By John Helmer, Moscow

The conflict between Romeo’s Montagues and Juliet’s Capulets went deeper than the scent or the name of flowers, and we know it ended badly for the two of them. That’s to say with white lilies, not roses.

In the Russian market for cut flowers – until recently, the fastest growing in Europe — the war has cut imports by a third in value last year, compared to 2014. The deepest cut of all for exporters was suffered by The Netherlands, whose government has been outspoken in support of European Union sanctions; NATO military movements towards the Russian frontier; and support of the Kiev regime in the investigation of the Malaysian Airlines MH17 disaster.

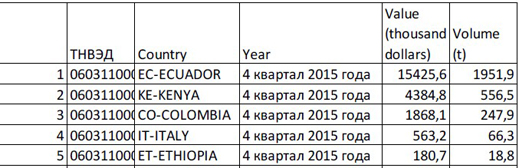

But wait! is that a Montague and a Capulet bloom, an Italian rose, which has appeared on the Russian market in recent months? Yes, in the December quarter of 2015 the Italians jumped to fourth place in the table of top-5 exporters of cut flowers to Russia with shipments of 66 tonnes, at a value totalling $563,200. They replaced the Dutch. In the comparable quarter of 2014, The Netherlands had ranked number-4 with 560 tonnes worth $4.8 million; at the same time Italy delivered almost no flowers at all to Russia. The explanation, according to Moscow market sources, is that the Italian growers have found a way to avoid the Dutch flower auctions, and ship directly to Moscow.

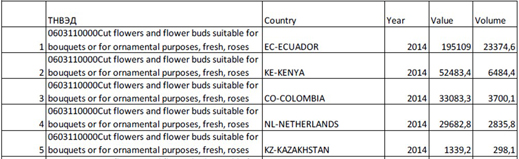

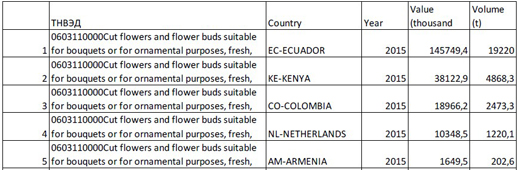

The aggregate numbers speak for themselves with another meaning. In 2015 the total value of Russian imports of flowers from the top-5 sources came to $215 million. That was a 31% reduction compared to 2014. Imports over the full year from The Netherlands fell by 65% — from $29.7 million to $10.4 million.

Rustam Azimov of Jaaz Flowers & Plants B.V., a flower broker with offices in Honselersdijk and Moscow, explains that sanctions imposed by the European Union (EU) and counter-sanctions introduced last July by Moscow have hurt the market less than the sharp fall in the rouble. He acknowledges the volume of imported flowers is being reduced drastically, and that in Ecuador, the leading grower of roses for the Russian market, plantations are shutting down. “Currently there are no special obstacles to the delivery of flowers from abroad, even the Dutch,” Azimov explains. “The situation with the currency puts the most pressure on us.”

Source: http://www.jaaz-flowers.com/

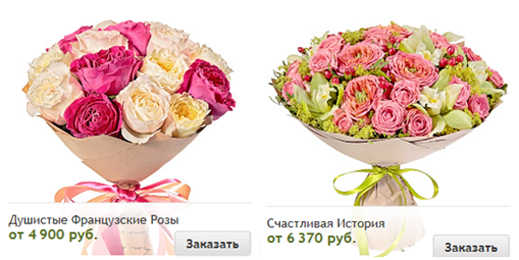

The traditional spike in Russian demand for roses for Valentine’s Day on February 14 and for March 8, Women’s Day, is again expected to push prices up at the Dutch auctions in Aalsmeer, as well as in freight rates for air-cargo shipments from South America. The spike is likely to double the price of roses in Moscow.

But the Dutch losses have been heavy, and they are getting worse. At peak in 2013, the Dutch exported to Russia €191.9 million ($255 million) worth of flowers, according to the Dutch statistics (which count re-exports). Then Russia ranked 4th in the Dutch table of export destinations, growing 2% annually, while the larger European markets like Germany, the UK and France, were shrinking. For the full story of the role the Aalsmeer flower exchange has played in the Russian market, read this.

In 2014, the value of Dutch imports (counting only flowers grown in The Netherlands), according to the Russian Customs data, was $29.7 million.

TOP-5 EXPORTERS OF CUT FLOWERS TO RUSSIA, 2014

Source: Russian Customs

Counter-sanctions against imported agricultural products from the EU member states were introduced in August 2014. A separate threat of a phytosanitary ban on Dutch flowers was announced a few days earlier. Then the rouble began dropping sharply in the final quarter of the year, and it followed the crude oil price downwards through 2015. The Russian Customs data for last year show that imports of Dutch flowers came to $10.4 million.

TOP-5 EXPORTERS OF CUT FLOWERS TO RUSSIA, 2015

Source: Russian Customs

Philip Owen of Volga Trader, a leading analyst and broker for the Russian agricultural industry, says foreign exchange volatility and falling incomes for Russian consumers have hurt all flower exports, but there have been political problems too, and it has been difficult for Russian importers to reorient geographically to new sources of supply. “The instant emergence of Italy as a flower exporter perhaps reflects Italian growers bypassing the [Dutch] auction houses. The same applies to Germany, Spain, and elsewhere in the European Union. Thailand, Malaysia and Indonesia are not beneficiaries of the Dutch collapse, perhaps because they are growers outside the Dutch system.”

Owen confirms that a small part of the diversification of Russian flower supply, hoped for and reported last July, has materialized. “Ethiopia is doing well. Zambia is now successfully exporting roses to Russia. There is a Dutch-owned flower farm in Zambia, so this is an easy substitution. Dubai’s huge investment in flower handling at the airport does not seem to have produced any benefit. Although, since New Year, Russia has launched a major charm offensive in the Middle East.”

TOP-5 EXPORTERS OF CUT FLOWERS TO RUSSIA, 4TH QUARTER 2014

Source: Russian Customs

TOP-5 EXPORTERS OF CUT FLOWERS TO RUSSIA, 4TH QUARTER 2015

– Rose olandesi, andate in malora!

Source: Russian Customs

A switch to home-grown flowers is also proving to be painfully slow. At the start of 2015 it was estimated that about 16% of domestic consumption of cut flowers was supplied from Russian growers; 84% from imports. But Russian industry reports indicate that local flower growers had been running into financial difficulty to raise bank loans and meet costs before the war economy impacts began to be felt.

New Holland, a St. Petersburg rose-grower, owned by Alexei Antipov, was obliged to halt production last November after two bankruptcy petitions had been filed against the company in local courts. Press reporting indicated that the greenhouse complex of 28 hectares had absorbed more than €53 million in investment since 2006. The plan had been to take a 50% market share of the rose market in Russia’s second city. By the time the federal government began to intervene against Dutch imports, New Holland was already deep in the red.

New Holland, a St. Petersburg rose-grower, owned by Alexei Antipov, was obliged to halt production last November after two bankruptcy petitions had been filed against the company in local courts. Press reporting indicated that the greenhouse complex of 28 hectares had absorbed more than €53 million in investment since 2006. The plan had been to take a 50% market share of the rose market in Russia’s second city. By the time the federal government began to intervene against Dutch imports, New Holland was already deep in the red.

Last December a Moscow newspaper reported that a greenhouse combine at Moksha, between Moscow and Samara, was already growing roses under cover in an area being expanded from 24 hectares to 32 hectares. This year further expansion is proposed to allow the start of production of carnations, whose import from Turkey has been under sanction since last November.

Taliya Akhmetova, head of the press service at Florist.ru, a major domestic retailer, says that Russian-grown roses are “ the most expensive, but the quality is high, with a tight bud, long lasting, and available in a variety of grades. The domestic producers have not raised the bar in terms of production in the last year.”

Source: http://www.florist.ru/

In the summer growing season, their maximum market share is stuck at around 15%. Akhmetova explains why. “Even these flowers depend for rootstock, fertilizer and equipment on imports from The Netherlands. Therefore, local producers depend on the macroeconomic conditions, so their prices are also correlated with the exchange rate as is the price of importers. Unfortunately, growth of domestic production of flowers cannot be expected.”

Note: The bear is making a pun between the Russian words for bear and for hello. He is also singing: “The 8th of March is close, close/and I am as happy as a bear /carrying flowers to you to congratulate/and call out to you, Hello!”

Leave a Reply