By John Helmer, Moscow

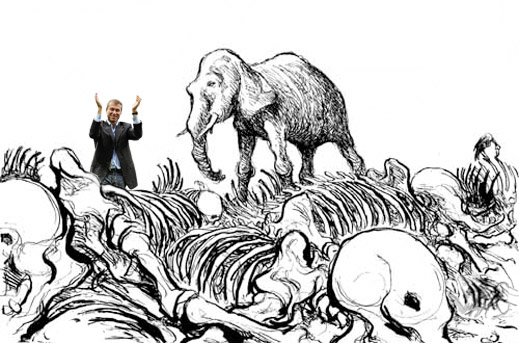

The two 20-year veteran coalminers who have directed Raspadskaya, one of Russia’s leading coking coal producers, have unexpectedly sold out their stake in the company. According to the terms of the deal announced in Moscow yesterday, Evraz, the vertically integrated steel and mining group controlled by Roman Abramovich (left image), will pay Gennady Kosovoy, currently CEO, and Alexander Vagin, board chairman, $202 million in cash, plus an 11.06% share of Evraz’s equity.

Kosovoy is the coalmine boss; Vagin runs political interference at the regional level and protection wherever required. They haven’t enjoyed being the co-control shareholders, with Abramovich, of the publicly listed company. Even less, they haven’t cared for Abramovich’s pressure to pay him dividends from Raspadskaya’s profit — and that was when the mining company was making a profit, and when the two veterans wanted to reinvest the proceeds in the mine itself. Because Raspadskaya was the only half-way independent coal supplier to the steel industry in Russia, its takeover by Evraz significantly reduces competition in the Russian market.

Call Kosovoy and Vagin red directors or throwbacks to the primitive Soviet era — Abramovich didn’t appreciate their standing in the way of his concept of Russian resource companies as cash harvesting machines. If, as expected, the Federal Antimonopoly Service will find no backing from the Kremlin to block the deal on competitive grounds, future regulation of coking coal prices will require nothing more than a telephone call from President Vladimir Putin to Abramovich.

This year there hasn’t been any coalmine cash for Abramovich to harvest because Raspadskaya has been running at a loss. “An unstable demand for coking coal in Russia and a declining price trend on export markets became the main negative factor that held production volumes back,” Kosovoy reported in the financial report for the first six months, issued on September 20. “At present, the Company production capacity exceeds demand.” The report indicates that output for the six-month period was 3.43 million tonnes of coal, down 1% on the same period of 2011. However, sales revenues fell 24% to $285 million; earnings (Ebitda) were down 46% to $99 million; and on the bottom line, instead of a $99 million in net income booked a year ago, Raspadskaya says it ran a $19 million loss. The financial results were much worse than the market experts had been expecting.

Rising costs of production and the falling rouble added to the woes. According to Kosovoy, the cash cost of coking coal concentrate has risen this year to $62 per tonne, while the average sales price of concentrate was $118.80/t in the first half of this year, compared to $156.70/t a year ago (down 24%). The foreign exchange loss for the first half was $31 million. Pushing the cost line upward is an estimated $43 million in charges for restoration of Raspadskaya’s Mine 1, which blew up in May 2010, killing 90 miners. That was bad; Evraz’s safety record for coking coal mines it operates directly apart from Raspadskaya, is much worse.

At the current market valuations, the Raspadskaya stake which is being transferred is worth $744 million. The Evraz compensation is worth $794 million. In March 2011, Kosovoy and Vagin announced that they were ready to sell out, as did Evraz. At the time, the asking price for 100% of the mining company was about $6 billion. However, the sale offers triggered an immediate sell-off of Raspadskaya shares, and the share price has continued downward, accelerated by the fall in demand for coking coal and the decline of prices and Raspadskaya’s sale revenues. The current market capitalization of Raspadskaya is $1.8 billion.

Sources close to the company believe last year’s sale talk was bluffing on Kosovoy’s and Vagin’s part – a tactic to make Raspadskaya too expensive and thereby prevent an Evraz takeover. Their decision to sell out to Evraz now comes as a surprise to the market, and also to executives close to the company. There is speculation that the veterans have been exhausted by the process of recovery, following Raspadaksya’s catastrophic 2010 accident. There is also speculation that they are selling out now because the prospects for a recovery of Raspaskaya’s profitability remain doubtful for at least another year. “They [Kosovoy and Vagin] were getting tired for a great many good reasons,” said a source close to the company.

Raspadskaya has been the leading coking coal supplier in the country. The 2009 production level, before a double methane blast destroyed Mine-1 on May 9, 2010, was 13.6 million tonnes. Until the accident, Raspadskaya accounted for 17% of coking coal supplies to the domestic steel mills. The production target for this year is 7mt, and for next year a maximum of between 10mt and 11mt, if export demand revives.

“Together with Mr. Vagin,” Kosovoy announced, “we decided to exchange our stake in Corber [the common holding company for their stake and Evraz’s in Raspadskaya] for the shares of a major metallurgical company, EVRAZ plc. Taking into account our strong partnership with the management of EVRAZ, we accepted the proposal to stay with the Company as Senior Managers.”

In 2007-2008, Gennady Bogolyubov and Igor Kolomoisky, commanding the Ukrainian Privat group, briefly occupied a board seat at Evraz with a 9.7% minority stake in the company, before they launched a fresh asset war against Evraz in the Ukraine, and Bogolyubov sold his stake. Since then there has been reluctance on the part of Russian stakeholders to accept a subordinate position in the company because it is so tightly controlled by majority shareholders, Roman Abramovich and Alexander Abramov. Kosovoy and Vagin aren’t expected to hold on to their shareholding in Evraz for long.

A report by Alfa bank steel analyst Barry Ehrlich warned today the Evraz takeover might lead to transferring the profit of coking coal out of Raspadskaya and into Evraz. He also warned that the deal “is negative for [Raspadskaya] as management is selling at a price much lower than earlier targeted and with a modest control premium of 15%. This may indicate low confidence or perception of high risk in the asset… Management exiting sends a negative signal on Raspdaskaya’s near-term outlook.”

Leave a Reply