By John Helmer, Moscow

Samvel Karapetyan (lead image) had a fortune last week of $4.6 billion. This, according to profiles in Forbes Russia, he made all by himself from Russian property development. The dollar number puts Karapetyan at No. 26 on the ladder of fortunes in Russia, where he lives and works; number 1 in Armenia, Karapetyan’s motherland and the location of his family’s alliance with the President of Armenia, Serzh Sargsyan, and his ruling Republican Party.

Karapetyan’s importance and visibility have recently leaped because of a deal in which Inter RAO UES, the large Russian power utility, has sold its 100% stake in the Electricity Networks of Armenia (ENA). The sale and purchase are reported to have taken place at a fraction of ENA’s asset value which Inter RAO reported on December 31, 2014, following a year in which ENA’s earnings tripled. Karapetyan appears to be the buyer, but through a spokesman at his Tashir Group in Moscow, he is refusing to say so. Inter RAO – the fifth most transparent power company in Russia in 2009, according to the company website — is also not confirming the sale. “We are not commenting,” the company spokesman said this week, “on the Armenia subject.”

The deal is exceptionally sensitive in Armenia, because ENA’s attempt between June and August to raise its electricity tariffs triggered countrywide protests. These have obliged Sargsyan and his ministers to back down, announcing last week that the 16% hike is being abandoned. At the same time, Gazprom has agreed to lower its gas supply price for Armenia’s power plants. Other financial sweeteners following from the Kremlin have included a $200 million military loan. According to Armenian commentaries and those of US and European political analysts, the ENA transaction, the protests, and the Russian reaction are the latest moves in the geopolitical contest between Russia, which controls most of the country’s energy sources through Gazprom, and the US, which is encouraging Armenia to reduce its dependence on Moscow, and taking over the big Vorotan hydroelectric combine through the World Bank and a New York-based company called Contour Global. What then is Inter RAO selling, and what is Karapetyan buying, if neither of them will say?

Press reporting in both countries suggest that ENA is a loss-maker for Inter RAO, with debts of a quarter of a billion dollars, and dismal prospects for profitability in future. In these accounts, Inter RAO, controlled by Rosneft and chaired by Igor Sechin, is doing no more than disposing of a liability in a non-core activity.

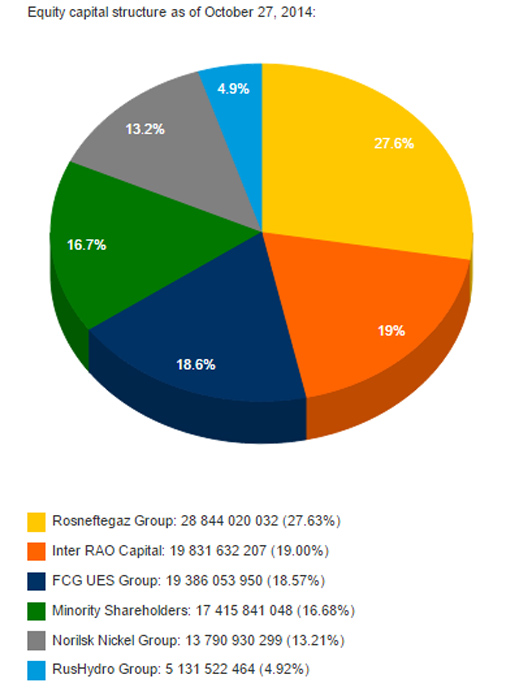

SHAREHOLDER STRUCTURE OF INTER RAO UES, October 27, 2014

Source: http://www.interrao.ru/en/investors/acapital/capitstr/

Inter RAO’s recent strategy presentations are ambiguous. They concede the company is intending to cut back on asset acquisition in markets outside Russia; “review all scenarios for existing foreign assets”; and “focus on countries where we are already present.”

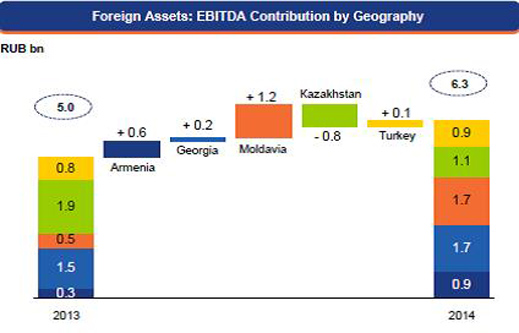

The audited financial reports of Inter RAO reveal that with revenues in 2014 of Rb14.7 billion, ENA represented just 2% of the company’s total revenues of Rb741.1 billion. Still, it was the largest of Inter RAO’s foreign country operations, and it was growing robustly at 42% per annum. Earnings (Ebitda) rose from Rb325 million in 2013 to Rb969 million last year – that’s a 198% gain year on year. Although this was erased on the balance-sheet by depreciation and the costs of servicing ENA’s debts, Inter RAO does not disclose a loss figure for ENA. Reporting from Yerevan in June, Kommersant corroborated the Inter RAO report of ENA’s revenues; the report added there was a bottom-line loss of $22.6 million.

It is also clear from the financial reports that Inter RAO’s operations in Moldavia. Georgia, and Kazakhstan, though smaller in turnover, are more profitable than those in Armenia and Turkey.

The latest financial report reveals that Inter RAO values its assets altogether at Rb345.6 billion, up 7% from 2013. In pre-devaluation terms, that was equivalent to about $10 billion. At the December exchange rate, asset value was $5.5 billion. The market capitalization of Inter RAO – listed on the Moscow and London exchanges — was $2.2 billion at the time; it is $1.5 billion today. The value of the Armenian assets was Rb13.1 billion – just 4% of the aggregate, but they comprised the largest stake in the foreign portfolio.

An Armenian source close to the deal claims that Inter RAO is letting ENA go for just $25 million in cash, and the transfer of ENA’s debt, guaranteed by Inter RAO, of more than $220 million. How much of a steal this appears to be depends on how large the debt, and ENA’s capacity to service it.

Inter RAO reports that at the end of 2014 its borrowings totalled Rb7.4 billion ($212 million in pre-devaluation terms). From 2013 the debt had jumped 59%. Industry sources claim ENA was borrowing in order to cover the operating deficit between what it was paying for power generation and what it was taking in electricity sales to consumers at the regulated tariff.

Note 19 of the 2014 financial report lists three foreign currency loans to ENA — until now guaranteed by Inter RAO. A credit of 3.9 billion Japanese yen (about $32 million) commenced in 2009 and concludes in 2039; the interest rate is 1.8%. The European Bank for Reconstruction and Development (EBRD) has provided a €42 million loan at a floating rate between 3.5% and 5%, repayable in October 2018. Vnesheconombank (VEB) has also loaned €22.5 million for repayment at the same time; the VEB interest rate commenced at 7% but has been cut to 5%. These represent about half the reported debt; no details of the loan balance are available.

If and when Karapetyan takes over ENA, does he have the financial capacity to underwrite the rising level of indebtedness?

DISTRIBUTION OF REVENUE BY SOURCE – SAMVEL KARAPETYAN’S TASHIR GROUP, September 2010

Source: http://m.forbes.ru/sites/default/files/users/user92/Tashir_in.jpg

KEY: Dark blue = construction, 30.7%

Grey = equipment supply, 23.6%

Red = land, project development, 16.9%

Light blue, production, 14.6%

Retail, yellow, 5.7%

Dark red, restaurants, hotels, 5.3%

Green, energy, 3.2%

Karapetyan’s reputation in Russia depends almost exclusively on what he tells Forbes Russia. The Forbes pie-chart, dating from 2010, reveals that Karapetyan is much less a land-banker and developer than a building constructor and contractor for projects he doesn’t originate or control. Industry sources believe his profit margins are much narrower as a result. His Cascade electricity group operates in Moscow, Kaluga, St. Petersburg, Yaroslavl, Kostroma, Ivanovo, Kolomna, Ryazan, Tula, Vladimir, Belgorod, and Bryansk; the major revenue-generating regions are Moscow and Kaluga. When examined more closely, Cascade’s operations turn out to be focused on equipment and infrastructure maintenance than on power supply. The website of Cascade-Energo describes these operations as “the reconstruction and replacement of worn out transformer substations, distribution and supply centres, laying high-voltage and low-voltage cables and overhead lines.”

Independent of the Forbes publicity source, there has been no substantiation of the value of these assets or of the commercial turnover of his businesses. Karapetyan has told Forbes that in 2014 the Tashir group collected more than $1 billion in revenue from leased space. Real estate market sources say this was an exaggeration last year, and is much less accurate this year. According to one, “Forbes has its own methodology. This figure may be far from reality. This year the market has dipped significantly.” According to a second analyst, “it’s unlikely that the [Forbes] data are exact; they are likely to be something approximate.” A third source said the Forbes calculations are compiled by one of the major Moscow real estate management firms. “Very roughly, they count the average market price per square meter multiplied by the area of all the buildings. But there are different tenants and value in each section, so the variation must be considered very carefully. The resulting data are credible.”

Bank analysts say there is no telling what the value is of Karapetyan’s Fora Bank. This is rated 106th in the Russian banking market, according to RusRating. But rating reports have identified multiple stakes in the bank, some controlled by Karapetyan, some by others. A report of 2010 indicated the shareholdings of the bank were being restructured, but it wasn’t made clear what shareholding Karapetyan ended up with. Over the past five years it is unclear how the shareholdings have evolved. No information is available to gauge how much of Fora Bank’s loan book is related-party lending to shareholders, and how problematic loan repayments from these sources may be.

Armenian sources believe – though not with corroborating evidence – that Karapetyan acts as the trustee of a sizeable cashflow from Armenia, originating with investors who wish to remain his secret, silent, or sleeping partners. In Russia the Armenian diaspora is also believed to dominate the tenant lists, retail partnerships, and sub-contractors engaged in business represented publicly by Karapetyan’s Tashir Group. This, the sources add, makes him influential socially and politically, but not as fortunate as his Forbes advertisements claim.

It is this intermediary role, according to Armenian analyses of the ENA deal, which Karapetyan is playing. The Armenian speculation is that President Sargsyan (right) has formed around Karapetyan a group to take over ENA and protect the government from popular discontent; deter public investigation and disclosure of the fraud suspected to have been rife inside ENA’s financial operations; and prevent another rival political group from turning ENA into a weapon in the succession race for the presidential election of 2018. At least one of the Armenian press versions of what is happening appears to be a placement by the president’s men. This claims Karapetyan’s mission is “a trump card against a ‘color revolution’ against pro-Russian power in the person of President Serzh Sargsyan. Not wanting to repeat the fate of [former Ukrainian president] Viktor Yanukovych, Sargsyan appears ready to take decisive action.” The byline name, Ilya Vakhlakov, turns out to be a nom de plume which noone at the publication wants to own up to.

It is this intermediary role, according to Armenian analyses of the ENA deal, which Karapetyan is playing. The Armenian speculation is that President Sargsyan (right) has formed around Karapetyan a group to take over ENA and protect the government from popular discontent; deter public investigation and disclosure of the fraud suspected to have been rife inside ENA’s financial operations; and prevent another rival political group from turning ENA into a weapon in the succession race for the presidential election of 2018. At least one of the Armenian press versions of what is happening appears to be a placement by the president’s men. This claims Karapetyan’s mission is “a trump card against a ‘color revolution’ against pro-Russian power in the person of President Serzh Sargsyan. Not wanting to repeat the fate of [former Ukrainian president] Viktor Yanukovych, Sargsyan appears ready to take decisive action.” The byline name, Ilya Vakhlakov, turns out to be a nom de plume which noone at the publication wants to own up to.

So far the Armenian reporting has failed to investigate ENA’s balance-sheets. One of the rare investigative media in Yerevan is Hetq. It publishes in Armenian, Russian, and English, and depends in part on funding from European government sources. In recent publications Hetq has made a target of alleged nepotism and corruption by Prime Minister Hovik Abrahamyan and his family. The publication has steered clear of the ENA sale.

Government officials in Yerevan have also tried to divert media attention away from Karapetyan to the Marcuard group. This Swiss-based investment management group has been identified by the government as engaged in the transaction through at least one of its Cyprus-registered companies. Officials have made Marcuard appear in Karapetyan’s place as the buyer of the ENA shareholding from Inter RAO, and the target of the government’s due diligence on the deal.

Marcuard’s Moscow spokesman said the group does not comment publicly on its business activities. An Armenian source explains: “Marcuard was a veil Sargsyan tried to draw over the Karapetyan group. Once the veil dropped, the Swiss, who had no financial or deal-making role, withdrew altogether.”

The Armenian analysis does not regard the buyout of ENA as reducing Russian influence in the country. Nor do Yerevan sources expect the ENA sale to prevent the electricity price from becoming a political lightning-rod soon again. US Government media coverage of ENA has been so emphatic in portraying the protests as anti-Russian, reporters have missed Karapetyan’s significance almost entirely.

The official US Government line on “malign Russian influence” was presented to Congress by Alina Romanowski (right), in June, and can be read here. The aid programme for Armenia is falling, however. It was $37.1 million in 2013, and it will be $25.7 million this year. Two-thirds of the State Department’s foreign aid budget, and thus the priority for the US Government, is absorbed by Ukraine, Georgia, and Moldova. The Balkans are also a focus. Armenia isn’t mentioned at all.

The official US Government line on “malign Russian influence” was presented to Congress by Alina Romanowski (right), in June, and can be read here. The aid programme for Armenia is falling, however. It was $37.1 million in 2013, and it will be $25.7 million this year. Two-thirds of the State Department’s foreign aid budget, and thus the priority for the US Government, is absorbed by Ukraine, Georgia, and Moldova. The Balkans are also a focus. Armenia isn’t mentioned at all.

The Jamestown Foundation is one of the few Washington think-tanks to employ a regular correspondent on Armenia, Armen Grigoryan, for its Eurasia Daily Monitor. So far he hasn’t recognized Karapetyan as an independent actor or genuine buyer in the ENA deal. “Whoever ENA’s final buyer might be, selling the problematic asset to a friendly business structure will likely help to avoid any further investigations into the probable previous misappropriations of funds. In any case, it seems unavoidable that the buyer’s connections with the Armenian political establishment will play an important role. Therefore, profiteering at the expense of the general public can be expected to continue in this case.”

Leave a Reply