By John Helmer, Moscow

Magnitogorsk Metallurgical Combine (MMK), a publicly listed shareholding company controlled by Victor Rashnikov, says that in the first two months of this year, it has not cut back on production of steel. “Everything is fine and we now have growth,” Yelena Evstigneyeva, MMK’s spokesman told CRU Steel News.

She was responding to a report [1] of monthly production and market data, issued on March 26 by the federal Ministry of Economic Development (MED) in Moscow. The report says that in January and February, MMK turned out 1.804 million tonnes of finished steel; this was down by 6.2% from the same period of 2011.

Ural Steel, one of the two Russian mills of the Metalloinvest group, controlled by Alisher Usmanov, was reported by the ministry as producing 304,000t in the same period, down 13.5% from a year ago. By contrast, the Oskol Electro-Metallurgical Combine (OEMK) turned out 451,000t, up 4.3% year on year.

Russian steel proprietors are under pressure from Deputy Prime Minister Igor Sechin and several of the federal regulatory agencies under his control to halt their practice of exporting profit offshore, while cutting back on investment, employment and production in Russia. MMK’s production results and financial reports have been drafted to camouflage the effect Rashnikov’s investment in Turkish steelmaking is having on the performance of the mill at Magnitogorsk [2]; not to mention the shortage of cash MMK has suffered as Rashnikov invests in iron-ore mining in Australia [3].

This week’s Russian government report contrasts the performance of MMK with its Russian peers, all of whom appear to have lifted their steel output in the first two months of this year. The MED report cites Mechel’s Chelyabinsk mill with a year on year growth rate of 18.2% to 537,000t; Novolipetsk Metallurgical Combine (NLMK), up 30.6% to 1.75mt; and Severstal’s Cherepovets mill, up 2.1% to 1.74mt. At Evraz’s Nizhny Tagil mill, reported growth was 6.7% to 689,000t; the Zapsib mill of the same group achieved a growth rate of 19.7% to 1.164mt.

NLMK, owned by Vladimir Lisin, announced earlier this week that it will be the largest-volume steel producer in Russia this year. “We launched a new BF#7 and a new BOF at our Lipetsk site, increasing our crude steel production capacity by a third. This new project was the largest incremental increase in steelmaking capacity in the Russian steel industry over the last 25 years… In 2012 we plan to increase crude steel output to over 15 mt on the back of incremental capacity growth thus becoming the largest steel producer in Russia.”

According to Evstigneyeva of MMK, the company “does not know where this [MED] information comes from”, adding that MMK’s specialists are now studying the MED report.

On January 27, MMK released its production results for the fourth quarter of 2011. These showed that MMK’s output of finished steel in Russia was falling between the third and fourth quarters by 6%; the volume for the final reporting period was 2.62mt. The company release also claimed that its projected growth rate this year will come mainly from its Turkish steel complex. “Steel consumption growth, realised investments in equipment modernisation and mastering of new products will help MMK to increase production of finished products in 2012 at its Russian facilities. General MMK Group output growth of finished steel products in 2012 may reach 15% among other [sic] due to ramp-up to full production capacity at the company’s facilities in Turkey.”

MMK might have responded to the production cut report from the Ministry of Economic Development by claiming that output is growing in relation to the last quarter of 2011; that that was a bad time for steelmakers worldwide, and that this year is bound to be better, etc. The spokesman didn’t do this, even though at this stage of the month of March, preliminary data are already available at MMK’s headquarters to demonstrate how the steelmill at Magnitogorsk is performing, up, down or flat, compared to the previous quarter. That the spokesman didn’t give this hint suggests that she hasn’t been cleared to make a premature disclosure for stock market regulatory reasons; or else that the latest MMK data do not show quarter on quarter growth. We can’t know for sure until next month, when the first-quarter production report is due, roughly in the third week of April.

At Metalloinvest, spokesman Igor Tikhomirov did not respond to a request for clarification of the downturn at Ural Steel.

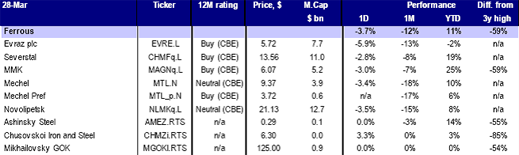

Do the stock markets punish cherry tree-type falsehoods by cutting down the share prices of those suspected of taking the hatchet to their performance figures? As the UBS chart of share price movements for the listed Russian steelmakers shows, so far this year MMK has gained more value, while Evraz has gained least. This may not mean that market investors are giving Rashnikov their Junior Washington awards for truth-telling. It may mean nothing more than that all Russian steelmakers are known to be cherry-tree cutters and are discounted accordingly in relation to their non-Russian peers –Roman Abramovich, controller of Evraz, most of all.