By John Helmer, Moscow

Multibillion dollar contracts between GlencoreXstrata and United Company Rusal, signed for trading of aluminium and alumina late in 2011, appear to have unravelled in a London arbitration court. However, because the arbitration has been conducted behind closed doors, Glencore is refusing to confirm or deny that the company is facing liability for a retrospective veto of their six-year $47 billion undertaking.

Glencore’s spokesman, Charles Watenphul for media and Paul Smith for investor relations, will not acknowledge that a ruling by the London Court of International Arbitration [LCIA] has upheld a veto of its Rusal contracts by Victor Vekselberg, the former chairman of the Rusal board and by SUAL Partners, a combination of Vekselberg and Len Blavatnik which holds an 8.75% shareholding in Rusal. The two Glencore spokesmen are also refusing to confirm or deny fresh evidence that Glencore has already paid SUAL Partners $80 million as their share of claims before the LCIA partially settled in January.

A report citing “four sources close to the different [Rusal] shareholders” was published by Vedomosti in Moscow on Monday. EN+, a vehicle of Oleg Deripaska, is the nominal holder of 48.13% of Rusal shares; Deripaska is the chief executive. In addition to the EN+, SUAL and Glencore shareholdings, Onexim, the Moscow holding of Mikhail Prokhorov, has 17.02%. The newspaper report cites each of the four for confirmation of the LCIA judgement that agreements between the four shareholders of Rusal, before its public listing on the Hong Kong Stock Exchange in January 2010, assign each an unrestricted and binding veto over Rusal board decisions on related-party transactions.

Rusal notices to the Hong Kong exchange in 2011 report the particulars of electricity supply agreements between Rusal and related parties, and voting by shareholders to endorse them. Nothing comparable was disclosed at the time, nor a shareholder vote identified, in relation to the Glencore transactions.

Those are referred to in the annual report for 2011. There, Rusal says, “the Company also has long term supply contracts with Glencore for alumina and primary aluminium, and Glencore was the Group’s largest customer of alumina and primary aluminium in the financial year, accounting for approximately 30% of the Group’s sales of primary aluminium.” In money terms, that percentage amounted to $3.1 billion. The revenue analysis in the financial report for 2011 suggests the amount of related-party trading with Glencore added up to $4.1 billion for aluminium sales, plus $181 million for alumina sales.

The report acknowledged that Glencore was a related party. Veto rights of the founding shareholders were also acknowledged among “the principal terms of the Shareholders’ Agreement between Major Shareholders” (page 203). They included “an effective right of veto in relation to any related party transaction (or amendment to or renewal of an existing related party transaction).” (page 205). However, the report omitted to say how the related-party agreement for aluminium and alumina was decided. “The Group has full control of its assets and its businesses, and operates as a business group which is separate from and fully independent of Glencore”, Rusal claimed.

At the time the LCIA challenge was dismissed, however, as likely to have no “material adverse impact on [Rusal’s] operations.”

Yesterday Alexei Sadykov, spokesman for Deripaska, did not dispute the accuracy of the reported conclusion of the LCIA case; he said Deripaska is making “no comments”. Andrei Belyak, speaking for Prokhorov, said “we don’t comment at all.”

Vekselberg’s Renova holding has not responded. When Vekselberg (right) resigned from the Rusal board to commence the LCIA proceedings, he and Renova announced: “It is with great regret that I have to state that, due to the actions of its management, UC Rusal is presently facing a deep crisis, as a result of which UC Rusal has, in my opinion, deteriorated from an international aluminum leader into a company overburdened with debt and entangled in numerous lawsuits and social conflicts. As Chairman and director, I disagreed with a number of decisions in relation to the company’s strategic development, modernization of production and social and human resources policies, some of which were adopted by management without Board approval and in breach of shareholder agreements.”

Vekselberg’s Renova holding has not responded. When Vekselberg (right) resigned from the Rusal board to commence the LCIA proceedings, he and Renova announced: “It is with great regret that I have to state that, due to the actions of its management, UC Rusal is presently facing a deep crisis, as a result of which UC Rusal has, in my opinion, deteriorated from an international aluminum leader into a company overburdened with debt and entangled in numerous lawsuits and social conflicts. As Chairman and director, I disagreed with a number of decisions in relation to the company’s strategic development, modernization of production and social and human resources policies, some of which were adopted by management without Board approval and in breach of shareholder agreements.”

On January 16 Rusal issued a notice to the Hong Kong Stock Exchange. The company said it had agreed with SUAL Partners to “terms of settlement”. “Subject to fulfilment of certain conditions precedent, the Arbitrations will be discontinued as against the Company and SUAL has agreed to withdraw its claims for injunctive relief, rescission and damages in respect of the long term supply contracts which are the subject of the Arbitrations. The Company makes no admission in respect of the claims brought against it, nor has it undertaken any financial obligations under terms of the Settlement.”

Sources cited in this report claimed that the “conditions precedent” included significant compensation paid by Glencore. According to the Vedomosti report on Monday, the sum was $80 million. Vedomosti added that it could not verify who had paid the compensation – Deripaska’s EN+ or Glencore. EN+ refuses to clarify the point, saying that spokesman Andrei Petrushinin is “on business trip until next week.”

Glencore, which is listed on the London Stock Exchange, has filed no notice to the exchange on the LCIA outcome. Watenphul and Smith won’t say whether it creates new obligations, contractual, compensatory and financial, on Glencore’s part.

The $80 million payment to SUAL Partners appears to represent the proportion of total liability the LCIA has arbitrated which is equal to SUAL’s 15.75% stake in Rusal. This suggests a total liability from the Glencore-Rusal contracts of 2011 amounting to $508 million. That appears to be the sum of profit which Rusal shareholders have calculated they lost to Deripaska and Glasenberg (right) on account of the sweetheart terms Vekselberg tried to veto. With his 17.02% shareholding, Prokhorov – though not a party to the LCIA proceeding — may now have a claim against Deripaska and Glasenberg for almost $87 million. In January Prokhorov’s spokesman said he wasn’t commenting for the time being, but might do so “in due course”.

The $80 million payment to SUAL Partners appears to represent the proportion of total liability the LCIA has arbitrated which is equal to SUAL’s 15.75% stake in Rusal. This suggests a total liability from the Glencore-Rusal contracts of 2011 amounting to $508 million. That appears to be the sum of profit which Rusal shareholders have calculated they lost to Deripaska and Glasenberg (right) on account of the sweetheart terms Vekselberg tried to veto. With his 17.02% shareholding, Prokhorov – though not a party to the LCIA proceeding — may now have a claim against Deripaska and Glasenberg for almost $87 million. In January Prokhorov’s spokesman said he wasn’t commenting for the time being, but might do so “in due course”.

According to the Vedomosti report, the upshot of the LCIA ruling is that the four stakeholders must now renegotiate the terms of trade between Rusal and Glencore. In 2013 Rusal reported its sales of alumina to consumers outside the Rusal group came to $567 million. Sales of aluminium for the same period were $8.16 billion. Estimating that Glencore conducted not less than one-third, and more likely one-half of these sales, including metal held in concealed warehouse inventories, the new negotiation of Rusal’s terms of trade will affect future annual revenue of $9 billion or more.

What has this to do with Beijing — and Deripaska’s vulnerability to the market equivalent of being hung, drawn and quartered when President Vladimir Putin meets President Xi Jinping next month?

What has this to do with Beijing — and Deripaska’s vulnerability to the market equivalent of being hung, drawn and quartered when President Vladimir Putin meets President Xi Jinping next month?

The answer is that the Chinese Government appears to be behind the refusal of China Development Bank (CDB), one of Rusal’s international creditors, to accept terms of refinancing which Deripaska has offered the international banks; together, they hold at least $4 billion of Rusal’s accumulated liabilities of almost $14 billion. The demand on the Chinese side — hinted at by Rusal insiders, unconfirmed by CDB — is that either Rusal reduce its debt by selling its 27.82% shareholding in Norilsk Nickel; or else arrange with the Russian state banks and the control shareholders to buy out the debts owed to the foreign banks. For that story, click.

The option of selling the Norilsk Nickel stake (worth $7.94 billion at today’s market price) has also been documented on the Kremlin’s agenda. That’s because, as one Rusal insider says, “all the shareholders are for it, except only one [Deripaska], as usual. Nobody knows what’s going to happen. As before, the main problem is that it’s the wrong time to sell on the present low market, and there are hardly any serious buyers — unless [President Vladimir] Putin makes [Norilsk Nickel control shareholder Vladimir] Potanin buy at a surcharge against a state loan. The internal information is rather conflicting, so it’s hard to rely on somebody’s single opinion or nod.”

The last time Putin met with the Russian oligarchs was at a special session of the Russian Union of Industrialists and Entrepreneurs on March 20. Deripaska wasn’t present, according to his spokesman.

Regarding offshore-registered Rusal and other major Russian companies, Putin warned that “entrepreneurs need to understand their responsibility. Our priority stance is that Russian companies have to be registered here, in their home country and have a transparent ownership structure. I am certain that this is in your interests too. This is why we set the task of de-offshoring the national economy and are drafting necessary amendments to the regulatory framework. I believe that we will return to this subject today both in this broad group and in more private discussions after this meeting.”

Following the Crimean referendum on March 16 and the start of US sanctions against Russia, Putin’s call to “responsibility” carried special weight; especially since in the closed session Putin, his advisors, and the oligarchs discussed what the state banks are prepared to do to secure the liquidity and credit of Russian companies hit by US sanctions.

Days earlier, a letter from Putin’s economic advisor, Alexei Belousov, had been leaked to the Moscow press. Belousov had told Deputy Prime Minister Arkady Dvorkovich in February that one of the options for managing Rusal’s deteriorating position with its foreign and Russian bank lenders was to sell the Norilsk Nickel stake. The option was already obvious. The leak, and Belusov’s anger at the disclosure, revealed how sensitive the Rusal problem was for Putin himself.

The subsequent volatility in Rusal’s share price has reinforced discussion inside Rusal that Deripaska is preparing a debt for equity conversion, or that one is being prepared for him by the Kremlin and by the other control shareholders. Their power to determine Rusal board decisions has now been enhanced by the London court judgement. Still, unless the Kremlin agrees, they lack the power to compel Deripaska to accept the sale of the Norilsk Nickel stake.

On March 14, Rusal’s share price hit its low for the year at HK$2.25. Since then it has jumped by 51% — from a market capitalization equivalent to US$4.4 billion to a current market value of $6.7 billion.

SIX-MONTH SHARE PRICE TRAJECTORY FOR RUSAL

Source: http://www.bloomberg.com/

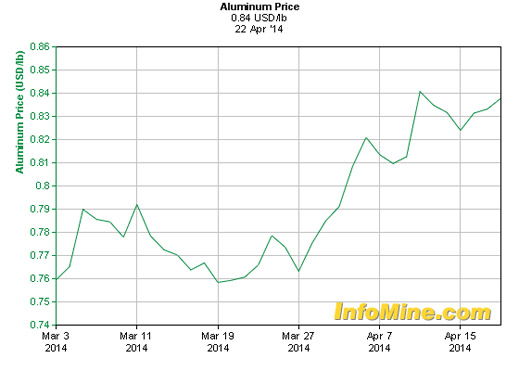

London and Hong Kong market sources say that neither the improving commodity price of aluminium, nor Rusal’s report of $3.3 billion in losses for 2013, nor the share-price gains of peers Alcoa and Aluminium Corporation of China can account for the extent of Rusal’s gain.

Insiders, the sources speculate, have reason to believe Rusal’s position is about to undergo a big change.

Leave a Reply