By John Helmer, Moscow

Alisher Usmanov’s enthusiasm for the earnings in the bush has always been more infectious than his success in getting his hand on the bird.

Maybe this metaphor needs to be rewritten — the bird, which London market has been giving Usmanov’s metal and mining group Metalloinvest for more than three years now, may have started flying with the successful IPO of Mail.ru (formerly Digital Sky Technologies) the internet media and portal company, which was launched on the London Stock Exchange last November. In that sale, 17% of the company’s shares were sold as global depositary receipts, raising $912 million, and valuing the company at $5 billion. At the IPO fixing price, the ratio of Mail.ru’s attributed enterprise value to its audited earnings (Ebitda) was a sky-high 47 to 55. In the speculative internet corporate universe, only Chinese companies were valued at this multiple.

Usmanov has convinced the Russian media to think of the Mail.ru share sale as a test of his own marketability. That’s because he owns a minority stake of 26.9% in Mail.ru. Bigger than he is in the company is the South African media group, Naspers, with a 30.8% stake. The portal’s founder Yury Milner took cash in selling down much of his shareholding in the IPO, but he retains 11.8%, along with operating control with the group’s managers. Another 8.3% is owned by Tencent Holdings, a China-based internet investment group and the third largest internet service provider in the world (after Google and Amazon). Rounding out the shareholder roster for Mail.ru 1% comprises other private shareholders; and 21.2% is now the free float of shares trading publicly.

Last November’s takeoff on the London market, it was interpreted by brokerages and fund managers at the time, was due in large measure to Goldman Sachs’s role in promoting upward valuations of Facebook, which has still to be publicly listed. Mail.ru owns 2.4% of Facebook, and stakes in other US internet media sites, Groupon, Zynga., and Mamba. Hyping internet asset valuations has a well-known bubble dynamic – what pops up also pops out. When skepticism set in on the valuation of the Goldman forecasts and the Russian assets in January, Mail.ru lost most of its gain since the IPO. It is now trading at roughly the same share price it achieved the day after the IPO:

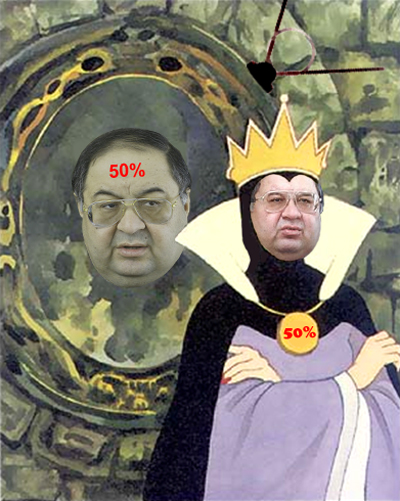

Usmanov’s contribution to the rise and retreat of Mail.ru appears to have been negligible. But he owns a much bigger stake — 50% — of Metalloinvest, a big iron-ore miner and small steelmaker in Russia and the United Arab Emirates. However, he has been unable to sell its shares publicly for several years now. His reputation in the London and US markets has been complicated by disclosures in long-running US litigation over an Arkhangelsk diamond mining asset he and a partner allegedly pinched. Usmanov denies all wrongdoing, and the case continues to wind its way through the Colorado state courts – without Usmanov as a named defendant.

This week, in case the London market hadn’t had enough of over-priced, oligarch-driven cash grabs in the past fortnight, Usmanov’s agents invited Reuters to repeat something which he had already unveiled last December. That is the plan to sell shares on the London Stock Exchange of a small television company Usmanov owns called UTV-Media.

Reuters didn’t refer to Usmanov in its report of yesterday: “Russian media holding UTV-Media, is looking to place its shares in London this year in order to raise up to $250 million, a source familiar with the company’s plans told Reuters on Tuesday. A second source confirmed that the company is mulling an initial public offering (IPO) this year. ‘The market is very volatile, but the company has been thinking about an IPO for some time,’ a source said. He said the IPO is unlikely to take place before autumn.” A day earlier, though, Reuters claimed that Mail.ru was “his [Usmanov’s] Internet firm.”

The Reuters news is old hat. Identical London IPO plans were reported for UTV-Media in December by Prime-Tass, RBK, and Gazeta.ru. These reports were more or less the same in claiming a valuation of UTV-Media of $350 million to $450 million, and an IPO sale of 30% to 40%, for a target cash raising of $105 million to $160 million. Because of the small size, the listing target was reported to be the Alternative Investment Market (AIM) of the LSE. The reports this week demonstrate valuation creep. According to a brief report by a Moscow newspaper, and also the Reuters report, the new target for UTV-Media is a raising from the IPO of $200 million to $250 million.

| How U or non-U UTV-Media will prove to be depends on what the group has to say in its prospectus about Usmanov, who owns 50% of the company. Created last July when Usmanov’s wholly owned AP Media merged with Media 1, owned by Ivan Tavrin (right), the company is at the threshold for investor acceptance which has proved insurmountable for Metalloinvest so far. |  |

UTV-Media has yet to release audited financial results. Together, Usmanov’s assets MuzTV and 7TV appear to have taken in Rb2.6 billion in sales and advertising revenues in 2009, which was not a good year, and so, along with Tavrin’s assets — 30 regional television stations – the group should be demonstrating revenues in 2010 of at least $100 million.

Leave a Reply