by John Helmer, Moscow

@bears_with

Every spring, when it’s certain no more snow will fall on Moscow, it helps to remember what the celebration stands for, and look forward with hope. Hope doesn’t come cheaply.

In English and many other languages including Latin, May Day meant the return of fecundity, flowers, food harvests, and so hopefulness after winter, with entertainment from the randiest, cleverest, and silliest of the field creatures, the hare and the goat.

Mayday! Mayday! That started in 1927 as an internationally recognized distress call put out on radio, which had nothing to do with the month of May. It started in French – m’aidez! “Help me!” That replaced the Morse code for SOS (“Save our Ship”) which was first adopted internationally in 1905. Mayday!, the radio call for help, was needed when radio replaced the telegraph and a speaking voice was required instead of taps and pips.

These days it’s the traditional left wing, based on workers’ movements, which need help. In France they have been superseded by spontaneous mobilizations, like the gilets jaunes, but they are failing against the Macron presidency; Keir Starmer’s British Labour Party is already a failure of the left before it defeats the Tories. There are leftwing movements in Germany and the US, but it is unlikely that such splinters can achieve more than splinters can – that’s pinpricks. Altogether, this left contributes next to nothing to the defeat of their governments, arms, and armies on the Ukrainian and Middle Eastern battlefields compared to the Russian Army and the Axis of Resistance.

In Russia, the party of Marx and Engels has one leader embalmed and horizontal in Red Square; and a stone’s throw away in the State Duma, the current leader, Gennady Zyuganov, embalmed and vertical. The vote for the Communist Party candidate for president, Nikolai Kharitonin, in the March election was just 4.37% — the lowest level ever reached. For this year’s May Day, the Communist Party has published no analysis of the current situation in Russia or party programme. Instead, it has called for a rally at the Karl Marx statue in front of the Bolshoi Theatre. In addition, the party has announced two dozen slogans for May Day. These include: “Long live the red May Day!”, “Proletarians of all countries, unite!”, “A job! Salary! Confidence in the future!”, “No increase in prices and tariffs!”, “Affordable housing for a young family!”, and “Scholarships at the minimum wage level!”

The alternative leftwing Russian leaders, Sergei Glazyev and Mikhail Delyagin, have published nothing for May Day.

Without mentioning May Day, Vzglyad, the semi-official platform for national security and economic analysis, has issued a report on a new government planning document setting out three scenarios for Russia’s economic future. The author is Vzglyad’s economics reporter, Olga Samofalova.

The text has been translated verbatim without editing; charts and pictures have been added for illustration.

Source: https://vz.ru/economy/

Stress scenarios for the Russian economy identified

What can prevent the Russian economy from continuing to grow

By Olga Samofalova

April 26, 2024

The Ministry of Economic Development has developed three scenarios for the Russian economy for several years ahead. Under one of them, the country’s economy, export revenues, and real incomes of the population are growing. Whereas in the high-stress case, everything happens the other way around, and it becomes more difficult to cope with inflation and keep the ruble strong. Which scenario do the experts consider the most likely, and why?

The Ministry of Economy has built three development scenarios for the coming years: high-stress, base case, and conservative (medium).

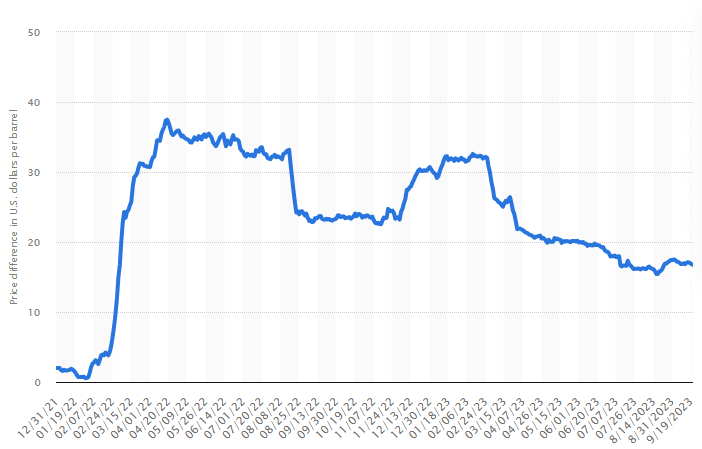

The high-stress scenario is the most pessimistic. It provides that the export price of Russian oil will fall to $58.50 per barrel this year, and to $51.80 per barrel in 2025. Currently, Russian Urals crude oil is trading at about $79 per barrel. But in the high-stress scenario Russia will be selling oil for less than $60 per barrel – this is the price ceiling set for sanctions by the West.

AVERAGE MONTHLY PRICE OF URALS CRUDE OIL, JANUARY 2007-JANUARY 2024

In USD per barrel

Source: https://www.statista.com/

PRICE DIFFERENTIAL (DISCOUNT) BETWEEN URALS AND BRENT OIL BENCHMARKS, DECEMBER 2021-SEPTEMBER 2023

In USD per barrel

Source: https://www.statista.com/statistics/

In this high-stress scenario, the ruble exchange rate will fall from 93 to 97 per dollar this year and next year to 107, against the background of reduced investment and oil prices, the documents say. By 2027, the ruble exchange rate will drop to 120 per dollar.

If everything goes according to this scenario, GDP growth will slow down to 1.5% this year, and next year growth will almost stop and amount to only 0.2% plus.

In this case, investments in fixed assets will increase by only 0.5% this year and fall by 1.5% in 2025; real disposable income growth, which amounted to 5.4% in 2023, will decrease to 1.9% this year and 0.9% next year.

Inflation will not be overcome in this scenario: this year it will amount to 7%, which will be 3% above the Central Bank’s target level of 4%. In 2025, inflation will again exceed the target and amount to 5.3%.

The high-stress scenario provides for a decrease in oil and gas production and exports in Russia. Thus, exports will decrease from $424.2 billion in 2023 to 195.3 billion this year and to $365.7 billion in 2025.

The high-stress scenario can come to life when one of two conditions is met.

First, if there is a global drop in world oil prices. “But this, in our opinion, is unlikely, since the stabilization of oil prices is artificially due to a reduction in quotas for the extraction of the black gold by the OPEC+ member countries and a voluntary reduction in exports by Russia. In other words, in order for world oil prices not to fall, Russia needs to continue to cooperate with OPEC+ and, if necessary, voluntarily reduce its exports or production,” says Vladimir Chernov, an analyst at Freedom Finance Global.

Secondly, such a scenario is possible if the West increases external pressure on the Russian economy. “Increased control over the circumvention of sanctions and sanctions pressure on third countries which trade with Russia can lead to an increase in the discount on Russian oil and a decrease in its exports, even with high world oil prices,” Chernov says.

In his view, the risks of a stressful scenario are now quite high, as the external pressure on the tanker fleet and foreign banks which accept payments from Russia has been significantly increasing recently.

Periodically, there are reports that certain banks have stopped accepting payments from Russia in fear of falling under secondary US sanctions. In particular, it has been reported that payments for Russian oil were delayed by banks in China, the UAE and Turkey. It was recently reported that four other major Chinese banks have stopped accepting payments from Russia.

The base-case scenario paints a rosier picture: GDP will grow by 2.8% this year, and by 2.3% in 2025. Oil will remain at the same high levels as it is now – $79.50 in 2024 and $75.10 per barrel in 2025. But even in this, the most optimistic of the three scenarios, the ministry has worsened its inflation forecast and expects the ruble to weaken steadily. So, this year inflation will be 5.1%, and it will be possible to reduce it to 4% only in 2025, according to this scenario. The dollar–ruble exchange rate this year will be 94.70, in 2025, 98.60, and in 2026, 101.2.

Exports in the baseline scenario will grow from $424.2 billion in 2023 to $428.7 billion in 2024 and to $455.7 billion in 2025.

Maxim Reshetnikov, head of the Ministry of Economy (right), has noted the risks of a slowdown in the global economy, continued sanctions pressure, and tightness in the Russian labour market; these factors, he says, have been taken into account in the ministry’s midline or “conservative” forecast.

As for the base-case and conservative (average) scenarios, these will operate if, firstly, it is possible to keep world oil prices high, for which Russia needs to participate in the OPEC+ deal; and secondly, if Russia continues to export black gold to friendly countries in approximately current volumes, Chernov believes.

“The base-case forecast of the Ministry of Economic Development assumes that budget injections into a number of production areas will continue at the same level as now, as well as high social spending. With this approach, of course, the salaries of Russians will continue to grow, albeit less than in 2023 and 2024,” said Fyodor Sidorov, founder of the School of Practical Investment. Real incomes of the population will grow by 5.2% this year (almost the same as in 2023), and by 3% in 2025.

FIVE-YEAR TRAJECTORY OF INFLATION RATE

Source: https://tradingeconomics.com/russia

RUBLE TO US DOLLAR, 2020-CURRENT GDP, 2020-CURRENT, $BILLION

Left, source: https://www.google.com/

Right, source: https://www.sularu.com/vvp/RUS

Why is it that even in the basic scenario – the optimum one – it is not possible to overcome inflation, and the ruble continues to weaken?

The fact is that for the last six months, the ruble exchange rate has been supported by the decree of the President of Russia on the repatriation of foreign exchange earnings by exporters on the stock exchange. But at the end of April, this decree runs out. “Apparently, the Ministry of Economic Development takes into account in these scenarios that they will not extend the decree, and a shortage of American dollars will begin to form in the country; that in turn will lead to an increase in their value on the stock exchange. Inflation largely depends on the exchange rate of the national currency, since all imported goods become more expensive in ruble terms with an increase in the dollar exchange rate. Therefore, in the basic and conservative scenarios, inflation remains elevated amid expectations of a decrease in the value of the ruble. Gradually, the Bank of Russia will begin to lower the key refinancing rate, which will also weaken the value of the Russian national currency – apparently, this circumstance is also taken into account in both scenarios,” explains Chernov.

On April 25, President Putin addressed the annual meeting of the oligarch lobby, the Russian Union of Industrialists and Entrepreneurs, whose chief executive is Alexander Shokhin (left). Shokhin has led the lobbying for Putin’s protection against investigation and prosecution of state assets transfer during the Yeltsin administration. Putin has promised the lobby in the past, and he promised again last week: “Our law enforcement authorities have recently opened a number of cases on de-privatising certain assets. I would like to emphasise that we are not proposing a revision of privatisation results, which we pointed out at our previous meeting. The matter concerns the cases when the actions or inaction of the owners of enterprises and other assets directly damage national security and national interests. I would like our colleagues in this room and in the law enforcement agencies to know that the expropriation of assets is only justified in the situations I have mentioned just now.” Click for the full speech. For a report of Putin’s last public promise on the same point, read this. For a review of the oligarch lobbying since the Special Military Operation commenced, click.

Also, an anticipated increase in investment activity will be a factor in accelerating inflation, Sidorov notes. In addition, in the next year and a half, we will observe a high key rate of the Central Bank of the Russian Federation, since now the regulator is actually hostage to the basic forecast of the Ministry of Economic Development, he adds.

The expectation of a decrease in oil and gas production and in exports from Russia, not only in the high-stress but also in the conservative scenario, may be due to two factors.

Either Russia may need to reduce oil production and exports under the OPEC+ deal in order to stabilize world prices for black gold. Or increased pressure on Russia may create logistical difficulties in transporting and paying for oil exports from Russia, which will lead to an increase in the discount on Russian oil, the source at Freedom Finance Global notes. Moreover, there are no plans to extend the contract for the transit of Russian gas through Ukraine.

“So far, I would call the basic scenario of the Ministry of Economy the most likely development of events. Notwithstanding, this year there are too many external risks leading to the high-stress scenario, Chernov concludes. He adds the caution that, in his assessment, the Ministry of Economic Development is underestimating the possible consequences of increased sanctions pressure on countries friendly to Russia.

NOTE: The lead illustration is a May Day poster published in Moscow in March 1922. The text says: “May 1 is the celebration of labour’s surge. In the heroic work at the machines lies the hope of the working class.”

Leave a Reply