By John Helmer, Moscow

Sovcomflot, the state-owned Russian tanker company, has reported that its vessel operating profit collapsed from $101.7 million to just $31.7 million in the six months to June 30, while on the bottom-line the company reported a net loss of $14.5 million; this compares with a profit of just $2 million in the first quarter, and a profit of $51 million in the first half of 2012. This is the first loss ever booked in Sovcomflot’s audited reports.

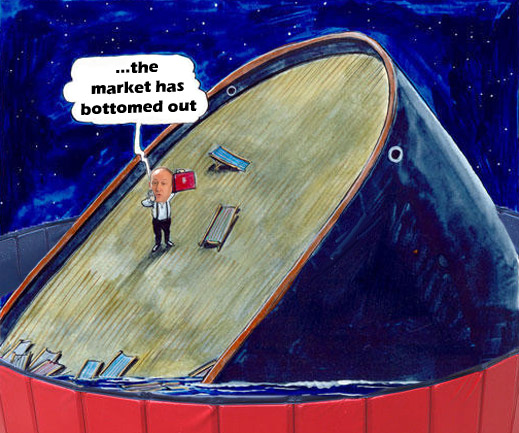

The chief executive, Sergei Frank, describes the market as “extremely challenging”, adding that “a recent improvement [in] product tanker rates may indicate that the market has bottomed out.” Nikolai Kolesnikov, the chief financial officer, disclosed that “SCF’s revenue base continued to benefit from more than 60% of the fleet being on time-charter and not exposed to spot market volatility.”

In 2005, after Frank had ousted his predecessor as chief executive, Dmitry Skarga, he attacked Skarga for booking too much of the fleet on long-term charter, not enough on spot. Skarga replies: “The ratio of long to spot was different at different times . We sold some old fleet, which were not on long term in the expectation of newbuilds, so at some points the ratio can be 80% either way.”

The balance-sheet presentation reveals that time charter equivalent (TCE) revenues dropped in the first and second quarters of this year, and for the first half amounted to $420.4 million, down 10% on the same period of 2012. Crude oil cargoes account for 42% of the TCE aggregate figure; oil products, 26%; offshore operations, 23%; gas cargoes just 5%.

Rising pay for executives and managers appears to be growing faster at Sovcomflot than the cost of ships. Impairments and depreciation jumped by 15%; administrative expenses also increased by the same margin. Vessel running costs grew by 2%.

The company’s debt has also been growing sharply this year, with short-term bank loans up 32% to $308.4 million, and long-term loans up 1% to $1.66 billion. Another $206.3 million in finance leases are required for repayment. The debt is expanding to cover the cost of new vessel construction, amounting to 1.1 million deadweight tonnes (dwt); the existing fleet is 11.2 dwt. Sovcomflot’s auditor, Ernst & Young, reveals in the financial report notes that the company has been trying to sell 9 oil product tankers for a total of 306,761 dwt; four of these vessels were sold and delivered to their new owners in August, but the transaction prices are not reported.

Oil product transportation accounts for 26% of Sovcomflot’s TCE revenues, according to the latest report. The first-half revenue total for this segment came to $109.7 million, a decline of 7.3% over the previous year. The crude oil tanker segment earned more revenues, but also suffered a bigger year-on-year decline – down 11.5%.

The long-running litigation in the UK High Court against former chartering partner Yury Nikitin will go into an appeal hearing in another month. According to Sovcomflot’s report, almost $154 million is at stake. Nikitin’s lawyer, Mike Lax, said that “in spite of [Sovcomflot’s lawyers] Ince & Co’s urging, the Judge [Christopher Clarke] declined to order us to pay any sums into court.” A final ruling by the Court of Appeal is not expected before the summer of 2014.

Leave a Reply