By John Helmer, Moscow

For Women’s Day, Mark Kurtser has a secret present for Russian women. His gynecology, obstetrics and maternal care company, Mother & Child (aka MD Medical Group, MDMG), is offering medical services at a rising price in cities across the country where the local governments have been persuaded to close down the publicly funded alternative. If you want a baby in Russia, Kurtser is saying, the state can’t be trusted to deliver.

What is secret about this is that the international stock market thinks Kurtser’s pitch is such an unlikely sell, it has slashed MDMG’s London share price to one-third in three years. Sales revenues and profits appear to be going up for Kurtser, but market confidence is going down. What is also secret is that Kurtser’s company and its London share broker, Bank of America Merrill Lynch, refuse to answer questions about their financials, and can’t explain why their present for Russian women is being turned down by the men in the market.

MDMG is slow to release its financial and operating details. First listed on the London Stock Exchange in October 2012, Kurtser sold his 100% shareholding down to 68%, creating what the company calls a free float of 32%. The membership of the MDMG board of directors by the Russian Direct Investment Fund (RDIF) and Sberbank suggests that much of the free float is in fact state, not market, financing. For the story of the initial public offering, read this. The market capitalization at peak was $1.28 billion; it’s now $412 million.

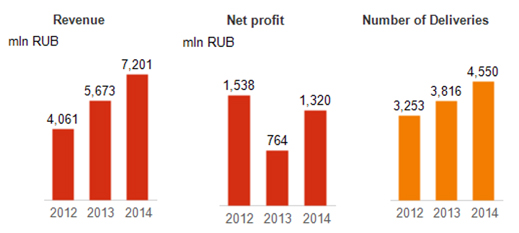

According to the company website, after an unexplained setback in 2013 the company claims it is now growing steadily, and profitably:

Source: http://www.mcclinics.com/factsheet/

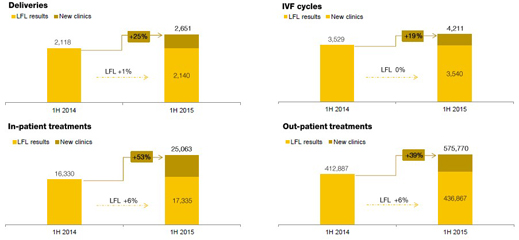

In the company report for the first six months of last year, released on September 9, 2015, the number of baby deliveries was rising at a rate of 25%; that’s 2,651 for the first six months of 2015 compared to 2,118 for the same period of 2014. In vitro fertilization (IVF) treatments, measured in cycles, was reportedly up by 19% to 4,211. In-patient numbers rose by 53% to just over 25,000 patient days for the six-month period. The number of out-patient treatments jumped 39% to 575,770.

Source: http://www.mcclinics.com/download_files/07_09_2015_mdmg_6m2015_ifrs_final.pdf

The production growth numbers for women walking into Kurtser’s plants look to have turned into cash left behind for Kurtser. Revenues reportedly jumped 36% over the 2014 period to Rb4.5 billion. Profit growth was more modest – from Rb625 million in the first half of 2014 to Rb768 million in the first half of 2015. That’s a growth rate of 23%. The ratio of profit to revenue was shrinking, however. It was 19% in 2014; 17% in 2015. If revenue was being driven, not by more women coming into MDMG’s existing clinics, but by the addition of more clinics to the MDMG asset inventory, then the current picture and the future prospects look a little different.

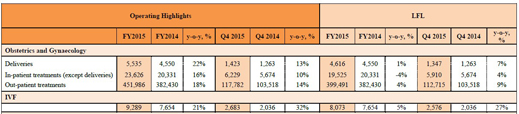

On January 20, MDMG issued a report for the full year, 2015. The annual total for deliveries was up 22%; IVF cycles up 21%; in-patient numbers up 42%; and out-patient numbers up 34%. According to Kurtser, “we were able to deliver excellent results despite continued challenging conditions in the consumer sector. This was driven by further leveraging the capacities of our existing facilities and by expending our network into high-potential regions of Russia. 2015 was a significant one in terms of our regional expansion. We began the year with the opening of the first ever IVF clinic in Ryazan, and in the autumn we started work on the expansion of our in-patient facilities in Novosibirsk, which have seen extremely high demand. Towards the end of 2015 we acquired Medica, the leading IVF clinic in Novokuznetsk. In 2016 we also intend to increase our presence in the fast-growing Moscow market.”

The share price the day before Kurtser spoke was $5. It plummeted to $3.60 a week later. After seesawing on weak share trade volume, the market is showing comparably weak confidence in Kurtser’s prediction that “expansion of our network by opening new clinics and further developing the potential of our existing high-tech facilities across Russia gives us confidence that we will be able to deliver further successful growth in 2016.” Part of the reason is that when the numbers are calculated on a like-for-like (LFL) basis, growth in deliveries drops to just 1%; out-patient numbers were down 5%; and in-patient numbers actually fell by 4% over the year.

PRODUCTION GROWTH DROPS WHEN MEASURED LIKE-FOR-LIKE

Source: http://www.mcclinics.com/download_files/press/mdmg_fy2015_operating_results_-_eng_-_2.pdf

Without a financial report, or even company guidance, the market isn’t confident that Kurtser’s takeover strategy won’t cost more money than it will return to shareholders.

Kurtser’s solution – get his stock broker in London to tout the share to Bloomberg. On October 30, Bloomberg ran a story headlined “Russians having babies at home has BOA backing for MD Medical”. By “home”, the reporter Maria Levitova (right) didn’t mean on the kitchen table or in the bed. Home means Russia – not Germany, Israel, the US, or elsewhere. Bloomberg was given special access to production and financial results for the company, which weren’t public at the time. “Business is booming at Russia’s largest private chain of mother-and-child centers,” the advertisement claimed. “The number of babies born in MD Medical Group Investments Plc’s private hospitals from Moscow to St. Petersburg rose 25 percent in the first nine months of the year,” according to Bloomberg, “catching the attention of investors and brokers including Bank of America Corp.”

Kurtser’s solution – get his stock broker in London to tout the share to Bloomberg. On October 30, Bloomberg ran a story headlined “Russians having babies at home has BOA backing for MD Medical”. By “home”, the reporter Maria Levitova (right) didn’t mean on the kitchen table or in the bed. Home means Russia – not Germany, Israel, the US, or elsewhere. Bloomberg was given special access to production and financial results for the company, which weren’t public at the time. “Business is booming at Russia’s largest private chain of mother-and-child centers,” the advertisement claimed. “The number of babies born in MD Medical Group Investments Plc’s private hospitals from Moscow to St. Petersburg rose 25 percent in the first nine months of the year,” according to Bloomberg, “catching the attention of investors and brokers including Bank of America Corp.”

That’s a reference to a report issued on September 30 by Bank of America Merrill Lynch (BOA) analyst in London, Jamie Clark (right). He told Bloomberg the collapse of the oil price and the rouble, sanctions, and the US war for regime change in the Kremlin, and for battlefield victories on the Ukraine and Syrian fronts, have been good for the baby business. “Given the wealthy demographic MD targets, the key competitors for its maternity services are private hospitals in Western Europe and the U.S., rather than the public health system in Russia,” Clark said. “Overseas travel has become much more expensive and MD represents good value to patients even after its own price increases.”

That’s a reference to a report issued on September 30 by Bank of America Merrill Lynch (BOA) analyst in London, Jamie Clark (right). He told Bloomberg the collapse of the oil price and the rouble, sanctions, and the US war for regime change in the Kremlin, and for battlefield victories on the Ukraine and Syrian fronts, have been good for the baby business. “Given the wealthy demographic MD targets, the key competitors for its maternity services are private hospitals in Western Europe and the U.S., rather than the public health system in Russia,” Clark said. “Overseas travel has become much more expensive and MD represents good value to patients even after its own price increases.”

Clark also forecast that so long as Russia remains in crisis, the number of stay-at home Russian parturitions will continue to grow – more healthily than the rest of the economy or other consumers. “With plans to open new clinics in Samara and Nizhny Novgorod along the Volga river as early as April or May [2016], the hospital-operator is betting that wealthier patients won’t want to compromise too much on the quality of maternal care if they opt not to travel abroad.”

This is not a bet the stock market is willing to share.

THREE-YEAR SHARE PRICE TRAJECTORY FOR MDGM

Source: http://www.bloomberg.com/quote/MDMG:LI

When Clark and BoA made their promo on October 30, the share price was $5.25. It then collapsed to $3.60 in January; collapsed again in February. The current recovery puts the share at $5.50. Nobody believes Clark or Bloomberg. The latter conceded this might be because “MD Medical’s stock carries more risks because trading volumes are thin, with no transactions on some days. As waning geopolitical concern over Ukraine helped drive a 6.9 percent advance in the dollar-denominated RTS Index in 2015, MD Medical retreated 4.6 percent.”

So why has Kurtser performed so much worse in the market than in the stirrups? According to an investment analyst at Aton, a Moscow investment house which doesn’t cover the company or promote the share, “the shares are not liquid. Investors came there at the IPO as long-term holders – the IPO looked like a private equity placement [not a free-float]. It’s too early to find a correlation between the results [and the share price].” One of the IPO investors turns out to have been the state bailout investor, Russian Direct Investment Fund; It subscribed $50 million of the total $311 million in the share sale.

On last year’s first-half financials the cost to the company for its takeover of existing hospitals and clinics is rising. Also, payroll, energy, imported medicines and supplies have been ballooning; the cost of sales figure was up 41%, while the revenue growth rate was 36%.

Clark was asked what were the production numbers, revenue and profit figures for MDMG last year calculated on a like-for-like basis, not counting the effect of acquiring or merging with existing medical plants and facilities. The analyst refused to say. Would he disclose the report he gave Bloomberg last October. No, said a BOA spokesman, Preesthaya Fixter. “We do not send equity reports to the press on a regular basis and similarly we’re unable to comment on the… questions. Our goal is to keep the content proprietary for our clients, so we are unable to accommodate your request for our proprietary Equity research.”

Health industry sources in Moscow say they suspect Kurtser and his company have been lobbying federal, regional and municipal health administrations f or the closure of maternity clinics, in order to remove low-cost competition and allow Mother & child a freer hand to raise its prices. An investigation published in The Village in November 2014 reported medical sources as believing that in return for cuts in state budgets to maternity clinics and for closure orders, officials get backhanders from the commercial replacements. There is no proof of this. The Village reports being obliged to publish a retraction of some of its claims. The suspicion lingers; Kurtser and his brokers encourage it by a secretiveness untypical of London market-traded Russian shares.

According to the MDMG’s last market presentation in September, substantial revenue growth in the first half of 2015 resulted from the takeover of the Avicenna clinic group in Novosibirsk; the launch of a new hospital at Ufa; and the opening of an out-patient clinic at Ryazan.

THE GEOGRAPHY OF MOTHER & CHILD OPERATIONS

CLICK TO ENLARGE

Source: http://www.mcclinics.com/download_files/07_09_2015_mdmg_6m2015_ifrs_final.pdf

In the small print MDMG admits that the production numbers in the regions aren’t as profitable. That’s because the price for Mother & Child services must be discounted to attract buyers outside Moscow. In its strategy, the company acknowledges that as disposable income falls across the country, it must sell to “regions where people have high disposable income and within Moscow city”. And to hedge against the risk that this clientele will still prefer to go abroad for their babies, MDMG is proposing to diversify out of women’s medicine, and into men’s.

RESULT FOR OTHER MEDICAL SERVICES, 2015![]()

CLICK TO ENLARGE

Source: http://www.mcclinics.com/download_files/press/mdmg_fy2015_operating_results_-_eng_-_2.pdf

Are takeovers concealing weakness in Kurster’s baby business, his spokesmen in Moscow, Elena Romanova in charge of investor relations, and Anton Grigorenko in charge of marketing, were asked yesterday. They won’t provide current like-for-like comparisons for revenue or profitability; nor will they explain why there is such a difference between what the company and its brokers say, and what the market answers to the big, where-do-Kurtser-babies-really-come-from? question.

According to Romanova, “regarding the share price, we do not comment.” The scheme devised by Kurster and the Bank of America Merrill Lynch to talk up the share price and then sell more shares at a premium – made public five months ago — has, well, aborted.

Leave a Reply