By John Helmer, Moscow

If you want to understand Russian politics, watch the tomato talk to power.

President Vladimir Putin rolled out the red carpet for Turkey’s President, Recep Tayyip Erdogan, last month, and it was announced that the Russian ban on Turkish food imports will soon be dropped. But the Russian tomato trade doesn’t agree. It says Turkish tomatoes will remain excluded from the Russian market.

The loss of the Russian tomato trade to Turkey, one of the top-5 tomato exporters in the world, is almost 366,000 tonnes worth about $440 million a year. The initial Turkish reaction was to try to smuggle their tomatoes into Russia as if they had been grown in Armenia. That too has been stopped. Now, as Turkey’s unsellable tomato surplus turns into sauce for the flies, and the Russian season for domestic harvest comes to an end, there is a concomitant gain for alternative tomato exporters to Russia. These are led by Morocco, China and Azerbaijan, with Jordan and Mexico eyeing their opportunity. Domestic Russian tomato producers will also gain, though more slowly.

Philip Owen of the Russian food trade consultancy Volga Trader, says: “At present sanctions are in place. Middle sized Russian retail firms find it hard to replace Turkish suppliers because potential suppliers do not have the logistics in place to deliver on the desired DDP [Delivered Duty Paid] terms. On the other hand, the retailers find paying higher prices to specialist importers, who do have logistics in place, a deterrent. Lack of real competition in Russia’s cold chain warehousing, or to be precise cool chain logistics, hampers change. Until now the big firms have filled the gap with the Russian harvest but clearly, the Russian glass-house companies have found the ear of the Russian government . There will be replacements from other countries for this year’s foreign tomato crop, which is now being harvested. The annual drop in the tomato import duty from 15% to 10% happens on 1st October.”

For a report by Volga Trader on the impact of sanctions on Russian food imports, read this.

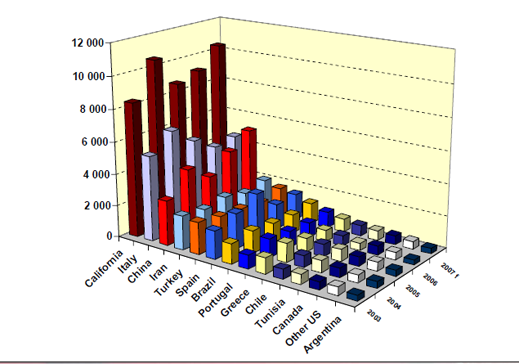

According to the Russian customs figures, in 2014 imports of tomatoes peaked at 847,142 tonnes for a declared value of $1.1 billion. Turkey led, with 42% of the trade. China and Morocco followed with 12% and 11%, respectively. The Netherlands and Spain came next with $74 million worth each; then Poland and Belgium at smaller values. They were banned in 2014 by Russia’s counter-sanctions against the European Union (EU), and Belarus and Azerbaijan took their place, although tonnages were down. Ukraine was also eliminated. In the six months to June 30, this year, tomato imports to Russia totalled $325,000 tonnes and $350 million; that’s an overall decline in trade of 23% in volume, 36% in value.

In global terms, Russia is insignificant as a tomato producer. But as a consumer of imported tomatoes, it has been a major market for Turkey and the EU, then Morocco.

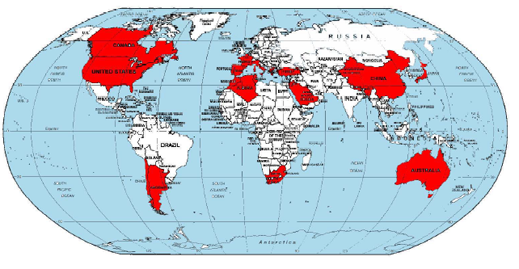

GLOBAL TOMATO PRODUCTION

Source: http://www.wptc.to/pdf/commissions/Exchange51.pdf

GLOBAL TOMATO TRADE

Source: http://www.wptc.to/pdf/commissions/Exchange51.pdf

The 2015 trade figures show that the disruption of global tomato flows caused by the war against Russia has particularly hurt the Netherlands and Spain, and benefitted Belarus, China, Morocco, and Jordan. In the last five years, the growth in export value for Belarus has been 178%, though how much of this involves EU tomato smuggling into Russia is difficult to estimate. The growth rate over the same period for China is 135%; Morocco, 54%; and Jordan, 48%.

The trade is relatively concentrated – fifteen countries produce more than 92% of all tomato exports by value.

CONCENTRATION OF TOMATO PRODUCTION BY COUNTRY

Source: http://www.wptc.to/pdf/commissions/Exchange51.pdf

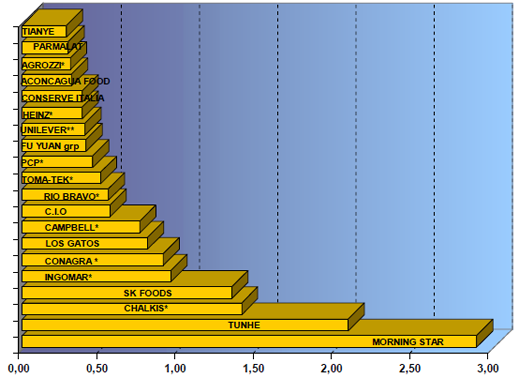

Growing tomatoes requires less investment than turning them into paste, sauce, canned pieces and soup, and is relatively diversified. But just twenty companies control more than half the world’s tomato processing plants. Morning Star, the leader, is based in California; COFCO Tunhe and Chalkis are Chinese; SK, Ingomar, Conagra, Los Gatos, and Campbell are all from the US.

TOMATO CAPITALISM – CONCENTRATION OF SALES BY COMPANY

Source: http://www.wptc.to/pdf/commissions/Exchange51.pdf

Hundreds of exporters, importers, traders, and marketers are this week in Moscow for the annual WorldFood Moscow convention. The Chinese dominate the exhibitor list. Among the global tomato exporters, Mexico and Jordan are making a small appearance at the show. A source at the convention says the Jordanian government “has a big stand for fresh produce but there are empty spaces and not a single tomato firm.” For the time being, the only foreign exporters to increase tomato shipments to Russia are Morocco, China, and Azerbaijan.

For domestic tomato production to expand, “requires a 3 to 4-year cycle,” Owen explains. “So assuming that the anti-Europe sanctions triggered investment decisions in 2014, there should be new production in 2017, and a large increase in 2018. Let us say a 5% increase in 2017, and a 25% increase in 2018. This is optimistic. Young tomato plants are grown by specialist propagators who will wait for a market to appear first. At the least, Russia will need to buy young tomato plants from foreign propagators – where is another question — although the biggest operations will try to do it themselves.”

Source: Philip Owen of Volga Trader: “Glass house near Saratov under construction 5 years ago. From decision to the start of producing fruit took almost four years.”

A Moscow supermarket analyst said that Magnit and X5, the retail food market leaders, have taken the policy decision to dump Turkish food supplies, and develop import as well as domestic alternatives. “They are looking for multiple suppliers in order to avoid dependency on a single source which may be affected by politics, like Turkey. They are making moves to move upstream into tomato production too, but so far they don’t think that’s profitable enough in the short term. How much of a longterm investment the supermarket companies will want to risk is doubtful.” For background on how the Russian supermarket chains are managing war conditions, read this.

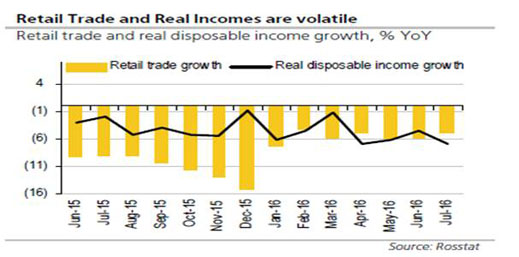

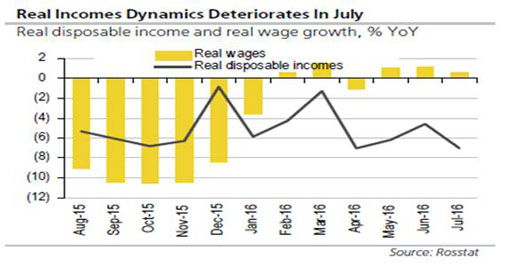

The industry bible Tomato News estimates that Russian per capita consumption of tomatoes is relatively low – 5 to 10 kilograms per capita per year. Only China and India eat less. The biggest tomato consumers are the US and Canada, Sweden, and Greece, quaffing between 40 and 50 kgs per capita per annum. But for Russians to be likely to consume more fresh tomatoes and tomato products depends on the tomato price – and the revival of consumer incomes to afford it. Incomes usually don’t revive in wartime – they may be static in Russia for years to come.

Source: Uralsib Bank

As Russian consumers suffered income losses during the first year and half of the war, and retail trade has worsened, tomatoes are proving too expensive for many shopping baskets. This is why imports are declining. According to Owen of Volga Trader, “Russia’s supply of tomatoes has halved in three years.”

Leave a Reply