By John Helmer, Moscow

Oleg Deripaska has told the Chinese to carry his water while he waits for the British to decide what he owes to the individual who, once upon a time, trusted him more than anyone else has done ever since.

In London this week, the UK High Court has fixed the date for Deripaska to face trial on claims he has stolen roughly $6 billion worth of shares, dividends and other assets from his original business partner and patron, Michael Cherney (Mikhail Chernoy). The civil case – the first time Deripaska has been forced to appear in an international court to testify on his business practices – is now scheduled to commence on April 23, 2012, with a planned duration of eight to ten weeks, court sources have disclosed.

The name of the High Court judge who will hear the case has not been announced yet. In 2007, Justice Sir Christopher Clarke presided in the first court proceeding; that tested whether the claims relating to the 2001 contract Deripaska signed with Cherney governing their shareholding and business obligations, came under UK jurisdiction. Clarke ruled they do, adding that “Mr Cherney has a good arguable case on this point, in the sense that he has a strong argument and that, insofar as any judgment can be made on present material, he has much the better side of the argument.” According to Clarke: “I am satisfied that Mr Cherney has a reasonable prospect of success in respect of his claim.” Deripaska appealed. But Clarke’s judgement, and his interpretation of the documentary evidence of the Cherney-Deripaska contract, were upheld last year by the UK Court of Appeals.

Last month, Deripaska lost the last of his attempts to delay the hearing of the lawsuit and his appearance in the witness box.

Although sixteen months remain before then, lawyers for Cherney and Deripaska are governed by a court-ordered monthly schedule for the production of new documents, cashflow accounts, and signature evidence, along with witness testimony on the long personal relationship between Deripaska and Cherney. Deripaska’s defence rests on two claims – that he hasn’t had a genuine business relationship with Cherney, and that he was forced by an alleged gangster, now dead, into paying protection money. On the rulings so far, the High Court doesn’t believe either.

The delay before trial also means delay in the recovery of the share price of United Company Rusal, the Russian aluminium monopoly, which Deripaska runs as chief executive and controlling shareholder. Rusal has told its shareholders it “is unable to express a view on the merits of Mr Cherney’s claim.” The company prospectus at its Hong Kong Stock Exchange (HKEx) listing last January cautioned that Deripaska’s shareholding in the company, plus certain assets of Rusal, “would be adversely affected” if the High Court rules in Cherney’s favour.

Rusal reports claim that following the Hong Kong listing, Deripaska nominally holds a 48% stake in Rusal. As the new evidence accumulates in the court files, the risk to Rusal’s share value, and the value discount borne by the other Russian shareholders, grows heavier, three people familiar with the matter say.

They are not the same three people who are reported in Bloomberg today as explaining why Deripaska’s attempt at selling shares of the power utility, which supplies Rusal with electricity, has failed to materialize in Hong Kong. According to the HKEx records , the listing application for the utility company, Eurosibenergo, has not been granted approval; no stock ticker has been assigned, and no prospectus, known by the Exchange as a web proof information Pack (WIPP), has been published.

This is the second Deripaska-controlled company to fail to list its shares on the HKEx this year; in May his Strikeforce Mining and Resources (SMR) announced it was withdrawing.

The exchange itself does not comment on applications pending before its listing committee, but a source close to the committee says he was told early this month that preliminary approval had been granted to Eurosibenergo and its backers, led by the Bank of China International, to start the marketing for the company’s share sale. The evidence from Hong Kong since then is that there has been little or no demand among institutional investors for shares at the lowest of the enterprise valuations Eurosibenerego was offering for itself — $3.5 billion. The Bloomberg publicity had started with an $8 billion target, but that had dropped through the $4 billion level before the latest marketing effort.

Eurosibenergo is obliged to repay about $1.5 billion, and a share sale by the end of December was intended to provide the cash required. But as investor demand in Hong Kong failed to materialize, and the company valuation fell towards the sum of its Moscow-listed parts, the amount to be raised has plummeted to roughly half the debt cover. If Deripaska had accepted this pricing in order to list Eurosibenergo and start debt repayments, there was also the danger of an abrupt collapse of the collateral value of the shares after the share sales opened; this is what happened to Rusal in January.

What appears now to have happened, according to people familiar with the matter, is that Deripaska tried to save the listing attempt and support his fixing price by proposing a Chinese cornerstone investor to buy into the initial public offering (IPO). A similar ploy had saved the Rusal listing in January, when the cornerstone investors were the Kremlin, through the state banks; hedge fund investor John Paulson; the Jacob Rothschild family; and local investors, Robert Kuok and Li Ka-shing. The non-Russians were persuaded to join in once the Kremlin had decided to secure everyone. The Kremlin had decided earlier on its intervention when Saif al-Qaddafi, head of the Libyan Investment Authority, offered to buy the entire 10% share bloc.

The very large, state-controlled Chinese companies have been decidedly reluctant to buy into unsecured Russian stock issues in Hong Kong for all the reasons deterring western institutional investors, and for the same reason that is on trial in the London court – they are not sure what Deripaska’s signature is worth. Joint operating ventures for specific projects, secured by output and offtake of oil, aluminium, or electricity are a different affair entirely.

Deripaska has already invited China Yangtze Power Company (CYPC) to consider spending cash on new projects to secure extra hydro-electric power from Russia. But their joint announcement of November 11 was a memorandum of understanding, which cost CYPC nothing to sign. No upfront cash was required either. If and when CYPC were to decide to reach into its pocket, the MoU provided plenty of security to recover value for its money. According to the press release by En+, the Deripaska holding which controls both Rusal and Eurosibenergo, “the Agreement [with CYPC], which is preliminary, subject to a definitive binding agreement, also covers cooperation in the exchange of technology and management information.” And one more qualifier – “the parties also agreed to make coordinated efforts to obtain support from their regulatory bodies and electricity grid companies in Russia and China.”

Governments usually aren’t asked to give their permission for companies like this to spend time at their drawing-boards. So it was perfectly clear early in November that the Chinese power utility was a long way from vouchsafing to Deripaska anything of substantial value.

But then Bloomberg’s report of today claims that CYPC and Eurosibenergo are “in talks to buy a stake in OAO Eurosibenergo as a key investor for the Russian utility’s planned initial share sale in Hong Kong, said three people familiar with the matter.” The Russian version of this claim suggests that CYPC is being asked to put down $168 million for an unknown bloc of Eurosibenergo shares, at an undisclosed share price.

A report from Alfa Bank power analyst Matvey Taits, issued to clients today, suggests that “the recently announced low end of the IPO range ($3.5 bln) is a more realistic valuation [for Eurosibenergo] as, according to our estimates, it implies a 2011Estimated EV/EBITDA valuation of around 7, which is very close to emerging market peers.” If CYPC thinks the same, then if and when it happens, the sale of 25% of Eurosibenergo shares should fetch $875 million. And if CYPC is being asked to commit $168 million, according to the Moscow reports, then that amounts to 19% of the entire IPO, for a post-IPO stake in Deripaska’s company of 4.8%.

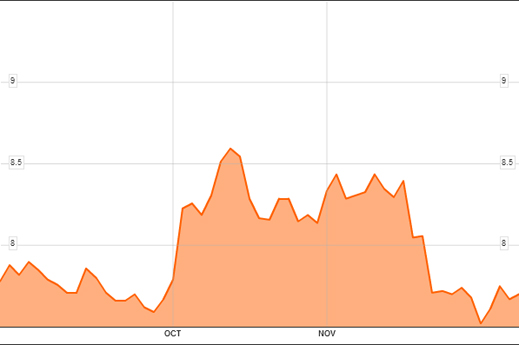

The numbers suggest that Beijing may take more than the expected amount of time to agree, not least of all because CYPC has been undergoing the slow-drip Chinese water torture itself, as its own share price has been falling over recent months:

And so it seems the transaction between Deripaska and China Yangtze Power appears to have been the former’s reaction to the failure of the Eurosibenergo marketing campaign. That it should require a change of filing at the HKEx, and permission from the Beijing state authorities – directly and indirectly they hold about 70% of CYPC – is unsurprising. But it will be surprising if the Chinese government decides to pay, or to appear to pay, an above-market price for Eurosibenergo shares. The deal and the concomitant delay are not the reason for Eurosibenerego to postpone its share sale. If this delay is prolonged on CYPC’s part, the risk is that sorcerer’s ploy will turn into the apprentices’ revenge.

Leave a Reply