By John Helmer, Moscow

Announcing its sale of the South African asset, Highveld Steel & Vanadium, to Nemascore, a company created just weeks before, Evraz issued the following announcement: “EVRAZ announces intention to sell its South African steel mill. EVRAZ plc…announces the signing of a non-binding term sheet in respect of the proposed sale of its 85% stake in EVRAZ Highveld Steel and Vanadium Limited (“EVRAZ Highveld”) to Nemascore (Pty) Ltd, black economic empowerment consortium, for an indicative cash consideration of approximately US$320 million (the “Transaction”). EVRAZ will utilise the sale proceeds for general corporate purposes.” That was on March 27.

Yesterday, April 18, the company referred in a quarterly report of its production results to the following “recent development”: “In March 2013 Evraz executed a non-binding term sheet for potential sale of Evraz Highveld.”

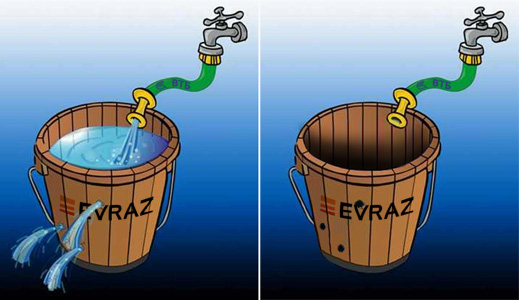

The shift from confident intention to conclude the sale to something that is no more than “potential”, and the continuing emphasis on the “non-binding” character of the papers signed so far, are fresh signs that support on the part of the South African government to provide the repayment guarantees required to underwrite financing for the deal is dwindling towards vanishing point.

Here is the story so far.

Subsequent South African press reporting and local sector analyst commentary have revealed that the South African government’s Department of Industry and Trade is “closely monitoring the situation” and that “high-level discussions” about the transaction have been taking place. Then on April 15 Mandla Mpangase, spokesman for the Industrial Development Corporation (IDC), the government’s support agency for enterprises like Highveld and for black empowerment groups like Nemascore, said categorically: “we are not involved in this transaction.”

After Evraz Highveld released evidence of continuing falls in its production in the first quarter (compared to the same period of 2012), the share price on the Johannesburg Stock Exchange fell, and sector confidence in the pricing of the Russian government-financed deal began to evaporate. According to Highveld’s report, hot metal steel was down 11%, compared with the same period last year. Tonnes of steel produced fell 25%. Vanadium slag output fell 24%, while ferrovanadium, a key product of Highveld, dropped 30%. Evraz followed on April 18 with more details, indicating that despite the deterioration in year-on-year results, there has been a pickup in both production of steel and vanadium at Highveld in the first quarter of this year, compared to the final quarter of 2012.

The share price is down 14% since Evraz announced its deal, and the market capitalization of the company is currently equivalent to $187.3 million. The Evraz offer price to sell its 85% stake for $320 million is more than double the value the market is putting on the asset.

Peter Major, head of mining at Cadiz Corporate Solutions in Cape Town, spoke for the consensus of SA’s institutional analysts when he said last week: “on the surface the offer does look overpriced. So I would start asking other questions like ‘Who is buying this asset’ and ‘Where is the money coming from?’ Once you answer those two questions it helps you understand why the price being offered is what it is. Worldwide, the resources industry is under huge pressure and really battling to find investors. So one would really like to understand how the bidders had arrived at the price quoted .”

Nemascore’s directors, Linda Makatini and Pathmananthan Alwar, refuse to answer questions on how they came by the deal, and how Nemascore can afford it. The SA press has been hinting that the unfamiliarity of the Nemascore names, the transaction secrecy and the high price suggest the potential for corrupt involvement of high SA government officials.

An Africa specialist who requested anonymity, says that getting rid of Highveld makes financial sense for Evraz. “In 2012, Highveld had negative EBITDA of around $85 million, so impact from the sale is positive.” As far as Evraz’s strategic interest in preserving its vanadium business, he notes: “Evraz’s market share of the vanadium market globally is 40%. It probably won’t change as, I understand it, they plan to sign a contract with Highveld so the latter will keep selling them raw material for vanadium production.”

So what to make of the sale of Highveld to Nemascore? “It is a ring-fencing operation poorly executed. At this point of time, the rationale remains unclear. Incidentally, the artist of this kind of processes is the Brazilian investment bank BTG Pactual, the Goldman Sachs of the tropics, and a recent strategic partner with Russia’s VTB Capital.” VTB appears to be the financier of Nemascore’s capacity to offer $320 million for Highveld.

David Gleason, SA’s leading investigative reporter for business, editorialized this week: “It has been suggested that the warehousing banks are Brazil’s BTG Pactual and Russia’s VTB Bank, neither of which wants to say why they are funding a deal on terms no one wants to get close to with a knobkerrie. What on earth is going on?”

VTB isn’t commenting, neither to deny its interest in the deal, nor confirm it.

Evraz was asked today to clarify whether the wording of its announcements on the deal imply the diminishing likelihood of completion of the sale. Speaking for the company, Tatiana Drachuk responded: “It is not a change of wording. This means that the transaction is not closed: an agreement of intent has been signed and standard due diligence is being conducted. As long as the deal is not closed, it can be considered quite logically as potential.”

Leave a Reply