By John Helmer, Moscow

In December, when we last visited with Mikhail Prokhorov, the only Russian to own an American basketball team, he appeared to be announcing that he prefers his ball to his shovel, and is getting ready to sell Polyus Gold, Russia’s leading goldminer, to “one of the leading gold companies in the world”.

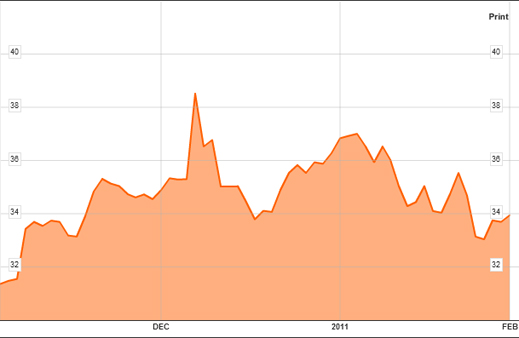

Prokhorov is chief executive of Polyus Gold, and owns about 35% of the company’s shares. His silent partner, Suleiman Kerimov, who reportedly has an interest in a boxing concession in Chicago, owns about 37%; the exact size of their respective shareholdings has never been confirmed by either shareholder, or by Polyus Gold. But since Prokhorov hung up the For Sale sign two months ago, the Polyus Gold share price has dropped from last year’s peak of $38.50 to $33.70 at the moment; that makes a loss in market capitalization of almost $2 billion. Not since Prokhorov had his run-in with the French police in January of 2007 has the downward slope been so slippery:

3-month price chart:

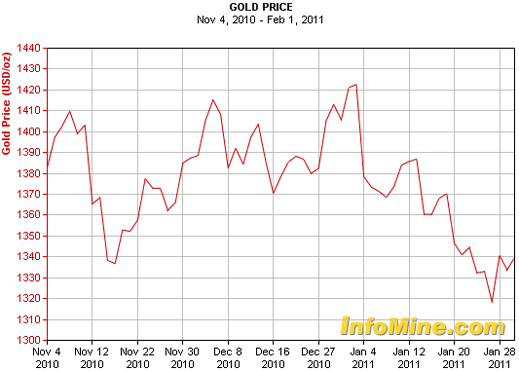

In the same interval, the price of gold has gone on a rollercoaster, ending $43 per ounce (3%) down:

In a report today by Alfa Bank’s metals analyst Barry Ehrlich, even if gold will pull upwards again, the share price of Polyus Gold is headed over a precipice, and may not come to rest until $24.90 – that’s a 26% drop from today — the evaporation of another $3.5 billion in market value.

According to Ehrlich, the problem is twofold — Polyus Gold’s most important mine, Olimpiada, is declining faster than expected, and capital spending by the company isn’t rising swiftly enough to offset this loss at other sites. Having begun with Olimpiada, in the Krasonyarsk region, before Prokhorov began adding other gold prospects and assets, Olimpiada still dominates Polyus Gold’s operating profile. In 2009, it accounted for 67% of the company’s total gold production. But output that year from the mine was 839,000 ounces. According to the latest company report, output last year came in at just 584,000 oz. That still accounts for 42% of the aggregate, but reflects a decline of 30% over the year. The company’s report, issued on January 28, explains that “the reduction was the result of technological difficulties that arose following the transition to deep level ores with high pyrrhotine content. The bio-leaching technology showed high sensitivity to the change in ore composition, which led to significant decline in recovery rate.”

Another way of putting this is to say that Prokhorov’s shovel is having to go deeper and deeper at Olympiada, and is striking less and less gold.

“Investors,” warns Ehrlich of Alfa Bank, “face a rude downward adjustment in expectations as they absorb FY10 operating results. Olympiada recovery looks set to remain permanently well below design level, Verninskoye was delayed and Blagodatnoye grade and recovery disappointed, suggesting lower production than hoped for. We decrease our production forecast by about 300 koz p.a. for FY11-12. 2012E P/E and EV/EBITDA, at 25x and 13x, respectively, are too high to be maintained.”

Ehrlich reports that he doesn’t think much of Prokhorov’s chances to find a buyer willing to add a premium to the current share price. “Though many investors hope for a value-accretive merger, we believe this is unlikely: Polyus is more expensive than its closest global major on most valuation metrics.” This is tougher than Russian analysts usually admit to in print.

The good-news merchants at Renaissance Capital (half-owned by Prokhorov’s Onexim holding) don’t disappoint, though. In a report issued on February 1, Rob Edwards and Andrew Jones concede how badly Olimpiada is going. “A poor year does little to lower our NAV [Net Asset Value]. However, sentiment needs to be reversed. The story is largely intact.” They are obliged, however, to divide this story into the good and the bad.

| On the positive side, the total of 1.39 million oz produced is up 10% on the 2009 total, “exceeding our forecast of 1.3mn oz, but in line with revised guidance of 1.4mn oz. Gold sales were 1.38mn oz. As a result, the preliminary gold revenues of $1.7bn were stronger than our $1.67bn forecast.” Then there is the Blagodatnoye mine, also in Krasnoyarsk, which “produced 249k oz in 2010, above our 210k oz forecast.”” This one wins Rencap’s golden shovel award. “Ten years after drilling began at the site, we think this is a considerable achievement that enhanced the mine-building credentials of Polyus. The project will produce 400k oz/year at peak…We reiterate that Blagodatnoye is an unqualified success. It is open pit and free milling.” |  |

The bad news is that if from the Polyus Gold aggregate are subtracted 110,000 oz mined last year by Kazakh Gold, the ill-fated acquisition target now being divested, Polyus Gold’s mines produced just 1% more in 2010 than they had the year before. And even that success has been costly.

Edwards and Jones concede that “costs were higher than forecast…Total cash costs, pre-G&A, rose to $550-570 in 2010 from $391/oz in 2009, according to initial guidance. This compares with $515/oz in 1H10, implying closer to $600/oz in 2H. Considering that grades and recoveries improved at Olimpiada, this is surprising to us. This lowers the 2010 EBITDA guidance to $710-730mn, below our $803mn estimate and Bloomberg consensus estimate of around $770-790mn.”

“We did not adequately forecast the full cost of ramping up Blagodatnoye, or the higher unit cost impact of ongoing operational difficulties at Olimpiada. We believe, however, that these higher costs will be transitory and will moderate as Blagodatnoye reaches its peak and recoveries continue to improve at Olimpiada. New production guidance for 2011 is 1.5mn oz, vs our forecast of 1.7mn oz+ This is a significant downgrade in expectations, mainly due to Olimpiada, where we reduced our production forecast by 144k oz due to ongoing problems at the mills. The plan to expand and modernise Kuranakh is also proceeding slower than

planned.”

All holes have their bottom, and all mines peter out. So for the foreseeable future “Olimpiada remains a concern,” the RenCap report acknowledges. Edwards and Jones are forecasting production there this year at 608,000 oz.

Then there is the famous reluctance of Prokhorov to spend money on the future. Again according to Renaissance Capital, “at $362mn, 2010 capex falls well short of previous guidance of around $600mn. Capex at Blagodatnoye was $116mn before maintenance, vs our forecast of $194mn, and a substantial part of the Olimpiada capex from 2010 has been postponed due to the delayed arrival of equipment on site. Hence, we move $30mn and $68mn from 2010 to 2011 at Olimpiada and Blagodatnoye, respectively.”

The most likely buyer for Polyus Gold is the Canadian miner, Kinross Gold Corporation. It knows how to detect a falling asset price when it sees one, especially one to which a Russian risk discount is already firmly attached.

Leave a Reply