By John Helmer, Moscow

The commodity supercycle made an offshore fortune for Oleg Deripaska, control shareholder of United Company Rusal, the Russian aluminium monopoly, and for Glencore, the Swiss combine which has financed and managed Rusal’s trade. But the cycle is now in reverse, as the markets accept that China’s economic performance will now trigger short-term booms and busts, keeping the price of aluminium low for the foreseeable future. Too low for the cost advantages to Rusal of the rouble crash to produce optimism for the company’s profitability as a global aluminium exporter.

In September Deripaska declared his first profit dividend in seven years. As an 8.75% stakeholder, Glencore’s share of the $250 million payout will be about $22 million. But Glencore chief executive Ivan Glasenberg’s parallel announcement of cuts to Glencore’s trade loans to its clients means that he is quietly asking Deripaska to pay more cash up front, both for trading commissions and interest on trade advances. How much is a secret Deripaska and Glasenberg aim to keep from the minority Russian shareholders in Rusal; and from the Russian government, which is pushing Rusal to refocus its business on the domestic trade in aluminium, for which Glencore is no longer necessary.

Glasenberg announced on September 7 that he intends to “sensibly accelerate the deleveraging of our balance sheet, maximise future cash flow generation in the current weak commodity price environment and substantially improve our financial and credit metrics, stability and strength, in the event of a prolonged weaker pricing environment.”

Glasenberg displayed a multipoint programme of cutting what Glencore owes to its creditors, reducing what it advances to clients, and selling assets. The asset sales should add up to $2 billion, the company says. The savings should be “US$500 million to US$800 million to be generated from a reduction in long-term loans and advances made by Glencore (c.US$4 billion at 30 June 2015).”

Asked how much of the target will come from Rusal, Glasenberg refuses to say. According to Glencore spokesman Charles Watenphul, Rusal shareholders, Glencore shareholders and the aluminium market should hold their breath. “We simply have a no-comment policy in relation to enquiries we receive regarding the specific details of our debt reduction programme. We will be making further announcements to the market in due course with regard to the Programme.” Glencore is also not revealing how much money it has currently advanced to Rusal for its aluminium sales; Rusal won’t say either.

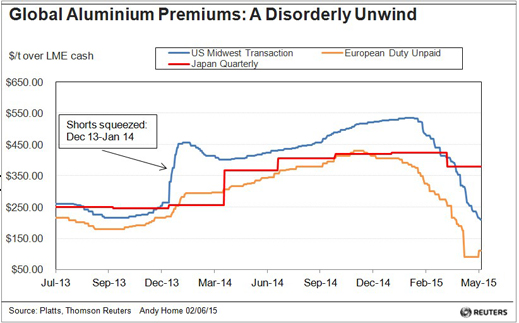

A veteran trader in Russian aluminium in London for the London Metal Exchange (LME) Week early this month says: “the drop in the aluminium premiums has dramatically cut the margins and they expect that all the traders will be putting pressure on the producers to help absorb some of the decline. This will affect all – not just Rusal.” For the story of the aluminium warehouse premium, read this.

A Swiss aluminium trader within eavesdrop of Glencore headquarters says it would be folly for Glasenberg to press Deripaska right now, when the Russian government is directing Deripaska to abandon his decade-long strategy of exporting primary metal. “Deripaska’s strategy in the past was to transfer money to the West which is the initial reason why Glencore got involved. The Kremlin has now stepped in — what exactly has happened is a mystery to me. The interests of Russia should be to develop Rusal into a fully integrated aluminium company producing all sorts of aluminium related products. The sanctions should have encouraged this thinking.”

“What can Glencore contribute to the game when Rusal is fully integrated and does not export primary aluminium? Russia has enough liquidity to handle the financing, and now as Glencore has its own financial squeeze, are they of any interest at all? Finally Glencore, and in particular its predecessor Marc Rich,were deeply involved with the CIA. Details of such transactions are deep under the carpet. Thus, Glencore does not necessarily play in the same camp of Russia’s interest.”

Rusal’s annual reports and financial statements claim Glencore is not a luxury the company can ill afford, but a necessity. Rusal’s annual report for 2014 identifies a Glencore loan to Rusal of $349 million, repayable in a year’s time, with annual debt service of 4.95% plus 3-month Libor. According to Rusal, this is an advance, not on aluminium trading, but for alumina, the feedstock for production of aluminium metal. “In February 2014 the Group entered into a USD400 million prepayment facility agreement with Glencore AG for the supply of alumina from one of the Group’s subsidiaries to Glencore AG for the period 2014-2016. Interest of 3M Libor + 4.95% and principal payable under the facility agreement will, to the extent such amounts are due, be offset against amounts due by Glencore AG under its alumina supply contract at USD40 per metric tonne for the first six months and USD286 per metric tonne thereafter.” According to the latest Rusal trading report, in the quarter ending June 30, it realized an average sales price for its alumina of $339.

Rusal hides its trade terms for aluminium with Glencore, revealing only that Glencore’s share of its total aluminium and alumina trade is 32%. Elsewhere in Rusal’s financial statement for 2014, it is revealed that “Glencore was the Group’s largest customer of alumina and primary aluminium in the financial year, accounting for approximately 40% of the Group’s sales of primary aluminium.” (page 128). The Glencore fraction of Rusal’s aluminium sales came to $2.8 billion in 2014, according to Rusal’s financial statement (page 182); $3.2 billion the year before.

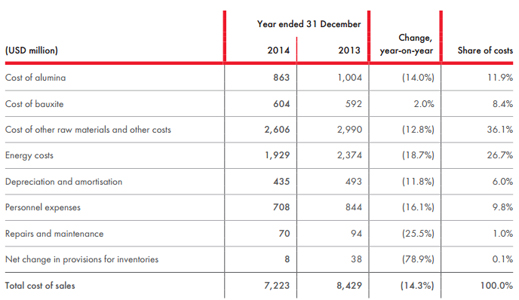

Trade sources believe Glencore takes home to Switzerland a commission of between 15% and 20% on this sales value. If it were reported as a line item in Rusal’s tabulation of costs of sales, the sources say it would amount to more than Rusal pays for the bauxite it processes into alumina and aluminium; almost as much as Rusal pays its workers and managers to turn out metal.

RUSAL’S COST OF SALES, 2014

CLICK TO ENLARGE

Source: http://rusal.ru/upload/uf/c17/E00486AR.pdf -- page 39

“Having considered all relevant factors,” this Rusal report claims (page 128), “the Group is satisfied that it can conduct its business independently of Glencore.” That’s Deripaska’s view; it has not been the view of minority shareholders, Victor Vekselberg (below, left), and Len Blavatnik (right), or the Russian state lenders to Rusal.

The story of their litigation against Deripaska can be read here. Glencore has offered its Rusal shares for sale to Vekselberg, and also to Deripaska, with a call option exercisable until March 26, 2017. But the price is a prohibitive 20% premium over the enterprise value of Rusal, or an enterprise value to earnings ratio calculated for Rusal’s peer group — whichever is higher (page 138).

According to Glencore’s Annual Report for 2014, it has raised its valuation of its stake in Rusal from $394 million in 2013 to $895 million at the end of 2014. At the same time, Glencore said it has taken an impairment charge on its Rusal operations of $446 million (see page 142). But Glencore isn’t selling out of Rusal, at least not yet. For the background, read this.

In its reports for this year Glencore doesn’t refer to Rusal. It does mention “negative headwinds” for aluminium, on account of the falling price for the metal, and for the physical delivery premium. For evidence of how dependent Rusal’s profitability has been on Glencore’s role in stockpiling unsellable metal, and manipulating the premium for releasing aluminium from storage, read this and this. Here’s how the LME describes its new warehouse premium for aluminium.

The expectation in the markets is that the premium will continue to fall, and so too the average realized price for Rusal’s aluminium sales. This is causing sharebuyers in Hong Kong, where Rusal has been listed since 2010, to push Rusal’s share price down towards an all-time low. Breaking seven years of loss-making, it is still too early for sharebuyers to want to be on the receiving end of Rusal dividends.

Rusal isn’t scheduled to publish its third-quarter trading and financial results until mid-November. Market sources say they anticipate the extension of this chart to September 30 will continue the downward trend; for Rusal the average realized premium of $306 per tonne in the second quarter looks set to be cut in half for the third quarter. Andy Home, the Reuters metals markets analyst, reports that between July 1 and September 30, the European premium fell from $120 per tonne to $57.50, a drop of 52%. In the US, the aluminium premium has dropped from 8.5 cents per pound to 7.15 cents, a retreat of 16%.

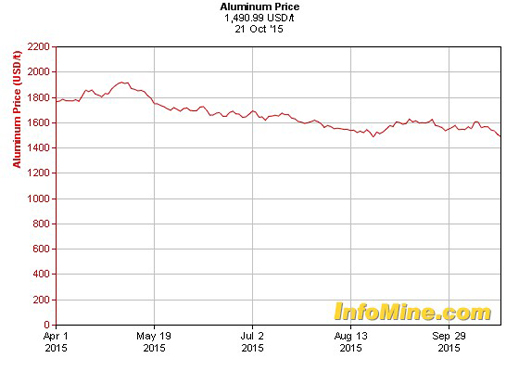

The aluminium price is also falling. This week it is at $1,590. When Rusal publishes its new report, the metal price for the quarter is likely to average $1,592; that’s a 10% decline since the 2nd quarter report.

Source: http://www.infomine.com/investment/metal-prices/aluminum/6-month/

Media releases from Deripaska have been emphasizing a shift towards self-sufficiency in raw materials supply from Russian sources, and the diversification of production and sales, also in the direction of the domestic Russian market instead of exports. For more on the strategy shift at Rusal, read this.

“In these hard times Oleg Vladimirovich is displaying himself as the model state servant,” comments an insider at Rusal. “There aren’t any alternatives, not for Rusal, not for the other metal oligarchs.”

Leave a Reply