by John Helmer, Moscow

@bears_with

The opposite of comeuppance ought to be comedownance. That’s when, instead of a negative outcome which the perpetrator has deserved, the outcome is positive but not what the perpetrator had planned or anticipated.

This is now happening to Oleg Deripaska’s (lead image, left) aluminium monopoly Rusal, according to an announcement this week by the Deputy Minister of Industry and Trade, Viktor Yevtukhov (right). “We have high-quality aluminium,” he told reporters at an industry conference. “And I do not think that the refusal of America and England to buy our aluminium, where we did not supply so much anyway — crumbs, so to speak — will somehow affect the possibility of our supplies to other countries.”

Yevtukhov was referring to the new US and UK sanctions, announced on April 12, to stop exports into their markets of Russian primary aluminium, copper and nickel, and put an end to stocking and trading of the Russian metals by the London Metals Exchange (LME) and the Chicago Mercantile Exchange (CME).

On April 24, Andrew Home, the London expert on the international aluminium trade, acknowledged that warehousers, metal traders and speculators, and the Russians have already devised schemes to evade the sanctions, keep the discount for Rusal aluminium sales from growing, and at the same time hold the exchange benchmark price of the metal steady. Home understands the complexities of the LME trade; he admits he doesn’t know what the outcome will be. If he knew more about Russian conditions than he and Reuters are capable of, it would be clear that Deripaska aims to buy time to defeat the sanctions and get the Russian treasury to pay the price.

Yevtukhov’s response is that if Deripaska and Rusal are asking for a bailout by the Russian government, there are conditions: in exchange for the misfortune which the Americans and British are attempting to impose on the Russian metals sector, Deripaska’s application for state budget funds to buy aluminium from Rusal and keep it in a new state stockpile, and in return for letting Deripaska hold up the profit flowing into the company and into his own pocket, he must change his strategy for the benefit of the Russian state.

“[Mr. Yevtukhov] drew attention to the fact that the restrictions imposed by Western countries apply only to primary aluminium. They do not affect products made from Russian aluminium. ‘Experts estimate the potential and capacity of our market to 2 million tonnes, despite the fact that Rusal, as you know, produces 4.1-4.2 million tonnes approximately. Of course, this is not done overnight, but such work is underway, and its results are already evident.”

What Yevtukhov means is that Rusal must now switch from being an upstream aluminium producer from bauxite mine to alumina refinery to aluminium smelter, exporting metal abroad, to becoming a vertically integrated producer of such secondary and processed aluminium products as beverage cans, foil, plates, sheets, and extrusions for construction, automobile and other manufactures.

The new strategy for Rusal puts a priority on the domestic Russian market. This had been Deripaska’s strategy for the decade between 1994 and 2004. But he then abandoned the downstream because it was less profitable than upstream, and impossible to hide from Russian tax as were the upstream and export lines of business.

For Deripaska to be told by a deputy minister that he can’t have a state bailout for his unsold metal unless he accepts a revolution in corporate tax avoidance is a plan no Russian minister or president has achieved before. Or else it’s a false flag Deripaska himself is waving at Washington and London.

For the duration of the war, readers will already know, this site has suspended its investigations of oligarch-controlled businesses operating against the Russian national interest. In the case of Deripaska and the aluminium business, the archive currently holds 233 pieces — and they go back only far as April 2004. In the decade before that, the archive of Platt’s Metals , then owned by McGraw Hill in New York, held several hundred more reports.

The lessons were summed up in April 2018 in a six-point guide to Kremlin handling of the company and the oligarch. Six years ago, Point 1 was: “the first and biggest of Deripaska’s business mistakes was to destroy Rusal’s business model as a vertically integrated producer of bauxite, alumina, aluminium ingot, and most types of downstream aluminium product in sheet or pressed and extruded form. This is also the model of Alcoa in the US. Instead, Deripaska turned Rusal into mining raw materials and smelting primary aluminium. That was advantageous for the man, not for the country, because Deripaska personally stood to make much more profit from exporting the metal and keeping the profits abroad. Reorganizing the Rusal group requires the revival of downstream metal fabrication, and a shift of company revenues and earnings from foreign to domestic sales.”

Yevtukhov’s initiative this week indicates, despite the sanctions against him personally, Deripaska has successfully resisted this reorganisation. But Yevtukhov is implying that this is once again a state priority, and that Deripaska is now in a weaker position to resist than he was before — in 2008 when he applied for and received a Central Bank bailout of his debts; and in 2010 when the Kremlin underwrote Rusal’s initial public offering of shares on the Hong Kong Stock Exchange.

Source: https://johnhelmer.net/

But as the charts reveal for Rusal’s share price, for the price of primary aluminium, and for the stock exchange trajectories of Rusal’s international rivals from China, the US and India, Deripaska has been a failure in the global markets before US and European sanctions began to strike at Russian’s exports of aluminium.

Also, the US sanctions against Deripaska personally driven by the Federal Bureau of Investigation and accepted reluctantly by the State Department, dating from a time well before the war began in the Ukraine in 2014, have followed after the stock markets of London, Frankfurt, New York, and Hong Kong voted their no-confidence in him.

TRAJECTORY OF RUSAL SHARE PRICE ON THE HONG KONG STOCK EXCHANGE SINCE LISTING IN JANUARY 2010

Source: https://markets.ft.com

The market capitalization of Rusal at the current Hong Kong dollar value of the share price is equivalent to US$5 billion.

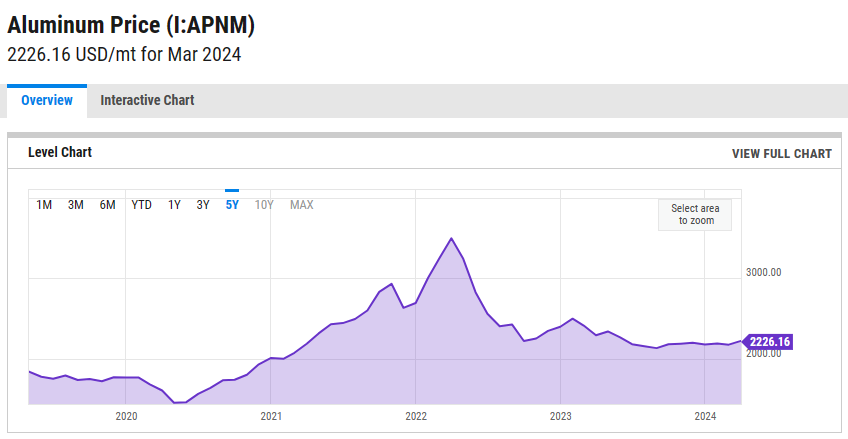

TRAJECTORY OF PRIMARY ALUMINIUM PRICE, 2019-2024

Source: https://ycharts.com/

Peak of $3,498 in March 2022.

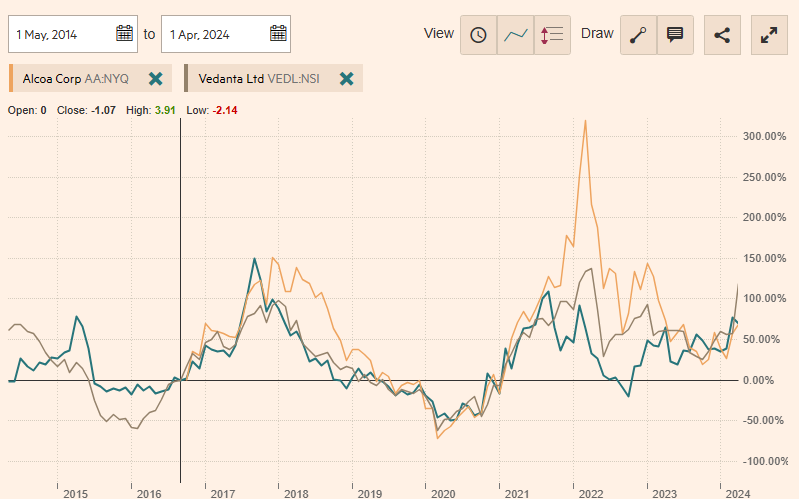

SHARE PRICE TRAJECTORY OF RUSAL’S INTERNATIONAL RIVALS – ALCOA (US), CHALCO (CHINA), VEDANTA (INDIA)

KEY: Grey=Aluminium Corporation of China (Chalco), market capitalization is $16 billion; yellow=Alcoa (US), market cap $6.5 billion; green=Vedanta (India), market cap $14.5 billion.

From 1998 to 2003, the period in which Deripaska and chief executive Alexander Bulygin consolidated their assets into Rusal and defeated their Russian rivals, they regarded Alcoa as their chief rival internationally. In private, Bulygin said that Paul O’Neill, the former Alcoa chief executive who was Treasury Secretary for a time in the 1990s, was one of the US officials responsible for imposing the first US visa ban on Deripaska, and for encouraging the FBI’s organized-crime dossier on Deripaska to be passed to other governments, including the UK and Australia, where Deripaska also had visa trouble. They also believed that Alcoa was a threat to Rusal’s interests in mining bauxite and expanding its concessions in Guinea, on which the group’s Ukrainian alumina refinery and Russian smelters depended. During the contested takeover of the Nikolaev alumina refinery (Ukraine) in 1999-2000, they believed that Alcoa conspired to deprive Rusal (then called Sibal) of standby alumina supplies which it sought in various parts of the world.

Left to right: Alexander Bulygin, Deripaska’s first chief executive; Victor Vekselberg, owner of domestic rival SUAL who was forced by Kremlin pressure to accept merger with Rusal; Oleg Deripaska; Paul O’Neill. Bulygin lost influence with Deripaska and power in the company and disappeared after being reported in the UK, too ill to testify in Mikhail Chernoy’s London High Court lawsuit against Deripaska for recovery of his $1 billion stake in the company.

During 2004 Deripaska and Bulygin told the press that they had decided to sell two downstream metal rolling factories in Rostov and Samara to Alcoa. Their reason at the time was that the mills were unprofitable. On May 6 of that year the sale transaction was announced officially. Publicly, Bulygin said: “this transaction arises from Rusal’s strategy to focus on its strengths upstream, as a leading producer of primary aluminum and alloys.” Bulygin appeared to be contradicting himself, and earlier Rusal presentations, which were depicting the company as a vertically integrated holding, from bauxite mining to aluminium applications in aviation and automotive construction, housing, and consumer products. Privately, Bulygin admitted failure to develop the domestic and exports for aluminium applications in aircraft manufacture. He said that growth in domestic Russian demand for processed metal wasn’t as fast or as profitable as he and Deripaska wanted. But most importantly, according to Bulygin, “if we concentrate on our cheap domestic electricity and cheap Guinean and Australian bauxite in order to produce low-cost primary aluminium, and then export it, we can make much bigger profits and keep them to ourselves [offshore].”

It was Bulygin’s ambition, he told the Financial Times in 2006, to move from “number three aluminium producer in the world to become number one in the world by 2013.”

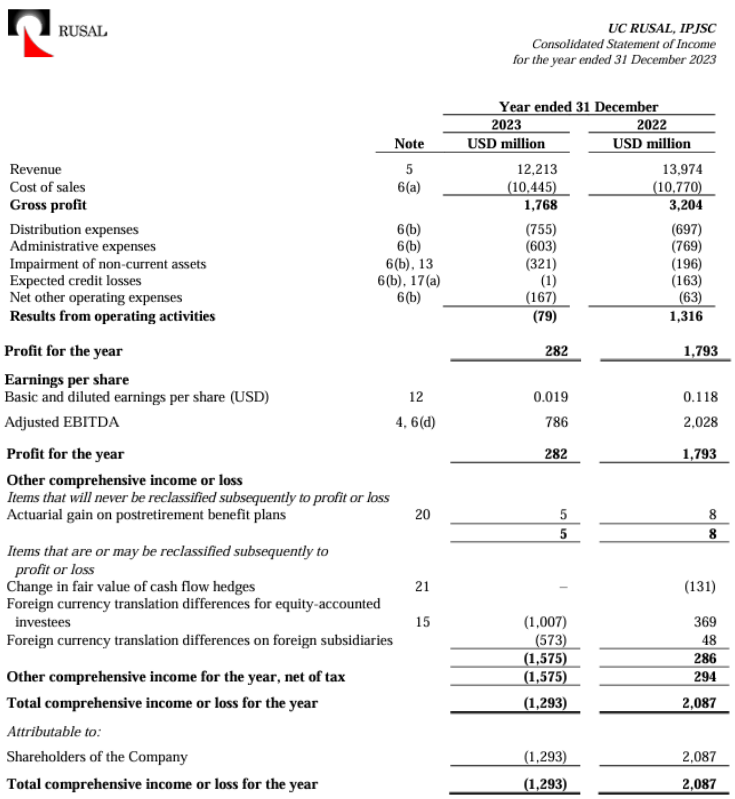

The war in the Ukraine and the sanctions war have now closed half the global market for Russian aluminium, and like all other Russian commodities and manufactures, forced the reorientation of the metal trade flows away from the US and Europe and towards Asia and Africa instead. A month ago, Rusal released its financial report for the year ending December 31, 2023. From earnings (Ebitda) of $2 billion and net profit of $1.8 billion in 2022, the company dropped to $786 million and loss of $1.3 billion.

Source: https://rusal.ru/

As of March 14, the company’s Russian auditors reported “material uncertainty in the [Rusal] Group’s ability to meet its financial obligations on time and continue as a going concern entity.”

“Ban of Australian government for the export of alumina and bauxite to Russia introduced in March 2022 and stoppage of production at Nikolaev Alumina Refinery Company Ltd due to developments in Ukraine starting from 1 March 2022 influenced the availability of alumina and bauxite or increase the purchase prices for the Group. Difficulties with logistics caused the Group to rebuild the supply and sales chains and lead to additional logistics costs. If the situation in Ukraine and overall geopolitical tension persists or continues to develop significantly, including the loss of significant parts of foreign markets, which cannot be reallocated to new markets, it may affect the Group’s business, financial condition, prospects and results of operations.”

“Potentially the Group may have difficulties with equipment deliveries that may postpone realization of some investment projects and modernization programs for existing production facilities. The facts described above, as well as the volatility of commodity markets, stock, currency markets and interest rates, create material uncertainty in the Group’s ability to meet its financial obligations on time and continue as a going concern entity.”

The report indicated that from 2022 to 2023 sales of metal to China jumped from $1.1 billion to $2.9 billion. No sales figures for the US were released. The domestic sales inside Russia dropped from $3.8 billion to $3.5 billion. The value of domestic Russian sales dropped slightly, but the domestic share of Rusal’s global sales rose from 27% to 29%.

Yevtukhov was asked to expand on his earlier remarks, and to confirm that it is now government policy that if Deripaska wants a state stockpile of aluminium to take the metal off the company’s hands and limit production cuts and job losses, he must reorganize the company along the lines of its strategy twenty years ago.

Yevtukhov’s spokesman asked for an email of the questions, and then did not answer.

Leave a Reply