By John Helmer, Moscow

@bears_with

President Vladimir Zelensky has enough fingers to count that $115 billion is worth almost three times more than $41.3 billion.

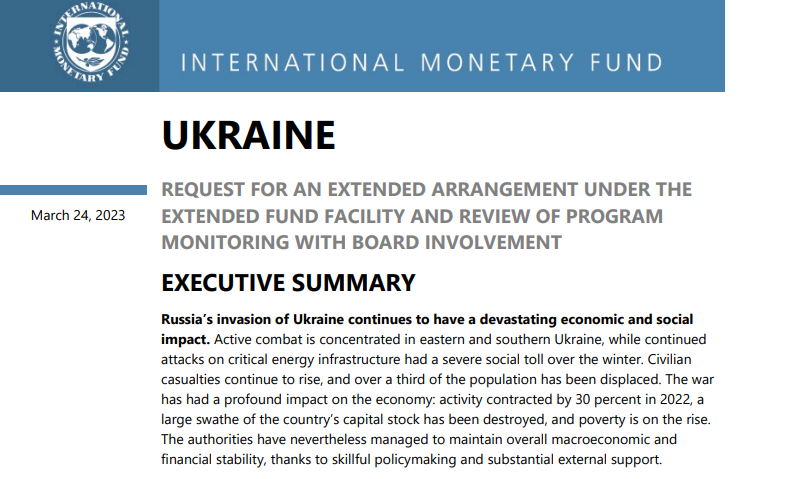

The first number is the International Monetary Fund’s (IMF) calculation of “external support over 2023–27 involving sizable official financing in the form of grants and concessional loans, as well as debt relief.” This includes “SDR [Special Drawing Rights] 11.608 billion (577.01 percent of quota, about US$15.6 billion).” No IMF member state has ever been allowed to take a six-times multiple of its borrowing quota at this money volume except for the Ukraine. Nor has any IMF member state ever been authorised by the IMF board of directors to stop new domestic bank lending and postpone all borrowing obligations (“current debt standstill”) for at least another three years from this Christmas.

The resulting money pile the IMF calls “the wartime liquidity surplus”.

Converting this into the Ukrainian banks’ profit line and diverting that into individual cash and assets, Kiev officials have told Reuters to report as the “Ukraine banks’ robust health.” “Across the banking sector,” the New York-based propaganda agency reports, “deposits are as abundant as they’ve ever been, and the country’s lenders have found ways to remain profitable.” This is being done, they explain, by borrowing more and more in government bonds at a 25% interest rate guaranteed by more IMF money flowing into the central bank; lending less and less to zero for customers; and ignoring the increasing pile-up of defaulted, non-performing, or fraud loans.

This is Zelensky’s pyramid, even Reuters and its Ukrainian banker sources imply, though the IMF staff cannot bring themselves to say so. “In the current context, Ukrainian bankers note, the choice makes sense. “’We will only survive if the government survives,’ [Privatbank chief executive Gerhard] Boesch sums up.”

The big money number dwarfs the Pentagon’s most recent estimate that “the Biden administration has committed more than $41.3 billion in security assistance to Ukraine since the beginning of Russia’s invasion in February 2022.” The new July 7 number includes deliveries of Patriot missiles, HIMARS rockets, cluster bombs, and “dual-purpose improved conventional munitions, or DPICM”. Using the banker’s term, the Pentagon announcement declared “the Ukrainian forces have effectively leveraged assistance…So we will continue to provide Ukraine with the urgent capabilities that it needs to meet the moment, as well as what it needs to keep itself secure for the long term from Russian aggression.”

When President Zelensky’s hands reach for his pockets, the calculation of “leverage” applies a liquidity risk discount for goods compared to cash; arms and ammunition cannot be diverted with the same profitability as cash. This is also because Pentagon delivery controls are more closely enforced on the ground than the IMF can follow the cashflow once it leaves the National Bank of Ukraine (NBU) and enters the oligarch banks now nominally nationalised.

It is thus clear that Zelensky’s pyramid is much more lucrative than the Ukrainian Defense Ministry and General Staff pyramid. This is why the war on the battlefields of the east is also a war of the two pyramids in Kiev.

To manage this war, the IMF uses its hands to pull the other leg. In the current IMF staff report it calls the war of the pyramids “progress in governance, anti-corruption, and rule of law reforms.”

The IMF staff report was issued on March 24, 2023, and can be studied here. The principal author is a Gavin Gray who served as the IMF’s chief functionary in Iraq between 2018 and 2020.

The IMF record for facilitating multi-billion dollar transfers of cash into Ukrainian bank and then individual oligarch pockets, has been documented in this archive. Under US control at the Fund’s board of directors, the chief executives, country directors, and Kiev residential representatives of the IMF began practising their blind-eye reporting on the Ukraine with the Igor Kolomoisky pyramid (Privatbank) and the Victor Pinchuk pyramid (Credit Dnepr).

The cashflow directed by Ukrainian President Petro Poroshenko and IMF managing director Christine Lagarde was a fraction, less than a tenth, of the cashflow now directed by Zelensky and the Fund director since 2019, Kristalina Georgieva.

Left: IMF managing director, Kristalina Georgieva, a Bulgarian, gives her helping hand to President Zelensky on February 23, 2023. Right, Briton Gavin Gray has been chief of the IMF’s Ukraine mission since last September.

On Georgieva’s orders and with the approval of the IMF board of directors, Gray has reported that there is no accounting or tracking of cash diversion, loan fraud, and pyramid schemes throughout the Ukrainian financial sector. This is because there is no inspection of bank books, and none is planned until “conditions allow”. According to the IMF report, “The NBU [National Bank of Ukraine] also plans to resume scheduled onsite supervision inspections for both bank and non-bank financial institutions (Structural Benchmark, September 2023) and unwind all emergency prudential measures by end-March 2024, if conditions allow.”

In the meantime, sitting at their desks “while waiting for suitable conditions to undertake the independent AQR [Asset Quality review] the NBU’s banking oversight teams will undertake an asset valuation and solvency assessment of banks comprising 90 percent of banking system assets by end December 2023. This review will provide an indication of bank balance sheet health and will be used to inform supervisory priorities.”

Georgieva and Gray are insistent that the less state supervision of the Ukrainian banks, the better; they also demand that the nationalisation of Kolomoisky’s Privatbank and other fraud shells should be reversed by re-privatisation as soon as possible. “The authorities have committed that any decisions that have the potential to increase state ownership in the banking sector will be taken in consultation with IMF staff and be strictly limited to matters related to national security decisions during the Martial Law period and preserving financial stability. In that regard, any further nationalizations should also include plans to promptly re-privatize or resolve [sic] the banks concerned.”

President Zelensky with Igor Kolomoisky; no date. Source: https://www.brasil247.com/

In the sixty thousand words comprising the IMF report, “fraud” isn’t one of them. In its place, Gray’s bromide: “Post-war reconstruction should meet the highest standards of transparency and accountability, with support from anti-corruption institutions, international partners, and civil society organizations. Enhancing governance of the Anti-Monopoly Committee of Ukraine, in promoting market competition and combating monopolistic practices would also support long-term reform prospects.”

The terms “lose”, “losing the war”, “surrender”, and “peace” also don’t appear in the 157-page IMF paper. Instead, Gray implies that the risk that the Ukrainians will capitulate on the terms foreshadowed by Moscow to reduce the country to a fraction of its territory and resources, is no more than an unmentionable, unquantifiable “difficulty”. “The banking system,” the IMF staff report concludes, “has been subject to regulatory forbearance on capital, credit, and reporting standards, thus the impact of the war on asset quality is difficult to ascertain with precision due to these measures.”

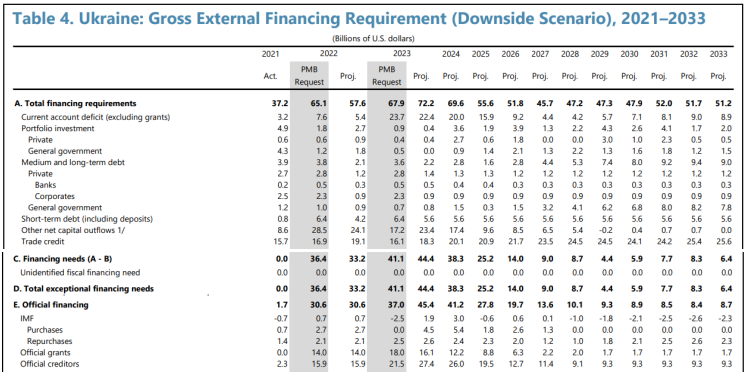

In an annex to the main report, Gray has produced estimates and projections for what the IMF is calling the “downside scenario”. This falls far short of the military realities now acknowledged at NATO headquarters and the Pentagon.

Gray claims that “a longer and more intense war” for Kiev will cost an extra $25 billion in blow-out cost for the IMF, the US, and other international guarantors of the Ukraine’s debt. But total blow-out of $140 billion doesn’t calculate the total default if the Ukrainian Army surrenders and signs terms of defeat with Russia. Since the IMF has agreed that the Ukraine should default and not repay its $3 billion loan debt to Russia, the Russian capitulation terms aren’t likely to be forgiving, let alone repaying $140 billion.

According to the IMF, “in light of exceptionally high uncertainty, staff has developed a downside scenario. The scenario assumes a longer and more intense war compared to the baseline scenario, weighing on sentiment, dampening the pace of return by migrants, and causing further infrastructure damage. This would result in a sharper real GDP decline of -10 percent in 2023 and a further contraction of 2 percent in 2024. In view of continuing high defense needs, the fiscal deficit would be higher in 2023–24 and improve more gradually thereafter. Imbalances in the FX market would be expected to persist for longer, given continuing constraints on exports, leading to higher nominal depreciation, though the extent of real depreciation would be contained by relatively higher inflation. The subsequent recovery would be more subdued than in the baseline scenario, given the even greater damage to the capital stock, slower return of migrants, and weakened balance sheets, leaving output to remain well-below pre-war levels.”

Click to enlarge at page 93 of the IMF report

Follow the wishful thinking from page 87 to 99 of the IMF report.

“Overall, extensive discussions with the authorities on contingency plans suggest that the program remains robust even in the case of such a downside scenario. The authorities’ policy commitments and track record, together with financing assurances from international partners and expected debt relief, give confidence that even in this downside scenario, the program objectives of maintaining macroeconomic and financial stability, restoring debt sustainability on a forward-looking basis, and ensuring medium-term external viability could be met. The debt sustainability analysis based on this downside scenario, presented below, suggests that under this downside scenario, additional financial assurances provided by Ukraine’s international partners would restore debt sustainability on a forward-looking basis.”

What the IMF means is that the gravy train will continue running because the US Treasury and the NATO allies will keep paying. Uncomprehending of defeat west of Dnieper River, the IMF is calculating that in Kiev, so long as Zelensky stays in place, short-term profiteering is bound to beat medium-term default.

Leave a Reply