By John Helmer, Moscow

![]() @bears_with

@bears_with

Not everything that glisters is gold, Shakespeare wrote as a warning about the seeming value of precious metal. Nor plisters is platinum.

The shine has been off for years now because the price of platinum has fallen steadily, and because the risks of mining it in South Africa have accelerated even faster. South Africa, with more than 90% of global reserves and supplying almost 70% of mine production of the metal, remains the market leader. But on account of the country’s political corruption, collapse of infrastructure, miner wage strikes, and falling mineable metal grades, the country has become an unstable, high-risk, high-cost source. So the stock markets for listed South African-based miners have been slashing the share price and devaluing the metal the companies have yet to dig up and sell.

Russia, which is the world’s second largest source of platinum reserves and mine production, is much more attractive by comparison: South Africa’s loss is Russia’s gain. And not just for Norilsk Nickel, the dominant Russian miner, but also for small platinum mining companies. Right now, they say they have the proven deposits; what they need is the cash to pay for the mining operations to dig it out, refine and sell it.

The problem for Russian platinum miners is that the supply of relatively low-cost alluvial – river-dredged — sources of the metal are petering out. To make up for this, junior Russian miners must raise investment to finance costly underground excavation. If they succeed, their combined output of platinum will double. It’s on speculation of this that the share price of Eurasia Mining quadrupled in London last week.

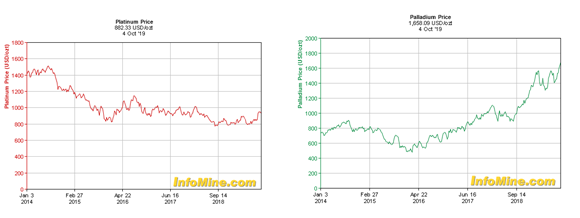

Platinum is usually found in combination with palladium and other less well-known metals of the platinum group – rhodium, ruthenium, osmium, and iridium. Depending on the geological conditions, the proportion which can be mined varies from deposit to deposit, country to country. The applications are also variable. Accordingly, the market forces of supply and demand have been running the price of platinum downwards since 2014. By contrast, palladium has been rocketing upwards, and is now higher than ever before.

FIVE-YEAR TRAJECTORY OF THE PLATINUM, PALLADIUM PRICE

Click on images to enlarge

Source: http://www.infomine.com/ and http://www.infomine.com/investment/metal-prices/palladium/

Platinum has been mined in Russia for almost two hundred years because it can be dredged out of river streams with simple technology and at a low cost. Palladium is less commonly extracted alluvially, and comes mostly from underground mining of deposits of nickel and copper. There are more of those ores in Russia than in South Africa.

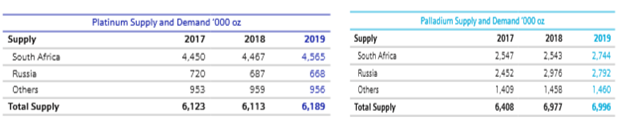

Click on images to enlarge

Source: http://www.platinum.matthey.com/

Johnson Matthey of London produces the bible of global supply and demand assessments for the platinum group metals every quarter. The latest report, released for May, explains that the worldwide demand for platinum has been falling for jewellery and emission control devices for cars (auto-catalysts). But that has been offset by the growth of other industrial uses in glass and petrochemicals, especially in China; and by a takeoff of Indian demand for platinum jewellery. Investment funds speculating on an increase in the platinum price cut their purchasing last year, but started to buy again this year. “It is impossible at this stage,” according to the Johnson Matthey experts, “to predict how durable the recent surge in investment will prove.”

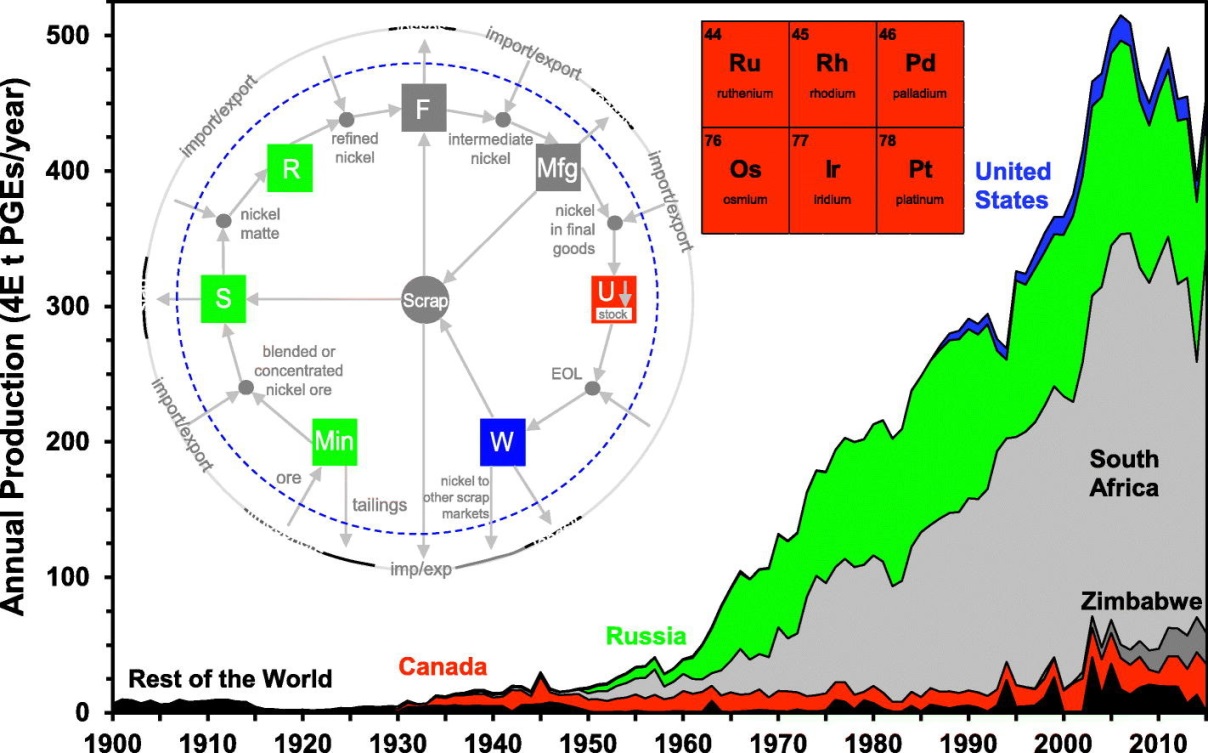

GLOBAL PLATINUM GROUP METAL PRODUCTION AND RESERVES, 2018

Click on image to enlarge

Source: https://ars.els-cdn.com/ in https://www.sciencedirect.com/

PLATINUM MINE PRODUCTION, MAJOR COUNTRIES, 2014-2018

Source: https://www.statista.com/

“In Russia,” according to Johnson Matthey, “the volume of ore mined at the Norilsk-Talnakh mines was stable, but pgm [platinum group metals] grades declined slightly, reflecting a fall in output of pgm-rich massive sulphide ore, and a corresponding increase in lower-grade disseminated ore. However, Norilsk Nickel has continued to supplement its mine output by processing surface materials, particularly stocks of old copper concentrate purchased from the state enterprise Rostec in 2017. This contributed to a 4% increase in Norilsk’s output of platinum in the January to September 2018 period. However, full-year production figures were affected by a build-up in pipeline inventory at the Krasnoyarsk Precious Metals Refinery during the final quarter, leaving annual platinum production flat.”

“Alluvial platinum production in Russia dropped steeply in 2018, due to declining grades at placer [alluvial] operations in the far east of the country. In the past, these operations contributed as much as 150,000 oz of platinum annually, but output is now below 20,000 oz a year. As a result, total Russian supplies declined 5% to 687,000 oz.”

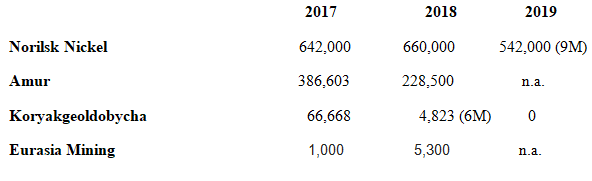

TABLE OF RUSSIAN PLATINUM MINE PRODUCERS, 2017- 2018

in troy ounces*

* One metric tonne (1,000 kgs) is equal to 32,151 troy ounces.

Norilsk Nickel publishes regular production and financial reports; the 2017-2018 data can be found here. The results of the smaller mining companies have been summarized in reports by the Union of Gold Industry Entrepreneurs. Russian Platinum publishes no accurate or up to date information on its operations. Koryakgeoldobycha announced it was halting platinum production at the end of 2018. Renova, the asset holding of Victor Vekselberg, had planned to sell the mining company to GV Gold during the year. However, following the announcement of US sanctions against Vekselberg, GV Gold withdrew.

This year’s alluvial mining season is already ended; the rivers have frozen. As the gaps in the table show, there is reluctance on the part of the alluvial miners who are not listed on foreign stock exchanges to publish regular and reliable production and sales data. Output at Eurasia, which mines in western Russia and is listed in London, is growing; at Amur and Koryakgelodobycha in the fareast, the platinum is running out. The platinum reserves, which are in the west, are not; but since they are underground, the cost of mining them is much higher than the traditional prospectors can afford.

Johnson Matthey reports, “we do not expect any significant changes in Russian platinum production this year. The pgm grade of ores mined at Norilsk continues to decrease gradually, reflecting an increased reliance on lower-grade disseminated ores. However, output will be supported for at least one more year by the refining of old copper concentrate. This material originates from historic pgm mining activities in the Norilsk-Talnakh area and was purchased from the state corporation Rostec in 2017. Norilsk has used it to replace production from stored pyrrhotite concentrate, which was an important source of pgm for a number of years until stocks were exhausted in 2017.”

The big advantage which Russian platinum has over South African is the cost of production. South African mining of platinum costs on average US$953 per ounce; in Russia the cost is between $300 and $360. The reason is that Russian mines are open-pit excavation operations; the South African operations require tunnelling to great depths, and much more manpower.

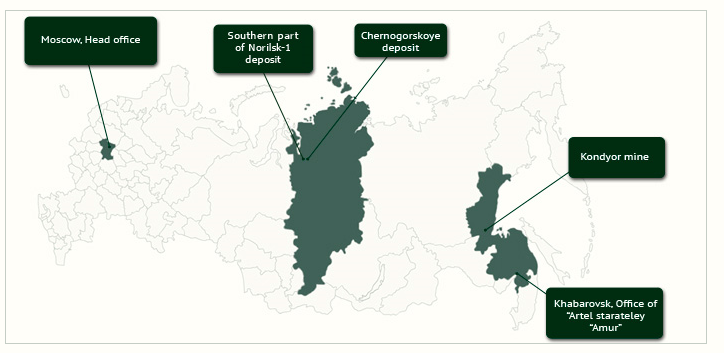

The largest of the Russian alluvial platinum miners until recently has been Russian Platinum, owned by Musa Bazhaev and members of his family. They started in oil refining in the Russian Fareast, and expanded into precious metals mining by taking over the Amur Artel in controversial circumstances. As alluvial prospects dwindled, the Bazhaevs have failed at raising investment on foreign stock exchanges, or from Russian investors. The unbankable Bazhaev is also untalkative, and vice versa. The Russian Platinum company website explains almost nothing except for identifying where its platinum assets are located on the map.

In 2017 the Kondyor mine reported production of 41,000 ozs of platinum, and there has been no news since then. Industry sources believe the mine is closing down.

The company doesn’t respond to questions. The history of the bitterly contested bidding for underground deposits in territory dominated by Norilsk Nickel – the Chernogorskoye story – has been told here. That report appeared in 2012. Insiders said then Bazhaev got high-level political help in his fight against Norilsk Nickel; they claim it came from the circle of President, then Prime Minister Dmitry Medvedev. Medvedev was president from 2008 and 2012. Arkady Dvorkovich, who was deputy prime minister between 2012 and 2018, was a supporter.

In July of this year, the inevitable, as Norilsk Nickel had been expecting, was announced. Bazhaev signed an agreement for joint development of his deposits and the neighbouring ones belonging to Norilsk Nickel. According to the Norilsk Nickel announcement, “the joint venture will be created on a parity basis (50/50 ownership), with Nornickel contributing its licence for the Maslovskoye Deposit and Russian Platinum — licences for the southern flank of the Norilsk-1 Deposit and the Chernogorskoye Deposit. The new company is set to become one of the world’s largest platinum and palladium producer. The investment decision on the project details and time-line will be made following the feasibility study to be completed before the end of 2019.”

The forecast Norilsk executives have given suggests annual production of platinum from the new project of about 220,000 oz (6.9 tonnes) per year. The investment required will come from Norilsk Nickel. So will the infrastructure supporting the mine and the refinery.

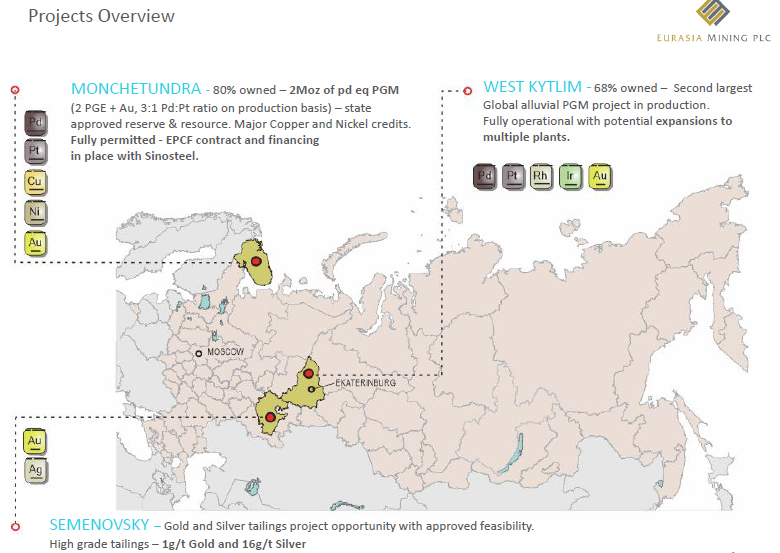

With a target of 130,000 ozs of palladium and platinum per year from its planned Monchetundra project, also in Norilsk’s neighbourhood on the Kola peninsula, Eurasia Mining is in no conflict with its neighbor; the region also includes a Norilsk Nickel mine and refinery, two phosphate mines and an apatite mine. Eurasia has now negotiated independent sources of finance for the prospecting, planning and construction stages of its project. The principal source is $150 million from Sinosteel, the Chinese state-owned mine engineering group which is to build the mine and ore-processing plant. The remainder of the money required for start-up is to be raised by the Russian and Chinese financial groups, VTB and CITIC.

Monchetundra will be primarily a palladium producer, with an unusually high ratio, 3 to 1, of palladium to platinum. Published market projections, based on a palladium price of $1,000 per ounce, indicate earnings from Monchetundra will be around $28 million in 2021 and triple that within two years. The current palladium price is $1,778.

Click on image to enlarge

Source: https://www.eurasiamining.co.uk

Eurasia’s West Kytlim alluvial mine, located southeast of Moscow in Sverdlovsk region, is principally a platinum producer. It has been many years in development, originally as a joint venture with the South American miner Anglo American.

Source: https://www.eurasiamining.co.uk/

Listed on the Alternative Investment Market of the London Stock Exchange, Eurasia Mining bought out Anglo American’s stake in 2014 for a nominal amount. More recently, Russian shareholders Dmitry Suschov and Dmitry Churakov have expanded their invested stakes in the company, which is led by board chairman and managing director, Christian Schaffalitzky. They have now taken over direct operation of West Kytlim from a contractor with whom revenues and royalties were shared when money was scarcer.

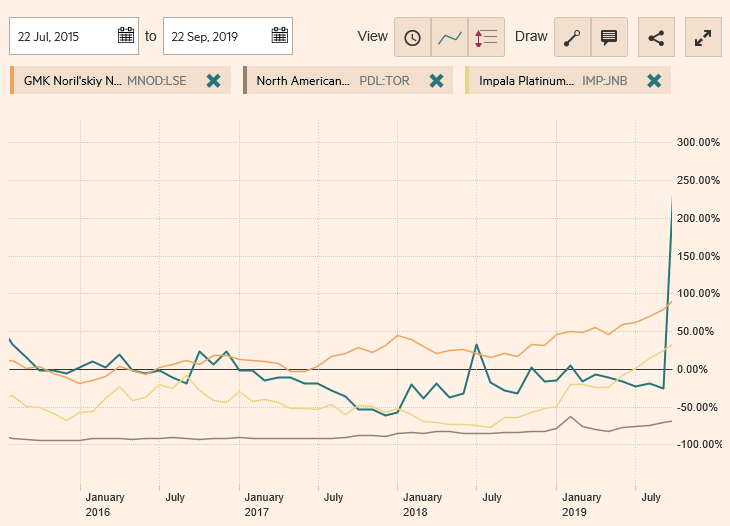

Market enthusiasm for Eurasia resulted in a takeoff of its shares in London in the last days of October.

FIVE-YEAR TRAJECTORY OF LISTED PLATINUM MINERS, 2015-2019

KEY: Grey=Eurasia Mining (market capitalization, £53 million); orange=Norilsk Nickel ($45 billion); green=Impala Platinum $6.3 billion); yellow=North American Palladium ($914 million). Source: https://markets.ft.com/

A vertical jump in share price like this has not been recorded for a Russian mining company on an international exchange since the phosphate boom of 2007.

NOTE: The controversial story of the Russian investment in platinum mining in Zimbabwe, and the state underwriting, was told here.

That was five years ago. In the interval the billion-dollar cash which the Zimbabweans believed would come from Moscow hasn’t materialized, nor has the pit been dug. Zimbabwean press reports blame the administration of former President Robert Mugabe and the involvement of local military officers. There is hope that President Emmerson Mnangagwa will resolve the problems; he met Putin for direct talks in Moscow in January, and then again at the Sochi summit of African leaders last month. In the meantime, the Russian promise of investment has been substituted by a credit line from the African Export-Import Bank (Afreximbank) and the African Finance Corporation (AFC). The President of Afreximbank, Benedict Oramah, was given a Friendship Award by President Putin in a Kremlin ceremony on Monday http://kremlin.ru/events/president/news/61963/photos/61845. Other Russian miners aiming to revive projects in Zimbabwe include Dmitry Mazepin, the controlling shareholder of phosphate miner Uralkali.

Leave a Reply