By John Helmer in Moscow

A Moscow brokerage named Metropol has recommended buying Alrosa shares with the promise of a 72% upside in value. But there’s a catch. At present, it isn’t quite legal for those who don’t already own shares in the closed joint stock company form of Alrosa to buy and sell them.

That’s something Metropol’s head of research, Mark Rubinstein, acknowledges. “You must be a shareholder to buy or sell the [Alrosa] shares”, he told Polished Prices.com. But he and his diamond analyst, Andrei Lobazov, insist that over-the-counter trading of Alrosa shares is going on. According to Lobazov, “the volumes are quite high. There are legal ways to trade over the counter.”

Metropol estimates that of the total Alrosa share issue of 272,726 shares, all but 9%, or 24,545, are owned by the Russian federal government (51%), the Sakha republic government (32%), and the uluses (districts) of the Sakha republic (8%). What remains, according to Metropol’s report, is 4.8% of the share issue, or 13,091 shares, held by legal entities; and 11,455 shares (4.2%) held by individuals. Alrosa documents refer to the latter shareholders as mostly current management and retirees. But so long as Alrosa remains a closed stock company, can there be a genuine “free float” of these shares at all?

Rubinstein was asked to say what the volume of turnover of these 24,545 shares is to warrant calling it a free float. “I don’t know exactly,” he replied. So what purpose is served by recommending retail investors to buy? “I’ve got just 2 more seconds for you,” Rubinstein replied. “Time’s up”, he added, replacing his telephone receiver.

Par value of the shares at present, according to the Alrosa charter, is Rb13,502.50 ($436). Earlier this year, one of the few foreign investment funds to admit to owning Alrosa shares, Vostok Nafta of Sweden, acknowledged that it had paid $28,000 each for a bloc of 966 shares in 2007. A year later, the fund said the unit value was down to $3,000. In 2009, the Swedes managed to buy more, they said; on a total bloc of 1,169 shares, Vostok Nafta assigned a value of $7.2 million; that makes $6,250 apiece.

Metropol’s report, dated September 8, claims the current Alrosa share price in the market is $9,500. The target price the brokerage calculates is almost double. “We initiate coverage of diamond producer Alrosa with a DCF-based fair value of USD 16,345 per share, pointing to 72% upside potential for 2011 year-end. Even when applying fairly conservative price assumptions for raw diamonds – a 3% CAGR in 2010-2016 – the stock looks undervalued in our view.”

This share promotion was Metropol’s idea, but according to Rubinstein, there is only one source for the idea that Alrosa shares will be available for sale on the open market sometime soon. Metropol says it has spoken to Alrosa chief executive, Fyodor Andreyev, and to Igor Kulichik, the chief financial officer. Andreyev told Metropol he expects to convert Alrosa into an open stock company form by the end of this year. This will then mean open share trading even before the company is ready for either a privatization sale of state shares, or an initial public offering (IPO).

Andreyev’s aims aren’t news, and neither is the fact that there is powerful opposition to them. The Metropol analysts acknowledge that in Sakha, where almost all Russia’s diamonds are mined at present, and where Alrosa counts as the region-sustaining enterprise, the administration and regional parliament may be reluctant to see their stake in the company diluted by open share trading, privatization, or IPO. This resistance, the analysts also concede, was powerful enough to delay the federal takeover of the majority capital of the company for several years.

In the report itself, however, there is no reference to this opposition, nor estimate of its political strength. Metropol says it didn’t talk about the future of Alrosa outside the executive suite. So, if the Metropol report is regarded as a megaphone to the markets employed by Andreyev, here is the good news – that is, the news Andreyev would like to persuade the market he’s aiming to deliver shortly: “After an IPO,” reports Metropol, “Alrosa will likely remain under government control, with 50% plus one share split equally between the federal government and the regional authorities of Yakutia.” This means that Andreyev is proposing, and Metropol believes, there will be a 49% free float of Alrosa shares. In other words, on top of the current 9%, another 40% will be sold from the shareholdings of the federal government, the Sakha government, and the Sakha districts. The dilution will be from 51% to 25% for the federal government; from 40% to 25% for the Sakha entities.

In interview, though not in his report, Lobazov for Metropol concedes that for the price of Alrosa shares to take off, such a sale by the two governments “isn’t the only driver”. Evidently, if the opposition of the Yakuts is the unmentionable obstacle, those in Moscow now promoting privatization would like to demonstrate how much money the federal and regional governments would earn if they agree to let go of their shares. Applying Metropol’s valuation to the Sakha-held shares, for example, the Andreyev sell-off would earn about $1.8 billion. A big number for the Yakuts — but far from enough to persuade them to accept a minority stake of 25% minus one share, and loss of control over their native company forever.

So much for the bad or doubtful news in the Andreyev plan.

The good news is that Alrosa’s future profitability looks assured because noone in the rest of the diamond world is discovering anywhere near enough new diamonds to meet the expected demand. Into this world, Alrosa claims to be holding one-third of global diamond reserves (numbers remain secret); and in terms of 2009 production and sales, Alrosa has a global market share of 30% of volume, 25% of value.

But 2009 was an exceptional year. De Beers had shut down its mines, and Alrosa was able to sell its production to the state stockpile agency, Gokhran. With output of 34.8 million carats, Alrosa’s 30% market share compared with De Beers’s 22.6%; Rio Tinto with 15%; BHP Billiton with 3.9%; and everyone else combined with 26.6%. This year, Alrosa’s production is down. In the first quarter, the company says it produced 8.6 million carats; this was 7% below the 9.2 million carats produced in the first quarter of 2009. In the second quarter, output was 8 million carats, down 2% on the year earlier. As of June 30, production is lagging the year earlier by 800,000 carats, or almost 5%.

Last year’s market shares don’t look so stable going forward. But Andreyev told Metropol he’ll manage to stave off a production decline. If so, Alrosa’s profitability ought to be able to surf on the wave of rising rough diamond prices.

“According to our estimates,” writes Lobazov, “a steadily declining mineral reserve base and a continued lack of new major discoveries suggest that production will remain relatively flat going forward. Under conditions of rising demand, this could mean a diamond deficit as soon as 2012, which would drive raw diamond prices higher.”

For every stone that’s going to be twisted on to a newly prosperous Chinese or Indian ring-finger, that should generate a 3% rate of annual growth for Alrosa’s sale revenues. “According to our estimates, global demand (measured in 2008 prices of USD 86.9/carat) could reach USD 16.9bn by 2016, while global supply could lag USD 2.2bn behind at approximately USD 14.7bn, causing raw diamond prices to rise approximately 16% from current levels. Overall, we conservatively estimate that raw diamond prices will increase at a 3% CAGR in that period.”

Getting there ought to be a snap, Andreyev and the Metropol boys believe. First, the company will cut its interest charges and convert its short-term debts to long-term ones, based on gilt-edged government guarantees – before the government sells its shares. Watch for the $1 billion Eurobond offer to come in November, managed by JP Morgan, UBS and VTB. “We believe this issue will be successful, because Alrosa’s bonds are virtually backed by the government. As the result, we calculate that Alrosa should be able to successfully refinance about 92% of its short-term debt by end-2010. Additionally, Alrosa should be able to ease its interest expense burden: the coupons of its RUB-denominated bonds are approximately 8.5% vs. the 14-15% rates on the company’s outstanding bank loans in 2009.”

Then with the debt safely shifted to other shoulders, it will be time to demonstrate the earnings potential of Alrosa on which the share price speculation is based:

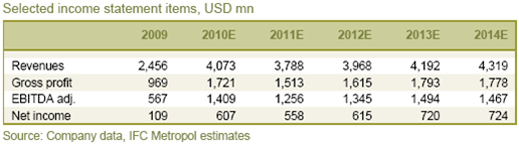

Andreyev has told Metropol that “Alrosa’s 2010 results promise to beat pre-crisis levels in terms of volumes shipped, revenues and profits…We anticipate 2010 revenues will increase by 71% y-o-y to RUB 120bn (USD 4.1bn). Adjusted EBITDA is expected to reach RUB 42bn (USD 1.4bn) with net income at RUB 18bn (USD 607mn).”

The table reveals Alrosa’s acknowledgement that it has a problem with production in the years 2011 and 2012. The revenue projection is downward because of the declining yield of diamonds from the current open-pit mines; and because of slowness (higher capital cost) in starting up production at the underground shafts being dug to compensate.

“We highlight that record results are unlikely to persist into 2011. We estimate the company’s raw diamond sales will decline to 36mn carats that year (from 41mn in 2010), as inventory depletion slows. We expect the impact on revenues, although softened by expected price increases, will be a 10% decline y-o-y to USD 3.8bn (RUB 109bn). From 2011, we expect revenues to grow at a 3% CAGR driven mainly by rising prices for raw diamonds.” So far, so good.

But there is expert opinion in the international diamond market which isn’t so cocksure. Charles Wyndham, head of the WWW consultancy and diamond valuator for Canada, agrees that there will be a long-term shortage of rough. “However that said, the the differential in price between rough and polished remains at unsustainable levels. Over the next few years rough prices must come down or polished has to rise very substantially. Most likely rough will ease down and polished ease up until an equilibrium is reached. Over the next couple of years, we think rough generally has to go down. Every time we say that rough rises! But in 2008 we did predict a correction, though it took much longer than expected and was much sharper.”

The diamond price curve isn’t the only thing the Yakuts have to worry about. “To remain competitive,” reports Metropol, “Alrosa should continue implementing its cost-cutting strategy. This is especially important as the company plans for underground mining to account for 30% of production by 2012 and for 39% by 2015, compared to 13% in 2009.” This is corporation-speak for the worst fears the Sakha government and its constituents believe will materialize once they lose their veto shareholding in the company – all social, welfare, and community costs will be slashed; tax optimization will be introduced; and the regional budget will be thrown back into dependence on Moscow – as if diamond mining were just another line of commercial business competing with international peers like DeBeers, Rio Tinto, and BHP Billiton.

There is a good, if unstated reason the Yakuts have for not trusting the money promises of Alrosa’s Moscow management and the federal stakeholder, led by board chairman and Finance Minister, Alexei Kudrin. In 1990 the then Soviet government pledged the diamond output of the region and a portion of the state stockpile for a loan of $1 billion from De Beers. During the turmoil of the Yeltsin years, the loan was repaid in full. But the Yakuts say they never saw a kopek to the benefit of Sakha. Since those days rival diamond-mining provinces in Canada, Australia, and South Africa have all introduced native rights protections and statutes to secure mining royalties, environmental protection and reclamation, and related income streams for the indigenous peoples. For the Yakuts, their best, maybe their only protection is the 40% shareholding they are hanging on to in Alrosa.

One of two Sakha republic senators in the Federation Council, Alexander Matveyev, is travelling and incommunicado on this issue for a week. When he last commented on Andreyev’s stock conversion plan in June, he was cautious. The federal and the Sakha governments, he said, “will find common ground on this matter.” How long that will take to materialize Matveyev didn’t say, except to hint that share brokers shouldn’t be holding their breath: “As to the terms for opening the company,” he said, “there is a standing procedure for such operations, and the company will carefully observe this procedure.”

The second of the Sakha senators is the former Sakha president, and before that the former chief executive of Alrosa, Vyacheslav Shtirov. According to his Moscow spokesman, he too is travelling, and until he returns to Moscow, no contact with him is possible.

At Alrosa, Andreyev’s spokesman told PolishedPrices.com:“Alrosa can be turned into an open company by an extraordinary general meeting of shareholders. A government decree is not needed, because the shareholders are actually people from the government.” Asked when Alrosa plans to call such a meeting, and what time period is required in advance, he did not respond. Alrosa is also not saying what the company estimates to be the volume of its shares which have been traded in the past year.

Ararat Evoyan, one of the veterans of Russian diamond policymaking, who continues as head of the Russian Diamond Manufacturers Association, says no shareholding move can be made without consensus between Andreyev and the Yakut leadership. Until that can be reached, there won’t be a shareholder vote. “The Federal government will not open the company without Yakutia’s consent. It is not only a legal question of shareholding, but a question of the relationship of the federal and regional governments. If the federals want to transform the stock, they will have to reach an agreement with the uluses [districts]. The company is interested in a peaceful solution of such problems if they emerge.”

In other diamond-producing countries, the Andreyev share sale plan and the Metropol report touting the upside would stimulate intense public debate. In Russia, Metropol uses double-speak to suggest what isn’t being said. “We expect transparency to improve significantly”, the brokerage suggests. “Alrosa’s IPO is still uncertain due to legislative constraints and the ‘special status’ of the company to state and local governments. According to a number of sources, an IPO should be expected no earlier than 2012, but the company is already taking steps toward going public. The company continues to improve its transparency; we note that Alrosa has been publishing IR releases regarding expected financial results, forecasts of global raw diamond supply and demand imbalances and other information. There is still room for improvements in transparency.”

At the end of the report, in the small print, there is also this: “METROPOL IFC Ltd and its affiliates may act or have acted as Market Maker in the securities or other financial instruments described in this publication, and may have or have had a relationship with or may provide or have provided investment banking and/or other financial services to the relevant companies.”

Leave a Reply