By John Helmer, Moscow

On February 1, 2010, the United States Securities and Exchange Commission (SEC) released a report on operational results for the previous year, 2009, of the Mechel steel and mining group, Russia’s fifth-ranked steelmaker, which is also listed on the New York Stock Exchange. The group is owned by Igor Zyuzin (image, centre) with 66.8% of the shares; and at the time of the SEC filing, he was the group chief executive officer. He also signed the disclosure.

On February 17, 2010, the SEC released its next bulletin from Mechel, also signed by Zyuzin. This reported that “two special heavy machinery convoys departed from the Upper Ulak station (Amur region)… [loaded with] equipment intended for the development of Elga coking-coal deposit. Both machinery convoys have already reached their destination.” The Elga coal mine is a multi-billion dollar project for which Mechel has been getting state bank financing and guarantees. The trucking isn’t exactly newsworthy, but Zyuzin wanted to disclose it as his way of showing that Mechel was hard at work developing one of Russia’s most important new coking-coal sources.

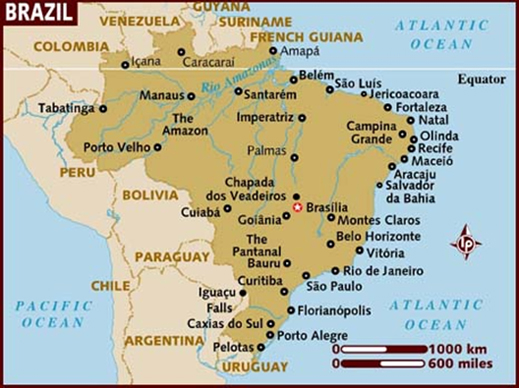

But in between the two dates, Zyuzin didn’t tell the SEC, his shareholders, and maybe not even the Kremlin that he had signed an undertaking with a Brazilian group, Cosipar – a family owned business and one of the largest pig-iron producers in Brazil – to build a new steel mill. According to the public report from the Brazilian side, the mill was designed to turn out 2.5 million tonnes of steel slabs, and its location was fixed at Barcarena, Para state, between the Amazon River and the city of Belem in north-central Brazil.

Formally, Cosipar’s announcement was of a joint venture with Mir Steel UK creating a new company called Russian and Monteiro (RAM) in a reference to Zyuzin, reported to be the owner of Mir Steel UK, and to the Monteiro family which controls Cosipar. The Russian side will own 75% of RAM, it was announced, with the balance belonging to the Monteiros. The announcement also claimed that in the first stage of the project, Mir Steel would invest $200 million in Cosipar’s subsidiary Usipar to build the new plant’s steel converter area with the first slab scheduled for production in 2015. Coking coal for the new mill was intended to originate from Mechel’s US subsidiary, Bluestone, also controlled by Zyuzin.

The news of this deal was published by CRU Steel News on February 10, 2010. Total capital required for the project was reported to be $5 billion.

Six months later, on August 23, 2010, the Russian news agency Interfax started another news ball rolling towards the very same Brazilian project. The next day the Moscow brokerage Otkritie reported that the joint venture “will include Cosipar’s blast furnaces and a steel plant (Mir Steel) in the UK. The idea is to create a logistics chain among Mechel’s North American coal producer Bluestone, Cosipar and Mir Steel. Bluestone will supply coal to Cosipar, while Cosipar in turn will supply pig iron to Mir Steel. According to the Cosipar’s official web-site, the current capacity of Usipar’s 2 blast furnaces is 500kt of pig iron, while total capacity of the company could reach 3mt by 2012.”

A bonza idea, reported Otkritie analysts Denis Gabrielik and Robert Mantse. “The establishment of such a JV certainly makes sense. Cosipar has access to cheap Brazilian iron ore, while Bluestone’s coal could be shipped by sea to Cosipar’s facilities thanks to its location in the North Brazil, which is near the coast. We view this news as slightly positive for Mechel, and expect the company to acquire this JV a some point in the future, that is, as soon as loan covenants allow. We reiterate our BUY rating for Mechel and a target price of $40.5/share.”

The qualifier in this Otkritie report suggests why Zyuzin was shy about revealing his expensive new scheme in the jungle. The problem was that the banks governing Mechel’s repayment of more than $5 billion in debts categorically, and in writing, disallowed new asset purchases without their approval. So was Zyuzin attempting to build his new Brazilian steelmill off his main balance-sheet, but with undertakings committing the flow of Mechel’s output, plus its cash, to running the new venture? Did Zyuzin have the $200 million, or more than $1 billion in ready cash to make good on his deal with Cosipar? And was he leaking the news of the Brazilian project to push up the Mechel share price, adding value thereby to its collateral value for personal borrowings Zyuzin might have been contemplating?

Other press reports at the time conceded that Zyzuin’s contribution to the joint venture was so much the greater of the two joint venturers, he would control the new steelmill. In December 2010, the value of the Cosipar assets in the joint venture were reported to be worth $1 billion, but because of the Brazilian group’s indebtedness, it was reportedly offering them at discount to Zyuzin for $250 million. There was no reporting in the Russian or Brazilian press of how Zyuzin came by Mir Steel UK, whose controversial history ended in bankruptcy for another Russian owner, Vadim Varshavsky. Zyuzin’s success in taking over Varshavsky’s assets inside and outside Russia has been chronicled already.

There is no reference to Brazil in the entire Mechel document archive, and nothing more has been heard of the RAM joint venture until yesterday. According to CRU Steel News, “Brazil’s largest independent pig iron producer, Cosipar, and partner Mir Steel UK have postponed their plans to set up a 2.5mt/y slab plant for a cost of $5bn at Barcarena in the northern state of Para, a Cosipar source told CRU Steel News, adding no further information would be given. But according to the local press, the parties’ decision was based on market grounds due to a lower-than-expected demand for steel products worldwide. The companies are understood to be planning to meet next year to decide on the project’s future.”

So what exactly has been Zyuzin doing in Brazil for the past year, his spokesman at Mechel, Yekerina Videman, was asked this week? She replied: “these are personal transactions of our shareholder, and we do not comment on them”. This is misleading, because the Brazilians in the joint venture and the Russian reports have explicitly referred to Mechel’s North American coal for the project.

Zyuzin himself is more talkative, but not on what he doesn’t want the market to know. The week before the Brazilians dropped the coconut, Zyuzin authorized the Russian media and investment banks to report, without source, that he has appointed JPMorgan Chase, Morgan Stanley and UBS to manage the sale of new shares in his coal and iron-ore mining spinoff company, Mechel Mining. The unnamed but authoritative source was also quoted as claiming that from 10% to 15% of the new company is planned for sale before the end of this year on either the London stock market or the Hong Kong one.

On the veracity of this, Videman says Zyuzin also won’t comment.

Experts on the regulatory disclosure requirements of the SEC say that because Mechel is classified as a foreign issuer and not domiciled in the US, it can claim the “safe harbour” of SEC Rule 144A to avoid the obligation of meeting the disclosure requirements of domiciled US companies listed on the New York Stock Exchange. Instead, the SEC regulations treat Mechel’s accountability to be subject to its principal place of share trading, Moscow.

Mechel’s prospectus, written by JP Morgan, Morgan Stanley and UBS and issued in October of 2004, says that “after the offering, we will be subject to the informational requirements of the Securities Exchange Act of 1934, as amended, applicable to foreign private issuers and will file annual reports on Form 20-F within six months of our fiscal year-end and other reports and information on Form 6-K with the SEC.” A close reading of Mechel’s 20-F reports to the SEC since listing in 2004 confirms Mechel’s status as a “foreign private issuer”, but there appears to be nothing on the transparency and accountability exemptions this confers.

This isn’t quite clear, so Zyuzin was asked to say whether Mechel claims to sell its shares (American Depositary Receipts, ADRs) on the US market under any SEC exemption, including but not limited to Rule 144A. Videman for Zyuzin refuses to say.

Leave a Reply