By John Helmer, Moscow

Who is Mark Kurtser, and what does he do for an honest living?

According to the Kremlin, when he was introduced to President Vladimir Putin last August, Kurtser was Chief Physician of the Centre for Family Planning and Reproduction. Two months later, on the London Stock Exchange (LSE), Kurtser sold a bloc of his shares in a company he established called MD Medical Group (LSE ticker MDMG:LI). This is the first medical services company from Russia to be listed on the LSE. Kurtser, who started with 100% of the shares, sold 35% to the market; took about $100 million in cash for himself; and kept 65% of the shareholding. The umbilical cord for that flotation was the Russian Direct Investment Fund (RDIF), a state funded cash-box which refuses to disclose details of its portfolio or operations. It paid about $50 million, and bought roughly one share of the six on offer.

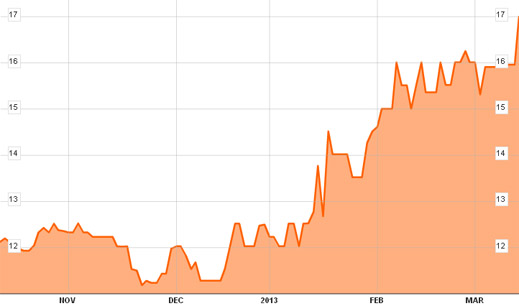

In the five months since listing, MDMG’s share price has jumped 40%, easily beating most listed Russian stocks — with the possible exception of Abrau-Durso, the champagne maker. Kurtser’s company now has a market capitalization of $1.3 billion, so he is worth, on paper, $830 million. In point of fact, Kurtser is Russia’s leading manufacturer of… babies.

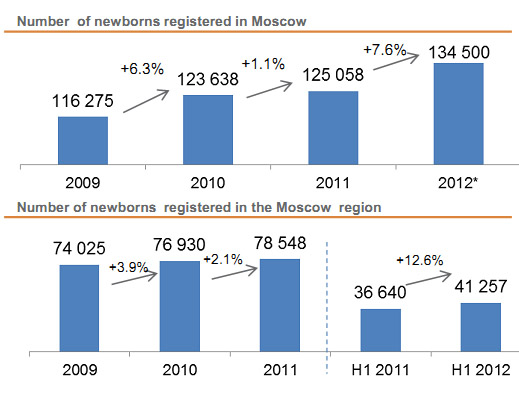

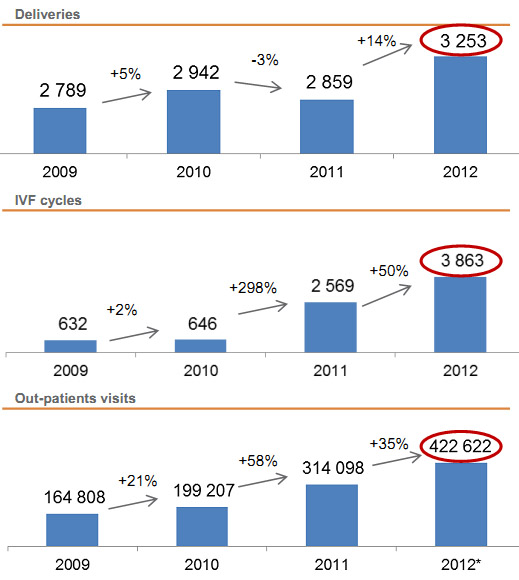

This is not only a boom business on the stock market. It’s a boom business in the fertility market even when, as the second chart shows for 2009, Russian women take a pause in delivering babies, but keep trying to reproduce, stopping in to MDMG for equipment checks, modernization, and upgrades.

SHARE PRICE TRAJECTORY FOR MDMG SINCE OCTOBER 2012 LISTING

DYNAMICS OF THE MOSCOW BABY MARKET

DYNAMICS OF MDMG OPERATIONAL PERFORMANCE

When Putin met Kurtser, along with several other medical academicians, the president said he wanted to discuss “high-tech medicine test and develop new treatment methods”. The president also claimed:

“I looked through the subjects proposed for discussion today. Of course, it is not easy for a non-specialist to get to the bottom of all of these issues, but I will do my best to listen carefully to what you have to say and then to formulate – with your coordination – instructions for the Government so as to have the Healthcare Ministry and other agencies react to your proposals and healthcare development plans…in order to raise the quality of medical services we offer our citizens.”

“I looked through the subjects proposed for discussion today. Of course, it is not easy for a non-specialist to get to the bottom of all of these issues, but I will do my best to listen carefully to what you have to say and then to formulate – with your coordination – instructions for the Government so as to have the Healthcare Ministry and other agencies react to your proposals and healthcare development plans…in order to raise the quality of medical services we offer our citizens.”

That sounds like an undertaking from the Kremlin to raise the quality of public medical services in Russia. But Kurtser’s business is different. He is selling private medical services to the narrow market which can afford to pay a premium for them. According to a February 2013 presentation by MDMG to a UBS investment conference in New York, “the company’s market share in Moscow is at 2.6% only. Full utilization of Lapino and PMC [clinics in the Moscow region] will give the company the market share of 5% (and 3% of the Moscow metropolitan area market).”

When it comes to what Putin called last December “de-offshoreization”, Kurtser is one of the clinical specialists, having done something like a trans-fertilization from New Zealand to the British Virgin Islands, and thence to Cyprus and London. His asset operations are itemized in the prospectus composed for Kurtser’s share sale by Deutsche Bank and JP Morgan last October. “From the date of the Company’s incorporation to 20 August 2012, 100 per cent. of the Company’s share capital was held on trust by GEL, a New Zealand incorporated entity, on behalf of the Group’s Chairman, Dr. Mark Kurtser. On 20 August 2012, as part of the pre-Offering restructuring, GEL transferred its 100 per cent. shareholding (50,100,000 ordinary shares of U.S.$0.10 each) in the Company to Pinscher Limited, a BVI incorporated entity. On the same day, Pinscher Limited transferred its entire holding in the Company to the Selling Shareholder. On 21 August 2012, to facilitate the conversion of the Company to a public limited company, the Selling Shareholder transferred three ordinary shares of U.S.$0.10 each to each of Pinscher Limited, Amicorp Management Limited, Ceantrust Limited, Menustrust Limited, Globiance (Nominees) Limited and Briantserve Limited to be held in trust for the Selling Shareholder. This reduced the number of ordinary shares of U.S.$0.10 each held directly by the Selling Shareholder to 50,099,982. On 18 September 2012, the Company’s shareholders resolved to increase the authorised share capital of the Company to U.S.$6,100,000 by the creation of 10,900,000 ordinary shares of U.S.$0.10 each. On the same day, the Company’s shareholders resolved to issue one ordinary share of U.S.$0.10 to each of Pinscher Limited, Amicorp Management Limited, Ceantrust Limited, Menustrust Limited, Globiance (Nominees) Limited and Briantserve Limited to be held in trust for the Selling Shareholder, and two ordinary shares of U.S.$0.10 each to the Selling Shareholder.”

After this protracted foreplay, the banks conclude: “Effectively, the pre-Offering restructuring did not result in any changes to the ultimate beneficial ownership of the Company, as both before and after consummation of these transactions, Dr. Mark Kurtser was the ultimate beneficial owner of 100 per cent. of the Company.”

The investment relations spokesman for MDMG, Maxim Novikov, was asked what reason Kurtser had for such complex shareholding operations, and from what or whom was he hiding his stake offshore? Novikov responded: “I will not comment. The fact is that there is nothing to answer.”

Did Putin appreciate when he met Kurtser last year — does he endorse now? — how much of the public health system is being transformed into a commercial one by privatization of the state hospital and clinic system about which there has been, to date, little popular press reporting and certainly no vote in parliament? A notable exception is this fine analysis by Dmitry Kryukov in Kommersant’s Secret of the Firm, published last July.

On February 9 there was a rally in Moscow to protest the closure of public medical facilities, and state support of commercial ones. The meeting was arranged by trade unions of medical workers, several State Duma deputies, and deputies from the Moscow City Duma.

Galina Buyanova, press secretary for the State Duma Committee on Health, was asked how members of the committee lined up on the commercialization issue, and which members supported last month’s rally. She did not reply.

According to MDMG’s presentation to investors last month, “Moscow (and some regional) governments intend to pass management contracts for selected state clinics to private companies. Management/investment contracts will be offered at open tenders. Private companies will have obligations to service non-commercial patients (under public insurance schemes) along with private patients.”

In Kurtser’s case, according to his biography on the company website, since 2003 he has been “the Chief Obstetrician and Gynaecologist of the City of Moscow.” The transfer of Moscow city medical institutions Kurtser administers to private companies he owns might thus be a forceps delivery between related parties. According to his prospectus, “as of the date of this Prospectus [October 11, 2012] and for the years ended 31 December 2010 and 2011 and the six months ended 30 June 2012, the Group did not enter into any other transactions with related parties.”

The transfer of public healthcare into private ownership is also being subsidized with public money. The budget outlays take the form of a zero percent tax rate on the corporate profit MDMG makes until 2020; exemption from VAT for the services it charges; a Rb120,000 deductible from individual income tax for medical care outlays; and direct maternity bounties paid to mothers for the second or later deliveries.

The MDMG prospectus makes clear that not only is Kurtser the controlling shareholder and board chairman of the baby business. He also consider himself free of conventional obligations to his new public shareholders. “The Company does not have an agreement, and has no plans to enter into an agreement, with the Selling Shareholder [Kurtser] to ensure that the Selling Shareholder will not abuse its control of the Company. The Selling Shareholder may acquire interests that conflict with those of the holders of the GDRs. In addition, Dr. Mark Kurtser, as a beneficial shareholder of the Selling Shareholder, may in the future have investments in other businesses, including some that may compete with the Group. Dr. Mark Kurtser may therefore have interests and exercise control of the Company in a manner that may be inconsistent with, and or even adverse to, those of holders of the GDRs, any of which could have a material adverse effect on the Group.”

What then do Kurtser and his company think of the risk that competition, either from public health institutions, or from rival commercial operations, might hold down the prices he can charge, and diminish thereby his profit? The prospectus acknowledges that public money is a serious risk to MDMG’s business. “Increases in governmental funding for the public healthcare sector and, accordingly, improvement in the quality of services rendered by the public healthcare providers, may result in increased competition between public and private healthcare providers. Increased competition could have a material adverse effect on the Group’s business, financial condition, results of operations or prospects, and the trading price of the GDRs.”

How then to make sure that funders of public health care, like Putin for the federal government, or the city of Moscow, don’t decide to spread the benefits of health care, and regulate what healthcare providers can charge if they receive government subsidies? By occupying public and commercial posts at the same time as MDMG is bidding in tenders to take over public healthcare facilities, Kurtser is in a pivotal position, not to say a conflict of interest. The prospectus concedes: “The Group’s operational success depends on the Group’s ability to retain the services of, or promptly obtain equally qualified replacements for, certain key members of its management team, including Dr. Mark Kurtser.”

Kurtser’s political and administrative skill is arguably more important here than his medical talents. It is standard operating practice for Russian asset owners to mitigate the risks of adverse administrative measures by sharing their equity, or their profits, or both. Even if such practices may not be illegal in Russia, MDMG admits in its prospectus that it may be pressured by corrupt state officials, or targeted by black propaganda contrived by its competitors. “State authorities have a high degree of discretion in Russia and at times they exercise their discretion arbitrarily, without due process or prior notice, and sometimes in a manner that may be not in full compliance with law or that may be influenced by political and commercial considerations. Unlawful or unilateral state actions could include the withdrawal of licences, sudden and unexpected tax audits, criminal prosecutions and civil actions.”

“The Russian and international press have reported high levels of corruption in Russia, including the bribing of officials for the purpose of initiating investigations by government agencies. Additionally, published reports indicate that a significant number of Russian media agencies regularly publish biased articles in exchange for payment. The Group’s business or reputation could be adversely affected by illegal activities, corruption or by claims implicating the Group in illegal activities. Additionally, the Group and/or its directors and management could face criminal sanctions.”

So can investors, particularly foreign investors, understand exactly what Kurtser is doing to keep his business, ensure its expansion regionally and growth financially, and deliver dividends and share price gain? Can he be trusted?

For the time being, the best protection for MDMG is that the state banks are willing to lend money to build expensive hospitals, whose occupancy rates are funded by corporate insurance plans, and by the wealth of its clientele. The MDMG prospectus concedes that for the time being the commercial operators occupy a very small segment of the Russian healthcare market. “Private healthcare services providers currently account for a small portion of the total Russian healthcare services market and amounted to approximately 4 per cent. (excluding VHI [voluntary health insurance]) of total healthcare services expenditure in 2011, indicating significant potential for future growth.”

In this corner of the market, the dominant providers are, for general practice, Medsi, Meditsina, and European Medical Center. For women’s health, the market is controlled by MDMG, Scandinavia (AVA-Peter), Bliznetsy, and Medlife. MDMG claims that in 2011, the number of its obstetric beds and deliveries came to 140 and 2,800, respectively, far exceeding the total of its commercial rivals combined.

But if the opportunity to make money is obvious, there are serious barriers to entry into the market, the prospectus acknowledges. The biggest is the capital requirement for hospitals and equipment; next are the “strict licensing and permit requirements.” As a state-appointed medico, and a borrower from the state controlled VTB bank, Kurtser appears to have both his surgical gloves firmly gripping the barriers which might allow new competition.

Leave a Reply