By John Helmer, Moscow

The European Bank for Reconstruction and Development (EBRD) announced yesterday that it has managed a successful private placement of a quarter of the stake it owns in Lenta, the Russian supermarket chain. The press release by Anthony Williams, head of the EBRD’s public relations, said the selloff had “attracted strong interest and demand from a broad mix of institutional investors internationally.” Credit for EBRD’s deal, in which it earned $140 million, was given to Credit Suisse and Morgan Stanley acting as the joint bookrunners.

The catch is that EBRD’s sharebuyers insisted on a price discount of 7.6%. When the market woke up to what was happening, it sold Lenta down by almost 9%.

The EBRD started buying Lenta shares in May 2007, paying $125 million for a stake of 11.1%. Over the next two years the bank combined with VTB and the American TPG group of David Bonderman to put an end to shareholder and management conflict in the company. Along the way EBRD has imposed secret conditions on Lenta, as the bank tried to lock in a stock market listing for Lenta, a profit on its buy-in price, and the right to a swift exit. The EBRD’s secret lack of confidence took two years to spill out. It was then revealed that EBRD required Lenta to buy the bank out of its share purchase if it failed to make an initial public offering (IPO) by a deadline of May 2010. EBRD also reserved the right to sell half its stake at the IPO, or 40% of the stake to another buyer without consulting other shareholders or making a comparable offer to the free-floating minorities.

In June 2011 the EBRD added $170 million to the shareholder pot, claiming “the Bank’s finance supports the further development of the Russian retail sector with improved access for the consumer to an efficient and competitive shopping environment. The project also supports improvements in corporate governance and transparency as well as improved operational efficiency in a successful Russian company.”

In January 2014 EBRD trumpeted a loan to Lenta of Rb4.6 billion to “support financing of both Lenta’s regional expansion (including construction of two new distribution centres) and significant sustainable resource investments in both existing and new stores. Lenta will have 24 months to draw down the funds.” Half the loan was earmarked for “investments in areas such as energy efficiency and water purification, aimed at making Lenta’s use of these essential resources more sustainable.”

For more on Lenta’s troubles, and the trouble with its IPO in 2013, read this.The EBRD says it’s stickler for transparency. In its 2011 loan announcement, the bank claimed it was supporting “improvements in corporate governance and transparency as well as improved operational efficiency in a successful Russian company.” What EBRD meant was transparency for Lenta, not for EBRD.

The bank refused to allow Lenta to release its prospectus when it tried its IPO again in February 2014. Click for that story. What EBRD was trying to keep secret was that it was selling shares in the IPO, cutting its 21.5% shareholding to 15.3%. Here is the prospectus. Put EBRD in the search box, and follow each of the secrets the bank has tried to conceal from the market.

This week Alain Pilloux (below, left), the EBRD banker whose bonus rides on such successful transactions, hasn’t explained why he was dumping Lenta shares at cut price even before the EBRD loan was fully drawn. “The success of this [share] sale,” he said yesterday, “signals the continued interest in Lenta from the international investor community and proves the tremendous achievements of the company to perform, even in trying market conditions. We continue to strongly support the company and sold only a portion of our holdings as part of the Bank’s normal portfolio management operations”.

If Pilloux means that churning to generate bonus is “normal” at the EBRD, Williams, the EBRD spokesman (above, right), is slyly, oops shyly silent. He was asked to respond to the Bloomberg report that the EBRD selloff signalled “a negative outlook for the company’s future.” Williams refuses to say. He also won’t explain how the EBRD press release he issued calculates success, when the sale price was below the market price, both before the deal, and after.

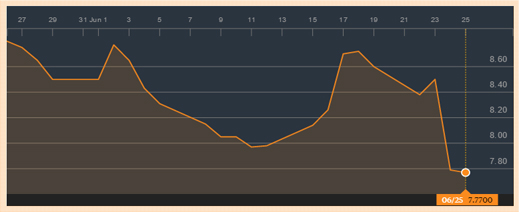

This is how Lenta’s share price trajectory looks in the month before Pilloux pulled his success, and just after.

Source: http://www.bloomberg.com/quote/LNTA:LI

Comparable tracking for Lenta’s Russian peers – Magnit, X5, Dixy, and O’Key – shows a steady decline in trajectory, but none so sharp as EBRD’s loss of confidence. For their stories, and for an assessment of the prospects of the Russian retail sector, read this.

A report this morning by Konstantin Belov of Uralsib Bank concedes that the sale of the EBRD stake is negative, but may turn positive in time. “Following the sale, Lenta’s free float has increased to 51.8%. In the sector, only Magnit has a higher free float of 54.6%, while the remaining public companies have free floats below 50%…The sale of Lenta’s shares by one of its strategic investors will result in short-term pressure on the stock, but in the long term it could improve the stock’s attractiveness through better liquidity. Lenta has been delivering excellent growth rates: revenues grew 34.5%YoY last year and 37.7% YoY in 1Q15. However, in the current macroeconomic environment, retailers focusing on the hypermarket segment are at risk of losing share to discounter formats as customers have become more price sensitive.”

The food market will continue to be governed by the sanctions campaign.

Yesterday, President Vladimir Putin announced at a meeting of ministers (above) that Russian sanctions against food imports from the US, the European Union (EU), Norway, Canada and Australia are being extended for a year. The action matches the extension of anti-Russian sanctions by the EU last week. “I think that this will be a good opportunity for our farmers too,” Putin added.

Leave a Reply