By John Helmer, Moscow

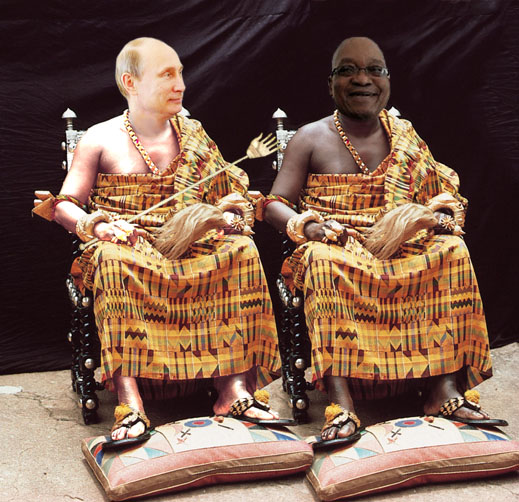

There has been no movement in Evraz’s proposed sale of its South African unit, Highveld Steel & Vanadium, to Nemascore, a special purpose vehicle created in February by a black empowerment enterprise linked to South Africa’s President Jacob Zuma (right). The deal for $320 million was announced by Evraz in March. At the time, the transaction was reportedly to be financed by Russian state bank VTB at a price which was more than double the market value of Evraz’s 85% stake in the company.

Subsequently, the Industrial Development Corporation (IDC), the SA Government’s business stakeholder, said it was not involved in providing VTB with repayment guarantees to facilitate financing for Nemascore’s purchase. Neamscore’s directors have refused to discuss the deal, say where the money is coming from, or explain it in light of Highveld’s lossmaking and other troubles last year.

The transaction was not mentioned when President Zuma met President Vladimir Putin (left) in Sochi on May 16. In their communique and press statements, the Russian priority in South Africa was evidently the sale of nuclear reactors by Rosatom, which recently opened an office in Johannesburg. According to Putin, “we see great potential for cooperation in nuclear energy. Russia is ready to provide assistance in creating a comprehensive nuclear energy industry in South Africa.” Putin also mentioned “we are planning joint production of a light multipurpose helicopter. A regional maintenance centre for Russian helicopters has launched operations in Johannesburg and talks are underway on supplying Russian passenger jets to South Africa.”

Asked to clarify what has happened to the steel asset sale, Tatyana Drachuk, spokesman for Evraz, says: “We can confirm that the status of the transaction has not been changed since our last announcement.” In its March announcement Evraz indicated the deadline for finalizing the sale to Nemascore is June 30.

On Monday Highveld issued unaudited results for the first quarter ending March 31, showing a significant recovery since the December quarter. Crude steel production rose 6% to 175,397 tonnes; rolled products volume was unchanged at 123,774t. Steel sales in the quarter jumped 21% to 135,512t. Despite a retreat in steel prices, Highveld reports a net profit of Rand50 million ($5.2m) for the quarter compared to a loss last quarter of R222m ($23.2m).

The improvement lifted the price of the free-floating 15% of Highveld shares on the Johannesburg Stock Exchange. Still, this morning’s market capitalization of the company is the equivalent of $154 million, making the Evraz stake worth just $131.1 million – 15% more than it was when the deal was announced, but still well short of the deal price.

David Gleason, the leading investigative reporter in South Africa, reports this morning in Business Day: “I remain convinced the purchase of Highveld is part of a much bigger arrangement which I am sure will extend to the BRICS’ Development Bank and through it to which specialist is selected to supply the next nuclear power station. The Russians, already building nuclear plants in Turkey, would love to give Areva and Westinghouse the finger in Africa, and South Africa’s a good place to start. There’s a you-scratch-my-back, I’ll-scratch-yours somewhere in this.”

Leave a Reply