By John Helmer, Moscow

Victor Vekselberg and his Renova group were put out of business by the US Treasury in the April 6 sanctions list. The reasons announced were that Renova is owned by Vekselberg, and Vekselberg “is being designated for operating in the energy sector of the Russian Federation economy;” and also because there is a two-year old Russian prosecution “of the company’s chief managing director and another top executive, for bribing officials connected to a power generation project in Russia.” For more on the criminalization of Russian electricity rates and the Kremlin policy of selective prosecution, read this.

One of the Renova group companies targeted by the US produces mineral water from Lake Baikal, the world’s largest, deepest freshwater lake and one of the purest of water sources in the country; Renova’s Baikal Holding also has plans to turn the water into lemonade and other soft-drinks. Because these too are an American target, the far from well-known Baikal brand of bottled water has become the likely recipient of millions of dollars in Russian federal budget assistance.

This is how the US economic war against Russia works. The target escapes; the sanctions achieve none of the declared US Government objectives. The collateral damage, on the other hand, is concentrated on Russian taxpayers and consumers. They pay to preserve the oligarch’s business intact.

In his inaugural address on May 7, President Vladimir Putin omitted to mention the state of war which the US is inflicting on all fronts. Instead Putin spoke of “this turning point in history, as the entire world is undergoing rapid change”. To manage, Putin proposed a strategy of “breakthroughs in all areas of life”; he repeated the word breakthrough seven times. “We should… organise our breakthrough development agenda so that no obstacles or circumstances could prevent us from determining our future on our own and only on our own.”

The next day, in his speech to the State Duma Putin noted there have been “new challenges” which he called “particularly acute, and often seemed dramatic”.

President Putin at the State Duma on May 8, discussing breakthroughs with Duma Speaker Vyacheslav Volodin, Putin’s former deputy chief of staff; in the foreground, Prime Minister Dmitry Medvedev, making his confirmation speech. Source: http://en.kremlin.ru/events/president/news/57431

On the bottled war front, mineral water is currently taking a 43% share of sales of non-alcoholic drinks in Russia. This market share was growing until 2014, then suffered a reversal in 2015, followed by a partial recovery since 2016. Lemonade and carbonated drinks have a 27% market share; this too has been growing for some products, such as kvass and energy drinks. For more details, read the Nielsen report. Russian consumers are increasingly sensitive to the health value of what they drink, while water bottlers try to diversify market demand for their products by adding flavours to the water. Except for highly regulated watering holes such as Moscow and St. Petersburg, Russians also don’t trust the quality of the tap water to drink.

Fruit juices and nectars (comprising about 12% of sales) have been declining in the Russian drinks market; iced-tea even more sharply. The US war against Russia has not been a cause. Rising product prices and falling consumer incomes since 2013 have done the most damage to the higher-priced drinks. PepsiCo and Coca-Cola, which have held two-thirds of the Russia juice market between them, started closing their juice plants in 2015.

According to the consumer market consultancies VVS and GRC, Russians consume on average far less bottled water and soft-drinks than their peers in Europe. The average yearly volume of Russian consumption is about 94 litres per person; in Europe the average is about 200 litres. Most Russian consumption of bottled water and soft-drinks is produced locally; between 2% and 3% is imported. The largest sources of imported water are Georgia (the Borjomi brand has been popular since the Soviet era) and France (Perrier, Evian, Vittel). Russian drinks businesses export more water than they import, mostly to former Soviet countries.

Globally, the volume of bottled drinking water was estimated at about 330 billion litres in 2015, worth roughly $170 billion in sales revenue. Over the decade to 2024 consumption and sales are forecast to double. In the worldwide market, the acknowledged leaders are Nestlé of Switzerland (brands include Perrier, Vittel, San Pellgrino, Acqua Panna), Danone of France (Evian, Volvic, Badoit), and from the US, PepsiCo (Aquafina, SmartWater, Aqua Minerale) and Coca-Cola (Bon-Aqua).

Russia produces almost 6 billion litres of bottled water per annum, worth about Rb165 billion ($2.5 billion). When consumption volume and value of sales dropped in 2015, and then began to recover again in 2016, what was happening, according to Mikhail Olkhov, business development director of Stelmas, was that Russians were economizing, choosing lower-priced products. Across the country, he said, the price varies enormously – from Rb14 for a litre bottle in Kostroma to Rb90 in the centre of Moscow.

The market experts agree that domestic plants dominating the water market start with Nestlé, PepsiCo (which in 2010 took over the Russian juice producer Wimm-Bill-Dann) and Coca-Cola. A Chinese franchisee of Coca-Cola announced earlier this year that it’s thinking of investing in a bottled water plant in Buryatia, branding it Baikal. Russian market research identifies single-digit market shares for the top-10 brands – Karachinskaya, Mercury, Narzan, AquaLife, Shishkin Wood, Saint Springs, Aqua Minerale (PepsiCo) and Bon-Aqua (Coca-Cola). The start of war in 2014, and the decline of consumer income, have triggered a drift in Russian preferences away from the global brand-names towards local ones.

To retain market share and stimulate sales growth the established local producers, as well as the Swiss and Americans, are trying to diversify their product lines, adding flavours and bubbles to their water; and exploiting their deeper pockets with costly advertising campaigns to promote health and youth. Anti-Americanism as a reason for not drinking Pepsi or Coca-Cola products is growing.

From the Russian website of Coca-Cola’s Bon-Aqua; source -- http://www.bonaqua.ru/ru/home/

The PepsiCo Russian website displays two popular water brands, and a kvass; source -- http://www.pepsico.ru/Brands/brand-explorer .

In this competitive market Renova’s Baikal Holding produces a bottled product that is not well-known to Moscow market analysts. Nielsen refuses to say what sales volume or market share Renova’s Baikal brand currently has. Another Moscow expert said he had heard about several Baikal brands but knew no details about their sales. An expert who asked not to be identified by name said he knew of three brands – Baikal Sea, Baikal Group and Baikal Export. The first and second, he said, concentrate on domestic sales; the third, from Buryatia, on exports to the Chinese market.

The experts also believe that Baikal water is taken from artesian wells drilled hundreds of metres into the banks of the lake. Another source is reported to be Port Baikal, downstream from Irkutsk city, where the Angara River enters the lake. Baikal Group, based in Moscow, is also active in promoting export sales to China and Japan.

Baikal Group’s website: http://www.baikalaqua.com/ru/about/

Market sources say Baikal Group is the Renova bottled water company; Vekselberg reportedly owns 47% of the shares; the remainder by a regional representative of Renova. There is nothing to identify Renova in the promotional materials of the company, or in a recent presentation of an investment project for a new plant to produce up to a billion litres of bottled water per annum. If implemented, this would represent almost 17% of current Russian consumption of mineral water.

The project presentation says: “Baikal group of companies (Russia) produces bottled natural drinking water from Lake Baikal from a depth of more than 400 meters from the relict layers of the lake, where high-purity water is not affected by external factors. In order to ensure an increase in production capacity, Baikal Group plans to implement an investment project for the construction of a new high-tech production complex on the shores of lake Baikal for extraction and bottling of deep natural drinking water. Creation and commissioning of a new production complex is planned to be carried out in several stages. The total planned output will be up to one billion litres per year…. The total investment in the project will amount to 85 million Euros. Part of it is expected to be financed by reinvesting profits of existing production, as well as profits from the implementation of the first and second phases of the investment project. Baikal group of companies is considering the possibility of cooperation in the framework of this investment project with foreign partners, including the supply of equipment and technologies, the use of leasing and other financial instruments, as well as the promotion of Baikal water to international markets.”

It is not possible to confirm with Renova or with Baikal Group the relationship between the two. Since the US declared war on Vekselberg and Renova last month, the company has gone underground. Baikal Group’s Moscow telephone is not answered. Renova used to have a corporate website. Now there is just this:

Source: http://www.renova.ru/

However, early this month a Moscow paper reported details of a rescue plan which Renova has submitted to the Russian government. The plan details can be read here. For support of the Baikal water company, the application is reported to be seeking a government ban on imported mineral water and lemonade. It is far from clear, the newspaper added, that since imports comprise less than 3% of the Russian market, what benefit an import ban would have for Baikal.

Since war conditions preclude Renova from responding to questions about the state support plan in general, or the bottled water programme in particular, it is premature to estimate what decisions will be made by the new government, and what they will cost. Finance Minister Anton Siluanov, promoted in the new government to be First Deputy Prime Minister, said last week that since April 6 he has received applications for about Rb100 billion ($1.6 billion) in budget support from the Russian companies hit by US sanctions. They include United Company Rusal, which is controlled by Oleg Deripaska, and in which Vekselberg is the largest of the minority shareholders. For details of the Kremlin’s Rusal rescue, read this.

Victor Vekselberg (right) with Anton Siluanov (centre) and Andrei Belousov (left), the Kremlin economic advisor, at the St. Petersburg International Economic Forum in May 2014.

In recent publications the State Department’s Office of the Chief Economist (OCE) has estimated that since March 2014, the accumulated cost of the US sanctions to Russian companies may be as little as $3 million, while the cost to the companies and the state budget, not more than $13 billion. OCE also reports that a much larger cost has been run up in losses by US and European companies required by the four-year old sanctions to forego trade, banking and investment with Russia.

These State Department reports are little known but unusually revealing. The first, authored by Daniel Ahn (right)  and Rodney Lukema, was released in January. A second followed in January 2018. Ahn is the acting chief economist at State. Before that, he was chief economist at Citibank, as well as a paid commentator for the Murdoch network Fox. Ludema, currently an academic at Georgetown University, was Ahn’s superior and Chief Economist at State between 2014 and 2016. Before that he was titled senior international economist at the Obama Administration’s Council of Economic Advisers. Both men have been active economic war planners against Russia since 2014.

and Rodney Lukema, was released in January. A second followed in January 2018. Ahn is the acting chief economist at State. Before that, he was chief economist at Citibank, as well as a paid commentator for the Murdoch network Fox. Ludema, currently an academic at Georgetown University, was Ahn’s superior and Chief Economist at State between 2014 and 2016. Before that he was titled senior international economist at the Obama Administration’s Council of Economic Advisers. Both men have been active economic war planners against Russia since 2014.

Despite the Kremlin’s reluctance to call US sanctions economic warfare, Ahn and Ludema concede there has never been a case before of “purely targeted sanctions against a middle-income economy fairly well integrated into the global economic and financial system.” The officials were forgetting US sanctions against Germany in 1917 and against Japan in 1941; for more details, read this.

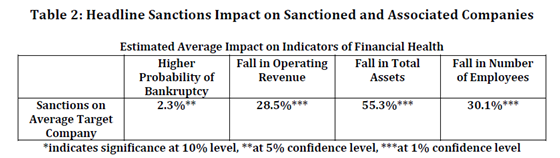

The US sanctions have caused financial damage, Ahn and Ludema report, but they have done nothing to change Russian government behaviour, policy, or personnel. The damage caused to Russian companies and their shareholders, they explain, has been almost entirely neutralized by Russian state financing. “Our main finding”, they reported in the 2017 paper, is that “targeted companies are indeed harmed by sanctions relative to their non-targeted peers. On average, a targeted company loses roughly one-quarter of its operating revenue, over one-half of its asset value, and about one-third of its employees after being added to a targeted sanctions list compared to non-targeted peer companies.”

Source: https://www.state.gov/documents/organization/267590.pdf -- page 15. The State Department officials qualify these calculations: “these results should be interpreted with caution. In particular, one should not simply add the firm-level losses of all targeted companies together to arrive at a macro-level impact. The reasons are twofold. First, the effect does not necessarily apply uniformly to all targeted companies, and may be smaller in proportional magnitude for larger-sized targets. This is also in part because the largest companies tended to face only sectoral sanctions which are deliberately designed not to have a large immediate impact but affect their long-term health via their access to credit and technology. This is one reason why the concentrated impact at the firm level does not necessarily translate into a large macroeconomic impact, despite the target list containing some of the largest Russian state-owned enterprises. Second, the results capture the differential impact of sanctions on the performance of targeted or associated companies compared to non-targeted companies. They do not measure factors that might affect all firms equally in a sector or a country.”

Moreover, the two war planners admit, “we find that if a firm is strategic, the estimated negative impact on both the probability of bankruptcy and Operating Revenue is entirely negated.” Thus, the State Department acknowledges that attacking Russian oligarchs or those whom the US Treasury has been calling “cronies” of President Putin fails in the targeting because the oligarchs apply their power to transfer the cost of sanctions away from themselves, and on to the state treasury. “We estimate it has cost the Government of Russia at least $13 billion to compensate strategic firms for their lost operating revenue.”

According to Ahn and Ludema (right), “we found numerous anecdotes and other qualitative intelligence documenting how the target government (i.e. the Government of the Russian Federation) may be providing various firms of state largess to some of these targeted firms via a variety of mechanisms. These include the granting of government contracts and monopolies, state-backed loan guarantees, capital injections by the state, and tax breaks.” This “shielding behaviour” on the part of the Kremlin, “should be recognized by policymakers when designing future sanctions regimes.”

qualitative intelligence documenting how the target government (i.e. the Government of the Russian Federation) may be providing various firms of state largess to some of these targeted firms via a variety of mechanisms. These include the granting of government contracts and monopolies, state-backed loan guarantees, capital injections by the state, and tax breaks.” This “shielding behaviour” on the part of the Kremlin, “should be recognized by policymakers when designing future sanctions regimes.”

As for the real damage to the Russian economy recorded since 2014, the State Department officials report “that oil price volatility explains the vast majority of the decline in Russia’s GDP and import demand, with very little left to be explained by sanctions or other factors. Thus either sanctions had only a small negative effect on these variables or other positive factors largely cancelled out the effect of sanctions.”

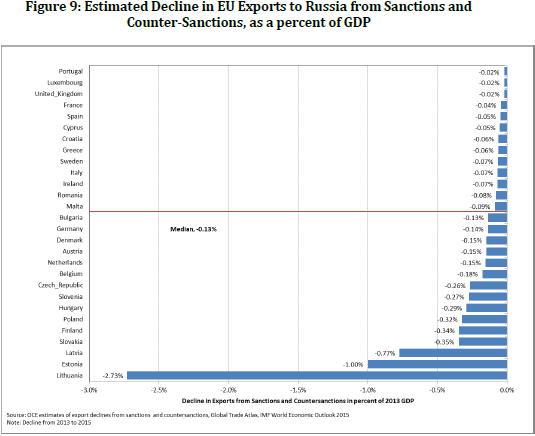

The real losers, they add, of the combination of sanctions and Russian counter-sanctions have been the European Union states, especially the most anti-Russian of them on the western border, which have paid a much higher price than the sanctions alone have inflicted on Russia.

CLICK TO ENLARGE

Source: https://www.state.gov/documents/organization/267590.pdf -- page 31. “The countries that seem to be impacted the most by sanctions are the Baltics. Lithuania has been hit the hardest, with a sanctioned-induced drop in exports of 2.7 percent of GDP. The exports of Estonia and Latvia fell by around one percent. (Incidentally, these countries are also strong supporters of sanctions.) The hit on exports for all other EU countries ranges from -0.01 percent to -0.3 percent of GDP. To summarize, at the macroeconomic level, given that oil price fluctuations alone can account for 80 percent or higher of the drop in Russian economic output and import demand, sanctions appear to have had a second-order impact, transmitting into relatively small spillover effects onto the economies of the European Union.”

Ahn and Ludema do not calculate and report the cost to US companies and banks from the sanctions campaign.

NOTE: After this article was published, Finance Minister Siluanov was reported in the Moscow press as confirming that substantial financial assistance for Renova has been decided by the government. "Vekselberg has already been supported, a week ago," Siluanov said. "The amounts I just don't want to say." Asked if additional support will be provided, Siluanov added: "Everything is being discussed. We are working on support issues, including credit support. First of all, there is the issue for companies which have fallen under sanctions – UC Rusal, Gaz -- and the issuance of loan support from the bank created by the state, Promsvyazbank." The Moscow press has also reported that the Promsvyazbank lending to counter the sanctions will be funded by the Central Bank and by the state budget.

Leave a Reply