by John Helmer, Moscow

@bears_with

It is now a fortnight since President Vladimir Putin (lead image, left) announced a tax on Russians exporting their cash and capital to tax avoidance havens abroad; and since Prime Minister Mikhail Mishustin followed to explain that Cyprus is the target. “We have started implementing the instructions on taxing dividends from foreign accounts with Cyprus”, Mishustin said at a Kremlin meeting with Putin on April 1. “The Cypriot government has been notified of the changes in the agreement on avoiding dual taxation.”

“For Putin to make his remark in a national address,” comments a Moscow finance source, “and then for Mishustin to confirm that Cyprus was intended in the President’s speech shows this is now a high priority move. It reveals how upset the Kremlin – especially Andrei Belousov [first deputy prime minister] — has been with the role Cyprus plays in the outflow of Russian capital. I do not see any government allowing capital flight now during a deep and lasting recession.”

“This sounds a death knell for Cyprus accountants and law firms,” says a Limassol investor. “This is their biggest business. From now on only the most hardened criminals or escapees from Russia will be here.”

There has been a flurry of press leaks from Cyprus Government officials claiming that the Russian move is not targeting Cyprus. But no official at the Foreign and Finance Ministries in Moscow, nor at the Russian Embassy in Nicosia, has said this on the record. According to Mishustin and Finance Minister Anton Siluanov, the new rules are still being decided, and will be announced on April 24.

By the way, the kibosh was an iron bar used two hundred years ago by cobblers in the north of England to flatten leather as they were making clogs. When the word reached the streets of London, it meant flatten in more ways than that one. The government of President Nicos Anastasiades (lead image, right) and Nicos Christodoulides, his foreign minister and aspiring successor, having chosen last year to cut their ties to Russia in exchange for American promises to protect the island from the Turks, is the clog in this story.

The new tax was announced by Putin on March 25.

“Those expatriating their income as dividends to foreign accounts should pay a 15 percent tax on these dividends. Of course, we will need to amend Russia’s double taxation treaties with some countries. I ask the Government to work this out. If our foreign partners do not accept our proposal, Russia will unilaterally withdraw from these treaties. We will begin with countries that attract substantial resources from Russia, which is a very sensitive issue for our country.” This was the first time that Putin has agreed to use taxation to enforce the policy of deoffshorization which he first announced in 2014.

Putin meant Cyprus because it is the country which attracts the most “substantial resources from Russia”. But the next day Prime Minister Mishustin didn’t say so. Instead, “as for the funds transferred to offshore accounts as dividends,” he said, “I am instructing the Finance Ministry to review all the double taxation agreements with our foreign partners. The tax on dividends transferred abroad must be charged at a rate of at least 15 percent. In the event of refusal by our partners, we will have to consider unilateral withdrawal from these treaties [emphasis added].”

The Prime Minister (rear centre) chairs the government meeting on March 31.

Mishustin waited until April 1 before announcing at a session of his ministers that Cyprus was the priority target, and that the government intends to make an example of it. “We have started implementing the instructions on taxing dividends from foreign accounts with Cyprus. The Cypriot government has been notified of the changes in the agreement on avoiding dual taxation. The related agencies have to submit their proposals on the next steps by April 24.”

Between 2010 and 2019, according to Central Bank figures, Cyprus received $273 billion from Russia. For shielding these funds from Russian tax and serving as a transit point for onward movement of the money to zero-tax havens, this number puts Cyprus well ahead of the British Virgin Islands and Switzerland. Over the same period, Russians operating Cyprus holding companies returned to Russia about $64 billion; this was less than Russian reinvestment from the Netherlands of $74.5 billion.

“Cyprus is the number one target for the tax increase, the Finance Ministry said,” reported the Moscow business newspaper RBC on the afternoon of April 3. “The rate increase will also affect other transit jurisdictions, but it was not officially announced which ones. Probably, the agreements with the Netherlands, Luxembourg, Singapore, possibly with Malta and Switzerland will be changed in the same way, the experts interviewed by RBC noted.”

“I believe Putin mentioning this in national address signifies three things,” commented a Cypriot with close ties to Russian business. “He has made it a national political question and thus left no scope for any negotiations with the Cypriots. This is totally political. Compare the [Kremlin] attitude toward Italy and Serbia in contrast with Cyprus. All efforts are on Italy now. Cyprus plus Greece are seen [in Moscow] as a lost cause unless, of course, they elect someone else.”

Cypriot officials didn’t wait for the Moscow press to report what the Russian plan was. Foreign Minister Nicos Christodoulides telephoned Foreign Minister Sergei Lavrov on the morning of April 3. The call, announced a 5-line communiqué from Lavrov’s office, had been made “at the Cypriot side’s initiative.”

Source: https://www.mid.ru/

“The foreign ministers discussed the developments in both countries due to the spread of the coronavirus infection. They exchanged opinions on topical issues of bilateral relations, including tax cooperation, given the decisions of the President of Russia on maintaining a proper level of taxation on all types of offshore income.”

When Lavrov told Christodoulides what the “proper level of taxation” was, Christodoulides realized he and his constituents have a serious problem. The usually talkative minister made no reference to the conversation with Lavrov in his Twitter feed, nor did his ministry in its public releases.

Instead, Christodoulides briefed the Cyprus Mail, an English language newspaper close to the British High Commission in Nicosia until 2019, when it was taken over by Andreas Neocleous; his law firm has had a direct stake in the Russian offshore business.

Cyprus wasn’t the Russian target, the newspaper reported. “Similar proposals will be sent to all European Union member states with which the Russian Federation has double taxation treaties…Earlier Friday [April 3], the Russian embassy in Nicosia stressed that there were no political reasons behind the decision to raise the tax from the current 5 per cent and 10 per cent, and that Cyprus had been the first country to be notified of the decision for objective reasons…the embassy told the Cyprus News Agency (CNA). ‘We also want to stress that there are no political reasons for this Russian action.’ The embassy said amendments will also take place to taxation treaties with other countries ‘mainly those which large amounts of Russian money go through’.”

The Cyprus Mail reporter was asked to provide links to the Russian sources for these claims; he did not reply. No trace can be found of the quoted statement from the Russian Embassy in Nicosia. Christodoulides also told the Cyprus News Agency (CNA) to report: “The Russian Federation’s proposal for increase in the withholding of tax for dividends and interest income was submitted to all EU member-states with which Russia has an agreement for the avoidance of double taxation, the country’s Foreign Minister Sergei Lavrov told his Cypriot counterpart Nikos Christodoulides.”

“Cypriots should have seen this coming for the past five years,” the Limassol source said. “They did not. Now [Christodoulides] calls Lavrov and begs him. It’s too late. It’s done. I believe Netherlands or Luxembourg will not be in the same category. That’s why Mishustin mentioned Cyprus only. The Cypriot Foreign Minister is playing to his domestic constituency to avoid the blame that what has happened is a screw-up by his government.”

Veteran Cyprus Government advisors have been warning for months there would be a Russian reckoning if Anastasiades and Christodoulides stuck to the commitments they have publicly given to US Secretary of State Michael Pompeo, US senators and congressmen. The terms they have agreed with them were first reported here. The US demands have included not only new financial controls, audits and inspections of Russian account holders in Cyprus banks, but the exclusion of Russian naval vessels from port calls and an investigation of all media on the island promoting “pro-Kremlin views”. A bilateral treaty (with confidential provisions) was to have been signed by Pompeo and Christodoulides in Cyprus in January; the signing has been postponed until after Easter.

Left: Foreign Minister Christodoulides with Secretary of State Pompeo in Washington on November 19, 2019. Pompeo was planning to meet President Anastasiades in Cyprus on January 7, and the text of the bilateral treaty between the US and Cyprus was to have been signed then. Pompeo cancelled at the last minute and there were telephone calls instead. Right: Pompeo and Anastasiades at a meeting with Israeli and Greek leaders in Jerusalem in March 2019. They agreed, their joint statement declared, to “defend against external malign influences” in the region. “Malign influences” is Pompeo’s term for Russia.

Philip Ammerman, the principal of Navigator Consulting, a leading financial advisory firm in Cyprus, acknowledges “the 15% dividend withholding tax undoubtedly reduces the attractiveness of Cyprus as a tax jurisdiction for companies with profits distributed from Russia to Cyprus. There are a number of other ways to repatriate or export profits from an operation in Russia (or any other country) to a holding company jurisdiction, including royalties, licensing fees, and equivalent methods. It remains to be seen if there will be a policy change to address these as well.”

“In Cyprus, there has been an effort over the past 2-3 years to further comply with international anti-money laundering (AML) and know-your-customer (KYC) regulations. This has been a European Union priority as well as a priority backed by the United States. Various examples have been reported by press (including Bloomberg, The Wall Street Journal, and others) of US and other international pressure on Cyprus in this area. In many cases, this pressure is also due to known money-laundering schemes and the operations of sanctioned enterprises in Cyprus. Many Russian firms in particular have been targeted for compliance, and have been required to end their operations in Cyprus.”

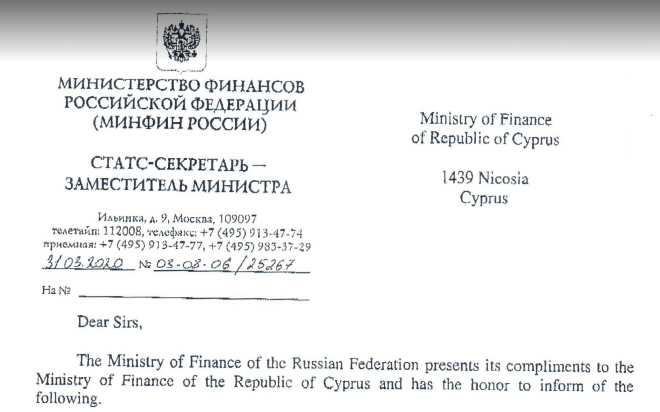

Another Limassol advisor warns that much more is now at stake for the Cyprus financial services sector than has been read into the official announcements and from the Finance Ministry letter which has been publicly released; dated on March 31 and delivered in Nicosia on April 1, it is signed by Alexei Sazanov, a deputy finance minister. The letter includes interest income as well as dividends in the new tax scheme.

Dividend payments have long been recognized by the Finance Ministry and the tax authorities (headed by Mishustin since 1998) to be a form of capital stripping; this occurs when the sums paid out by Russian operating companies to their Cyprus shareholdings have exceeded earnings and income, and have been financed by bank loans, and in the case of Leonid Lebedev’s schemes at the regional electricity utility TGK-2, diverted out of sales revenues; read more here and here. This report by Arsen Danelyan explains how the tax rules in force until now saved up to 8% of the cash flowing out of Russia into the offshore pockets.

The Russian letter sets a deadline of June 15, 2020, for reply by the Cyprus Ministry of Finance. Source: https://drive.google.com/

The source says that Russian bank looting schemes, which have been exposed at National Bank Trust, Otkritie Bank, and Promsvyazbank, have long been managed by Cyprus companies, lawyers and accountants. Court records in London have documented the role of the Cyprus go-betweens in many of these fraud schemes; for details, read this. For evidence exposed in a New York court of Leonid Lebedev’s cash diversion schemes, employing President Anastasiades’s law firm, read this archive.

London reporters at the Financial Times and the Guardian have defended these frauds with “exclusive interviews” in which the fraudsters have presented themselves as persecuted leaders of the political opposition to the Kremlin. Dmitry Ananiev, for example, the owner of Promsvyazbank, recently invited a reporter to his “comfortable exile in Cyprus. His home in Limassol is a colonial-style, bougainvillea-covered property overlooking the sea, with a garden of palms, spiky pines and sparrows… he describes Russia’s political system as a ‘one-man show’ and says a terrified elite wait on the president’s every decision. Five well known close friends of Putin are in charge, he says. Anyone who has an independent position is vulnerable to arrest… He points to the fate of Sergei Skripal…’The security agencies can hit anybody without evidence. They create the evidence,’ [Ananiev] says.”

The role of the Cyprus-based managers, explains the Limassol source, “has been to create tax residents in jurisdictions where there is no personal income tax, such as the United Arab Emirates. German shipowners were the first to invent these schemes with Cypriot holding companies operating as transit points for funds borrowed from European banks and then moved on as personal income to the UAE. After Russian tax inspectors were able to get behind the use of Cypriot nominees for the movement of Russian money offshore, the Russians arranged informal trusts with their Cyprus managers. They in turn established themselves in the UAE. There the Russians would fly in on their private jets and out with suitcases of cash.”

Russian experts in Moscow interpret the new measures as the culmination of the deoffshorization process and the beginning of the end to the loopholes which Putin has tolerated until last month. They also interpret the explicit targeting of Cyprus as a test case for the broader goal of stopping the tax optimization and fraud schemes uncovered in Russian, British and US courts to date.

“These holding companies receive dividends, accumulating them from different jurisdictions. This can be a holding company of an enterprise that is located in Russia, Ukraine, or anywhere else. [But if Russia taxes at origin] it will become meaningless for Russian companies to have holding companies,” according to Ivan Mikhnevich, a Belorussian developer of computer games who is based in Cyprus and leads a political party representing Russian speakers on the island. He forecasts a sharp decline in all Russian-source income for Cyprus. “The Cypriot economy at the moment, in my opinion, is based on three pillars. The first is tourism, and in 2020 everything will be bad. The second pillar is the service sector — if it doesn’t make sense to have holding companies, then the service providers will lose customers. This is also a very important sector. The third important sector is that of the ‘golden passports’ or citizenship by investment. And this will also begin to lose meaning.”

Leave a Reply