By John Helmer, Moscow

United Company Rusal, the state aluminium monopoly controlled by Oleg Deripaska (right), has failed in a bid to ward off billion-dollar sanctions from Alpha Conde (centre), the President of Guinea, with an offer to start a cheap, new bauxite mine three years from now.

Sources in Conakry, the capital of the West African republic, have confirmed that an inter-ministerial committee, which has been reviewing the contract records for more than a decade of mineral resource concessions and mining agreements signed by earlier Guinean governments, has found Rusal to have under-paid and under-performed at its Friguia bauxite mine and alumina refinery. Word that the Technical Committee for Review of Mining Titles and Agreements (Comite Technique de Revue des Titres et Conventions Miniers, CTRTCM) was about to rule Rusal in violation and propose major financial penalties led Deripaska to despatch Victor Boyarkin to Conakry for talks to head off the committee’s recommendations.

Boyarkin’s return to Rusal in June after fifteen months at the state arms and defence industry conglomerate Rostek, was reported here. Last week, on Boyarkin’s return from the latest round of negotiations in Conakry, Rusal authorized this Moscow press report of the outcome of his negotiation. Rusal, “begins implementation of the Dian-Dian project,” RBK claimed. “At the first stage, the project assumes construction and commissioning by 2016 of a 3-million tonne bauxite mine, with a further increase in the volume of production to 6 million tonnes.” No duration or deadline is reported for the 6-million tonne capacity expansion. For bauxite transportation from the field, the press report claims, a 25-kilometre spur-line will be built connecting the minesite to an existing railway to Kansar port. The volume of investment Rusal plans to spend at the first stage of implementation of the Dian-Dian project will be “more than $220 million.” That figure, according to RBK, will include the construction of rail and port infrastructure.

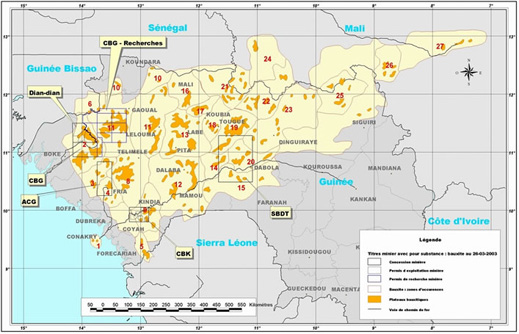

The numbers do not match those estimated for the project and the Dian-Dian concession terms by Guinean government officials. They have previously insisted that Rusal’s agreement for Dian-Dian, signed originally in 2006, requires that it construct considerably more rail and port infrastructure, because the main rail line to Kansar is already fully utilized by Alcoa for bauxite shipments from its CBG mining operations.

On the map, Dian-Dian can be seen in the northwestern corner of the country. Compagnie des Bauxites de Guinée (CBG) operates the largest bauxite mine in Guinea, and in the world.

Stakeholders are Alcoa, Rio Tinto and the Guinean government, with Alcoa the mine operator. Alcoa has also been obliged by the government that, in return for the bauxite mining rights, it must build an alumina refinery. That promise was signed in 2005. Alcoa announced the site plan, near Kamsar, in July 2007. The US company then claimed “alumina production could be expected in 2012”. Rio Tinto has also made promises to build the new alumina refinery. But the billion-dollar plant has yet to be built. In the present global market for aluminium, the Americans and British want to delay their project as long as possible.

Rusal is just as reluctant to invest, and to say so.

Rusal’s detailed references to the Dian-Dian project plans in its Hong Kong Stock Exchange listing prospectus of January 2010 revealed two project cost estimates – one for the bauxite mine, and another for the alumina refinery. “Dian-Dian is a greenfield project to be constructed in Guinea. The studies to date have identified Measured and Indicated Mineral Resources compliant with the JORC Code of 472.1 Mt with 47.7% Al2O3 and 1.5% silica. The expected volume of bauxite mined, subject to confirmation by additional studies is 13.1 Mtpa (for alumina production) and 10 Mtpa (for export). A feasibility study has been prepared by international consultants. The capital expenditure of the mining aspects of the project has been estimated at US$425 m, which would include the development of the mine and mine related infrastructure.”

The prospectus also acknowledged the Dian-Dian alumina refinery would be a much more expensive proposition. This, said Rusal, “is a greenfield alumina refinery project which is planned for construction in Guinea, West Africa. A detailed feasibility study has been completed for a 5.1 Mtpa alumina refinery including a power plant, railway, port and other associated infrastructure. First alumina is currently scheduled for 2015. The CAPEX for this project, including development of the bauxite mine, is estimated at US$5,566 million, of which US$42 million had been spent as of 30 June 2009.”

In a 2011 presentation the company claimed it was planning to mine 10 million tonnes of bauxite at Dian-Dian, and convert it all at the new refinery to 5.1 million tonnes of alumina. The same presentation claimed the company intended to add another 413,000 tonnes of alumina to the production capacity at the Friguia plant. “Extensive and flexible project pipeline contributes to a sustainable global leadership” claimed Rusal’s sales director at the time, Steve Hodgson. What that flexibility meant one year later was the closure of the Friguia refinery, and the trimming of the Dian-Dian plans to a mine one-third its promised size, and no refinery at all.

On December 31 2012 Rusal had announced to the Hong Kong Stock Exchange that it had agreed with the Guinean government on terms for delaying the Dian-Dian project, scaling down the production targets, and cutting the costs. The deal, said the company, “may or may not proceed as contemplated or at all.” That depended on “approval of the Board of Directors of the Company and the ratification and promulgation in accordance with the laws of the Republic of Guinea.” In March 2013 Guinean sources claimed the attempted ratification by the government, outside parliament, was illegal.

In Rusal’s financial report for 2013 the company acknowledged its flexibility was causing “risk”. Guinea, along with several other countries where Rusal operates, the report said, has “been experiencing political and economic changes that have affected, and may continue to affect, the activities of enterprises operating in these environments. Consequently, operations in these countries involve risks that typically do not exist in other markets, including reconsideration of privatisation terms in certain countries where the Group operates following changes in governing political powers.”

Rusal, according to Guinean officials , has dealt with Guinean “risk” in the same way, they accuse, as Rio Tinto and other international mining companies – by inducing government officials to drop their demands and suspend the enforcement of mine concession terms. Rusal “risk management”, Guineans charge, has not been different in motivation or method from Alcoa or Rio Tinto or others. The story of what Rusal did along these lines during the military government which took power in December 2008 and relinquished it to Conde after the election of November 2010, can be read here.

For the Financial Times, Conde is the “west African bulwark against the jihadists of the Sahara”, who has engaged ex-UK prime minister Tony Blair [lower left] and US investment fund operator George Soros [right] to advise him on good governance. “Mr Soros has been instrumental,” the London paper recently claimed, “in making Guinea what Mr Condé acknowledges is a ‘laboratory’ for a global campaign, led by the US and EU, to open up the oil and mining industries to greater scrutiny. Under Mr Condé, the government has published mining contracts, overhauled the mining code and is nearing the completion of a review of deals signed under past dictatorships.”

The Comite Technique (CTRTCM) started with an attack on the process which cost Rio Tinto part of its Simandou iron-ore concession to the benefit of Israeli Beny Steinmetz and Vale of Brazil. Here is the CTRTCM letter of initial findings.

Among Conde’s ministers and members of the parliamentary opposition in Conakry, the role of Soros is widely believed to have not only guided Conde, but also to have persuaded the US Justice Department to open a corruption prosecution against Steinmetz.

Rusal appears to be the new target. The latest report from the Comite Technique, according to those who are close to the investigation, accuses Rusal of paying well below the real value of the Friguia assets in the privatization sale of 2006; of failing to pay for the environmental clean-up required; and of violating its concession agreement by unilaterally halting operations in 2012. The CTRTCM is reportedly recommending to Conde that he issue a retrocession notice to Rusal, and require the company to renegotiate the terms with a significant compensation. Rusal is not commenting.

Such moves carry the threat of government sanction against Rusal’s remaining source of bauxite and earnings in Guinea, the Kindia bauxite mine. Rusal’s annual report for last year, issued in April, indicates that Kindia is producing 3.3 million tonnes, 100% of capacity. That bauxite is specially adapted to refining at Rusal’s Nikolaev alumina refinery (NGZ) in southeastern Ukraine, with a strong balance-sheet effect: “use of technology utilised [for] Guinean Kindia bauxite as a sweetening ore at NGZ developed in 2012 has also proven its commercial efficiency in 2013. This reduced the consumption of the expensive Guyana, Boke, Sierra Leone and Jamaican bauxites by at least 30 % and caustic soda consumption by 15 kg NaOH per tonne alumina resulting in 10.5 USD/t reduction in NGZ alumina cash cost.”

The findings of the new investigation by the Comite Technique reinforce and substantiate a report commissioned in late 2009 by former Mining Minister Mahmoud Thiam through a Washington consultancy, Alex Stewart International (ASI).

The ASI report estimated that $831.3 million had been earned by Rusal from exports of alumina from Friguia between the plant takeover in 2006 and the 2009 ruling of a Conakry court that the refinery had been illegally privatized. Another $142.4 million was calculated as Rusal’s liability for under-production below the concession requirement of 640,000 tonnes per annum. Compensation for a lethal crash of an alumina train, a dam collapse, and other environmental pollution “could reach hundreds of millions of dollars,” ASI concluded.

Action on these amounts was pending at Thiam’s ministry when he retired and returned to the US, after Conde’s election. Thiam was the target of Rusal and Rio Tinto while he was in office. Since he left Conakry, Thiam [lower left] has been the target of Conde, Soros, and most recently of Rio Tinto’s chief executive, Sam Walsh; he was in charge of Rio Tinto’s iron-ore operations in Guinea when Thiam was minister. Walsh has launched a suit against Thiam in New York.

Walsh (second left) meets Conde this year

A Rusal insider says that Deripaska has been telling shareholders, as well as senior management, that “it is less cost-effective to revive the Friguia alumina plant than to build a new one from scratch. There are several plans, including a new refinery in Dian-Dian, which are in heated discussions now. A decision depends on the negotiations in Guinea. Financing doesn’t seem to be a problem despite Rusal’s huge losses/debts and despite the present loss-making aluminium market.”

Another source close to Rusal speculates that if the conflict in eastern Ukraine continues to deteriorate, Rusal’s hold on the Nikolaev refinery (NGZ) may be broken. For background on NGZ, see this report.

In Rusal’s share debut in January 2010, the company acknowledged that its assets in Ukraine were vulnerable to expropriation. “The political environment in Ukraine in recent years has been particularly unstable, with frequent changes of government. Private enterprises, including the Group’s businesses, can be affected by these political changes. The Group acquired the Nikolaev alumina refinery in a privatisation that was challenged in the past, and the Zaporozhye aluminium complex in a privatisation that is currently being challenged…Political change in Ukraine could result in a revival or intensification of such challenges.”

This week the source close to the company suggested that building the Dian-Dian alumina plant might make sense “as an eventual substitute for NGZ if things go completely wrong in Ukraine. It would also allow savings for freight costs. To produce alumina in Guinea is also cheaper than in Ukraine.”

NOTE: Following publication of this report, on July 21 Rusal announced that it has won a ruling from the International Chamber of Commerce (ICC) in Paris where it has been challenging the Guinea government and Conakry courts on the legality of the Frigia privatization. According to the Rusal statement, “the tribunal upheld a share purchase agreement by which the Group’s subsidiary in Guinea was acquired, rejecting all of the Republic of Guinea’s defenses. The tribunal also ordered the Republic of Guinea to reimburse the Group subsidiary € 250,000 in legal costs.”

Leave a Reply