we present to suppliers because for us the brand, the image are not just words. Everyone is trying to cope with this problem in some way. For example, some manufacturers are rejecting label parts for their product.

What about the departure of competitors and Budweiser (Bud)? Two other major players in the beer market — Heineken, Carlsberg — announced their departure, the sale of their business in Russia. Has something changed from this in retail, in wholesale?

Announcement [18] of the war-related exit of Budweiser. For earlier announcements from Carlsberg and Heineken, click to read [18].

We have all read the statements of their headquarters. As far as we understood them, the market situation will not change until all the announced transactions are completed. Obviously, some products from Russian stores will leave. But it’s too early to talk about it. If you go to the store, you will see products whose manufacturers have announced their withdrawal from the Russian market. So long as there are reserves. The picture with the availability of the usual brands of beer will be more or less clear by autumn. Beer has an average shelf life of 12 months. As a brewer, you have produced a huge batch, which should be enough for a season — that is, at least for six to seven months you will see it on the market anyway. Now, after three months, it is very difficult to draw conclusions.

Can we say that, conditionally, by November, by December, some popular brands of beer known to us will begin to disappear from the shelves simply because stocks have run out and there is no new production yet?

Over the past three months, we have observed various manoeuvres of the foreign companies. They made statements, then denied them, or modified them in some fashion. Sometimes a company makes a statement, but in fact nothing changes. That is, we understand that such a statement was mostly made to save face.

Could it happen that by the end of the year some of your familiar brands will simply disappear?

At the moment, we continue to work with the current range without any changes.

Source: https://www.ab-inbev.com/ [19]

Bud was a very popular and popular beer brand. Will there be any replacement for it? Are there developments? How long will we be able to see Bud on the shelf?

As long as the situation allows. Budweiser is the most expensive alcohol brand in the world. In Russia, it is really a significant [market brand], and a lot has been invested in it. I am not ready to make predictions, because the situation may turn out differently.

Let’s talk about the deal with Anadolu. Is it planned [20] to close it by the end of 2022, is there an understanding?

We have no understanding on the terms of this transaction. It was announced that there is a discussion between shareholders. We cannot say anything more here, I am afraid that even the shareholders themselves will not be able to say more at this stage. One thing is absolutely certain: our shareholders are interested in preserving the business.

What will happen to local production facilities and employees if the Turkish Anadolu transaction takes place?

At the moment, there are no staff reductions, there are no plans to leave production lines idle. Moreover, we are working on new products and launching them, although many companies have announced a reduction in investment. In our case, there were no such statements. We are working normally.

What about prices, excise taxes and labeling? What will happen to beer prices based on the assumptions that are current now? Can we say that the price of beer in stores will not rise by more than 15%-20% per year, or will there still be a more sizeable increase?

There are a lot of criteria which can influence this. At the beginning of the interview, we discussed the more external criteria – those of geopolitics, economics. But there are also the internal factors. These are state regulation, excise policy and innovations which should come to us in the form of labeling.

How expensive is state regulation?

It’s very expensive.

How much more expensive does it make one can of beer or a bottle of beer?

It is expensive by exactly as much as it costs for an excise stamp.

How much does a stamp cost?

We are currently conducting an experiment on beer labeling. How much the stamp will cost when it becomes mandatory, I cannot say now, because no one can say – since there is no document. At the moment it is 50 kopecks. Beer is a fairly low-margin product which earns money due to volume [of sales]. This is not like a bottle of vodka, which costs 900 rubles, hypothetically, with a cost price that is ten times lower. We have a slightly different situation. Beer companies can earn one or two rubles from one bottle. When we talk about the impact of 50 kopecks on a fur coat which costs tens and hundreds of thousands of rubles, that’s one thing. Fifty kopecks for a bottle of beer is quite another – it’s half of what you can sometimes earn from it. In any case, this is a sensitive story for us, especially in the current situation. The CRPT [21][Centre for Research in Perspective Technologies] and I discussed and agreed with the Ministry of Industry and Trade that the terms of the experiment will be extended for at least six months.

The second point is excise taxes. They are increasing no matter what — this year they have increased, and next year they will increase. In the current conditions, we asked the Ministry of Finance for support measures and are grateful that the regulator listened to the industry, leaving the excise tax rates at the same level that was originally laid down in the Tax Code

So what should the consumer expect in the end?

We predict that the industry will show about a 3%-5% drop in production this year. We will be forced to raise prices, because we need to compensate for the fixed costs which will not disappear with the drop in output. But an increase in the price leads to a decrease in sales, because the purchasing power is falling. It’s like a snowball. Therefore, we, like any other companies in different industries, will try to spread the likely price increase over a long period.

That is, the price increase is inevitable.

The price increase is inevitable, because basically it happens all the time. We cannot give forecasts. But if you look at recent years, beer has been growing in price at a rate that has been slower than inflation.

Will this strategy be maintained in any case?

Yes. Last year, the excise tax was 4.5%, and inflation was 8.6%. If you look at how much prices have been raised in the industry as a whole, that’s half of it. All manufacturers are trying to minimize the stress on the consumer, and trying to compete.

What about non-alcoholic beer? Do Russians follow the global trends for interest in this?

The non-alcoholic segment continues to grow. Compared to last year, its sales in Russia increased by 8% in the first quarter of 2022. And the market share in total sales has already exceeded 2%. In the past this was influenced by the trend for healthy lifestyle. Now we are seeing that it has become an absolutely conscious choice. An independent category, an independent product. We have already stopped being surprised and we are glad that the consumer consciously takes non-alcoholic beer. Maybe this was also prompted by the tightening of legal responsibility for drunk driving.

For a July 2020 report on the non-alcoholic beer segment of the Russian market, read this [22].

What do we have in the craft beer market, how serious competitors do you consider them?

We have never considered craft a competitor, because it is a completely different segment. We are very glad that they exist, as they bring culture, educate our consumers, give a variety of tastes that large brewers cannot always afford because they make a more mass-produced product. It’s great that they are there, it’s great that you can come and try from chocolate to mango beer, from sour to triple hop, milkshake IPA [India Pale Ale — https://www.provi.com/blog/beverage-program/growth-of-milkshake-ipa-beer ] and so on. This is great because we understand that brewing is an art.

Russian craft brewing is praised. How do you rate it in the company at the global level?

Being inside the market, I hear quite positive reviews. In my opinion, they are not inferior in anything — at least they are not lagging behind. The variability that I observe in craft beer bars is very large.

Do you drink craft beer yourself?

I periodically try some other, alternative beer. They are not very competitive with us, but I have to be aware of the trends. It would be strange to be in this market and not understand what sour ale is. I think they are having the same difficult times now. In many ways, we have a common agenda. In order to preserve their variability and creativity, we and they advocate that there should be fewer restrictions on the addition of certain ingredients. I’m talking about the state’s attempt to drive us under the law on the purity of beer. This is, in fact, a tracing paper from the German Reinheitsgebot law, which appeared in 1516 in Bavaria, according to which beer should have only three ingredients – hops, malt and water. At the same time, in neighbouring Belgium, in England, brewing developed in a completely different way, and we see excellent ales there: Leffe, our brand of abbey beer [23]; Hoegaarden [24], that’s beer with coriander and wheat. This is great beer. All Belgian beer is included in the UNESCO Intangible Cultural Heritage List, but in Germany it will not be considered beer due to the German legislation.

A very strange story happened to us in 2012, in my opinion – that was the year when they came up with an artificial category of beer drinks, where any beer with an alternative flavor additive began to be classed. A Belgian will be sitting in front of you, sipping Hoegaarden, and you will tell him that this is not beer at all — he will smile. Also, Guinness and Corona Extra in Russia are not beer, but are some kind of beer drink. Despite the fact that the category of drinks — beer, dairy — there has been a prejudice on the part of the consumer. In this regard, we have generated something that does not exist.”