By John Helmer, Moscow

“Let the little children come to me, and do not hinder them, for the kingdom of heaven belongs to such as these.”

That was Jesus Christ (lead image, left) talking, not German Gref (lead image, left), chief executive of Sberbank and the most powerful banker in Russia. The children Gref has been talking about are paying clients of a new Moscow school established by Yana Gref (image, far right),German’s second wife, who is financed by Sberbank. And also Oleg Gref, son by Gref’s first wife, whose asset appraisal and consulting business depends on contracts from Sberbank. The kingdom of heaven belonging to Yana Gref is called Khoroshevskaya progymnasium [2] – for short, Khoroshkola (Хорошкола); the one belonging to Oleg Gref is called Brayne Asset [3] and Change Management.

When money flows from Gref’s bank to these relatives and their businesses, the relationship is understood in international anti-corruption practice to be nepotism. Originally an Italian word meaning nephew, the term referred to the practice of medieval Catholic Church cardinals and popes, purportedly celibate and childless, of promoting and enriching their kin. It means the same in Russian (непотизм). The Russian language makes doubly sure everybody knows this crime by having a word of local derivation to mean the same; that’s kumovstvo (кумовство).

In 2013, the State Duma proposed to make nepotism unlawful by adding an amendment to the Anti-Corruption Law [4] of 2008. This provision made it illegal in Russia for money to be paid from state agencies, state corporations or state banks to organisations whose directors, deputy directors and chief accountants are close relatives of the directors, deputy directors or chief accountants of the state agency which is the source of the money.

But the amendment failed to pass. Nepotism (непотизм, кумовство) is missing from Russian law and current practice. It’s legal; the Gref family proves it.

The Gref family nepotism is not breaking news. It has been more frequently reported by Russian journalists than for any other Russian banker or minister of state. Also, Gref has been more thoroughly exposed in the press than his business friend, the grand larcenist, fraudster, tax felon and money-launderer Suleiman Kerimov; the details of those allegations (repeat allegations) can be read here [5].

The unreported novelty in today’s story is how Russian law and those who enact it have allowed a loophole for Gref to get away with what are serious felonies in other places.

Gref, 54, has been a Russian state official for his entire career, beginning in the St. Petersburg City Administration when he was 28 and still studying at university (1992-1998); First Deputy Minister of State Property (privatization, 1998-2000); Minister of Economic Development and Trade (2000-2007); and President and Chief Executive of Sberbank, Russia’s dominant bank, since 2007. This makes Gref a Politically Exposed Person (PEP). This is the special category of officials who are subject in international policy and practice to the most stringent standards to deter them from using their political power to generate financial gain for themselves, their family, friends and associates; and to punish them if they are caught.

This document from the Financial Action Task Force (FATF [6]), to which Russia is a signatory, along with 34 other member states. It sets out who qualifies as a PEP, and the standards of disclosure, accountability and transparency which the anti-corruption authorities of FATF member states agree they should enforce [7]. Because Gref qualifies as a PEP, so do his current wife Yana, his son Oleg, and other family members.

THE RUSSIAN FAMILY GREF

[8]

[8]

Left to right: Yana Gref; Oleg Gref; Yelena Peredriy, German’s sister and with her husband Sergei Peredriy a major shareholder [9] in Primorye Bank in Vladivostok; and Yevgeny Gref, German’s older brother. For details of the brother’s and sister’s benefits from Sberbank, read this [10].

The nepotism which has enriched Yana Gref comes from Sberbank loans. They have financed the construction and operation of the special school Mrs Gref has created in the Khoroshevsky district of northeast Moscow. The school is for the especially talented children of unusually wealthy parents. Oleg Gref, German’s first offspring, sends his children to the school at a fee reported to be the equivalent of $17,150 per child per year. More than 700 children are enrolled, but the operating costs still exceed the revenues, so the school is making a loss on one set of Mrs Gref’s books. On another set, there is a small profit.

[11]

[11]

Source: https://mbk.media/video/cur-kak-german-gref-nezakonno-postroil-dorogu-dlya-svoix-detej-i-vnuchki-za-milliard/ [12]

Mrs Gref’s business partner, who also shares in her losses and profits, is Alexei Popov. He is a partner in a Moscow law firm called INFRALEX; that’s a Latin phrase which means BELOW THE LAW.

Popov [13] and his firm receive a multi-million dollar stream of contracts from Sberbank, reportedly awarded without tender. In a comparably favoured position is the construction company which built the Gref school, Krost [14]. The special road which Krost built over legal objections and crowd protests was reportedly one of the most expensive local roads in Russia. It is not known if Krost contracts for its legal work with BELOW THE LAW.

The press report with details of these money transfers and relationships was published on February 6 and can be read here [15]. A documentary film of the story can be viewed by clicking [12].

One of the cases in which Popov is reportedly paid to represent Sberbank is a lawsuit in federal US District Court in New York. This charges Sberbank, German Gref and Oleg Gref with nepotism, fraud, and racketeering to steal the assets of Pavlovskgranit, a Russian construction materials company. The lawsuit is claiming damages of $750 million.

The Pavlovskgranit case, which started in January 2017, is so notorious, the Russian press reports of the details are legion. The New York court papers set out how Oleg Gref, and two companies with which he had financial and shareholding interests – Neo Centre (Russia) and Nisoram (Cyprus) – are alleged to have conspired with his father and Sberbank to under-value the Pavlovskgranit assets and trigger a Sberbank loan recovery proceeding, bankrupt the owner, seize his assets, and during his resort to legal action, put him in prison. Read the indictment here [16]. For a rare western media report of the case, click [17].

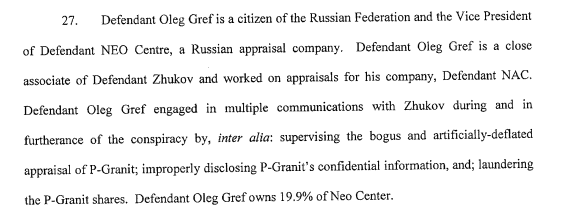

German Gref and Oleg Gref appear in the court papers accused in this way:

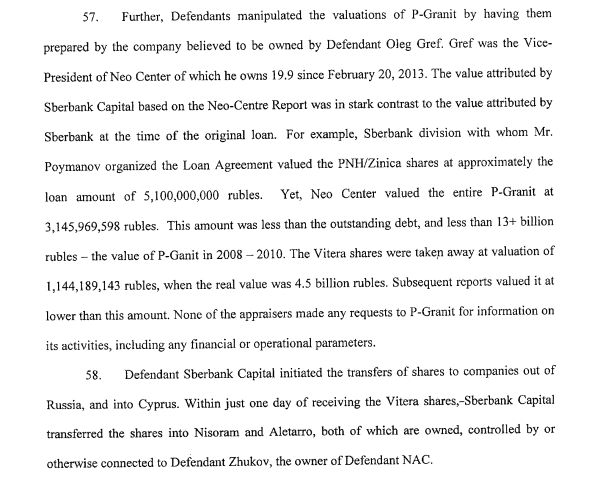

Their raid against Pavlovskgranit is alleged to have been operated like this:

The US proceeding has been delayed by parallel Russian court cases. The Moscow lawyer for Sergei Poymanov, former owner of Pavlovskgranit and of the plaintiff company in the New York litigation, refuses to clarify the current status of the pending cases. For the time being there has been no adjudication in the US of the allegations against the Grefs.

German Gref’s response in the Russian press has been to say that Sberbank doesn’t do business by raiding assets. Oleg Gref has made no public comment. However, within weeks of the US court filing, he left NEO Center, one of the corporate defendants in Manhattan, and established a brand-new Moscow company called Brayne Asset and Change Management. Click [21] to see where he was in January of 2017. Click [22] again to see where Oleg Gref is today. A spokesman for Brayne confirms that Sberbank is one of the firm’s clients. According to Brayne, it’s in the business of “restructuring of distressed assets” – Oleg and German Gref’s line of business together, according to the New York court papers.

It isn’t known whether any of the children of the partners at NEO Center or Brayne go to school at Khoroshkola. It would be entirely lawful if they do. Desirable that they should, according [23] to last month’s advertorial by Bloomberg and by the endorsement of President Vladimir Putin.

In his recent address to the Federal Assembly, Putin didn’t mention the Gref school. He did say he is ordering the Russian state budget to finance a “shift to completely new education methods, including personalised learning, in order to cultivate in our children a readiness for change and creative curiosity, and teach them to work in teams, which is very important in the modern world, and other life skills applicable to the digital era.” For the story of Putin’s speech, read this [24].

[25]

[25]

The last official Kremlin meeting between Putin and Gref was reported on August 7, 2017. Gref told the president that “lending growth [at Sberbank] is good as concerns small and medium businesses and individuals. The most important result is that lending to small businesses increased by around 6 percent over the first half of this year.” Read more. [26]Gref is a regular at Putin’s oligarch dinners; he attended both the September 21 and December 21, 2017, dinners. For more on those occasions, read this [27].

The “personalised learning” money Putin has proposed hasn’t been budgeted nor any received by Mrs Gref’s school, yet. No Russian report claims there is nepotism at that level, yet. Also, the FATF recommendations for dealing with cases of nepotism are not the law of Russia, yet.

PRESIDENT PUTIN CHAIRS PRESIDENTIAL COUNCIL FOR COUNTERING CORRUPTION

[28]

[28]

Kremlin record of January 26, 2016: http://en.kremlin.ru/events/president/news/51207 [29] Left: Sergei Ivanov, then Kremlin chief of staff and head of the Anti-Corruption Council, addresses the meeting. Right: Chairman of the Investigative Committee Alexander Bastrykin; Director of the Federal Security Service Alexander Bortnikov; and Minister of Economic Development Alexei Ulyukayev. In December 2017 Ulyukayev was convicted of taking a bribe from Rosneft and imprisoned for eight years.

Although Russia is a signatory of FATF, and also of the United Nations Convention Against Corruption (UNCAC), enactment of laws to implement the international standards and enforcement of the laws are up to the Russian government. Read this [30] for the case of the Russian PEP, Suleiman Kerimov, who was authorized last month by the Russian Central Bank to acquire a leading commercial bank, while he is under arrest in France for money laundering, fraud and related offences. Gref is Kerimov’s personal advocate in Moscow; Sberbank is also Kerimov’s largest lender and creditor.

In 2013 a group of parliamentary deputies aimed at adding nepotism to the anti-corruption measures already signed into law. The key measure they introduced proposed to criminalize money [31] transfers from state agencies to organisations whose directors, deputy directors or chief accountants are close relatives of the directors, deputy directors or chief accountants of the state agency which is a financing source.” This was widely reported at the time here [32] and here [33] and here [34] too. Then the amendment disappeared, and the media fell silent. Victor Shudegov (right), a deputy from the minority faction Just Russia, was the principal drafter of the nepotism provision. This week he refused to say what happened.

[31] transfers from state agencies to organisations whose directors, deputy directors or chief accountants are close relatives of the directors, deputy directors or chief accountants of the state agency which is a financing source.” This was widely reported at the time here [32] and here [33] and here [34] too. Then the amendment disappeared, and the media fell silent. Victor Shudegov (right), a deputy from the minority faction Just Russia, was the principal drafter of the nepotism provision. This week he refused to say what happened.

Lawyers from international law firms advising Russian and foreign companies on Russian anti-corruption law and practice have also failed to mention the anti-nepotism amendment, or explain what became of it. Here is the report [35] from the London firm HerbertSmithFreehills, dated January 23, 2018, summarizing the provisions originating in the first comprehensive law on anti-corruption of 2008, and the amendments added since then:

[36]

[36]

Source: https://www.herbertsmithfreehills.com/latest-thinking/the-anti-bribery-and-anti-corruption-review-6th-edition-russia-chapter [35]

The Freehills report is as silent on the Shudegov amendment as Shudegov himself. The author of the report, Alexei Panich, a partner in the Freehills Moscow office, was asked to say if nepotism offences are defined in the current law; and if in his legal opinion there is currently no ban, no offence, for money transfers from state agencies, state corporations or state banks to organisations whose directors, deputy directors or chief accountants are close relatives of the directors, deputy directors or chief accountants of the state agency paying the money? Panich did not answer.

[37]

[37]

Russian sources claim that nepotism is covered by Article 10 of the current law. Click [4] to open the law in Russian. For an English translation, click again [38].

Article 10 is headed “conflict of interest”, a broader term than either Russian word for nepotism, which do not appear in the law. Section 2 of Article 10 identifies the conflict of interest arising between office-holders and their kin – nepotism — but it stops short of making this a criminal offence, as the Shudegov amendment had attempted.

The Gref family are covered by Section 2 because they include “ the person referred to in Section 1 of this article, and (or) consisting with it in close relationship or property of persons (parents, spouses, children, brothers, sisters, and brothers, sisters, parents, children of spouses and spouses of children), citizens or organizations with whom the person specified in part 1 of this article, and (or) persons, those who are related to him or her in a close relationship or property are related to property, corporate or other close relations.”

Section 3 also covers German Gref because he qualifies in this list: “employees of the Central Bank of the Russian Federation, employees of positions in state corporations, public law companies, the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, Federal Compulsory Health Insurance Fund, [and] other organizations created by the Russian Federation on the basis of Federal laws.” Sberbank is one of the “other organizations” listed last.

The difference between Article 10 Section 2 and nepotism as the rest of the world understands and prosecutes it, is that the Russian law does not make nepotism a crime. Instead, Section 3 imposes “the obligation to take measures to prevent and resolve conflicts of interest”, and then lists who should exercise that duty.

In other words, Gref has the legal duty “to take measures to prevent and resolve conflicts of interest.” If Gref and his bank send millions of dollars in loans and contract awards to his wife, his son, and their friends, and their children benefit from the “personalised learning” financed thereby, Gref is committing the nepotism felony recognized everywhere, but not a crime in Russian law.

No Russian prosecutor can indict Gref for falling short of implementing “measures to prevent and resolve conflicts of interest” because that’s a family affair, not a criminal one. In Russia Gref family nepotism is below the law.