By John Helmer, Moscow

@bears_with

Barnacles are unambitious. Once they attach themselves to the keel they don’t think they can influence the direction or even the speed of the boat. They confine themselves to feeding and reproducing. Barnacles are good at that because their penises are closer to their mouths than is true of most journalists. In this respect, the arthropod is a dickhead.

Anglo-American reporters reporting on other journalists reporting on Russia lack the genital-in-mouth modesty of barnacles. But whether in the mainstream media or alternative media, they are stuck where they are and must feed on each other. Unlike barnacles, they think they control the battleship in its fight with Russia; this is how it pays for dickheads to think.

The advertising markets are ambitious, parasitic, and dickheaded in the same way. But it’s not the same way in the US as in Russia. The latest reports on advertising revenues in both markets reveal that if it hadn’t been for the US election campaigns in 2020, revenue spent trying to persuade the American people would have fallen by 17%; this counts only how-to-vote adspend, not how to think adspend. They are correlated because as traditional advertising revenues fall, so do jobs for journalists.

The other driver of US advertising revenue last year was the pandemic-related growth of Amazon belonging to Jeff Bezos; the more money he makes, the more losses he can afford on promoting war against Russia at the Washington Post. In general, Covid-19 helped increase mainstream newspaper readership — without adding to their revenues. But in the US market there is no reader revenue competition over war against Russia between the Washington Post and the New York Times, as the war against Spain once served the competition between William Randolph Hearst’s New York Journal and Joseph Pulitzer’s New York World. However, last year the combination of Covid-19 and war against Russia improved reader trust in the New York Times brand compared to the Bezos brand at the Post, which had been more trusted than the Times in 2019. The Times also increased its lead in the size of its online readership compared to the Post.

In Russia, according to the report from the Association of Communications Agencies of Russia (AKAR) released last week, the total spent on advertising in all media for 2020 came to Rb473 billion ($6.5 billion); that was 4% less than 2019. Traditional Russian journalism in newspapers suffered most – adspend in this market segment went down by 50%; radio advertising dropped by 30%; advertising on trains and buses, down by 38%; outdoor advertising, down by 27%. By contrast, advertising revenue spent on the internet grew by 4%; on videos, up by 5%.

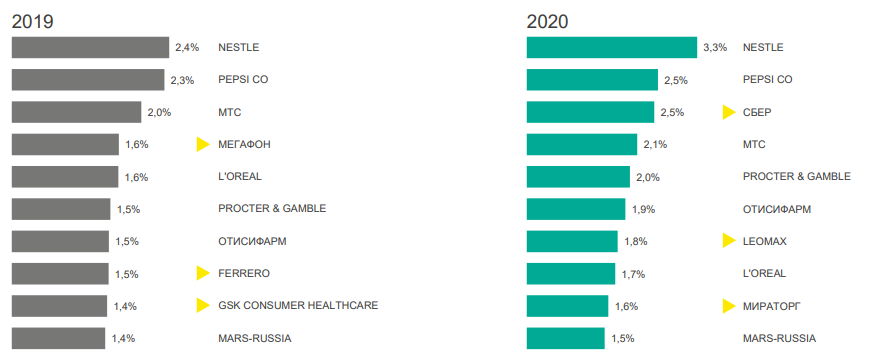

By contrast also, the pressure on Russians from the Covid-19 restrictions triggered the biggest gain in advertising expenditure from the state savings bank Sberbank. Next in percentage gain in the Russian market came Leomax, a television retailer, and Miratorg, a producer and distributor of meat products. Political advertising was negligible in the Russian market; the next parliamentary election isn’t due until September 2021; the next presidential election until March 2024.

AKAR reports that the Russian advertising trend was “a fairly good result, given that the average drop in the global advertising market was about 7.5%, and many leading foreign markets declined by 10% to 15%, and even 20%.”

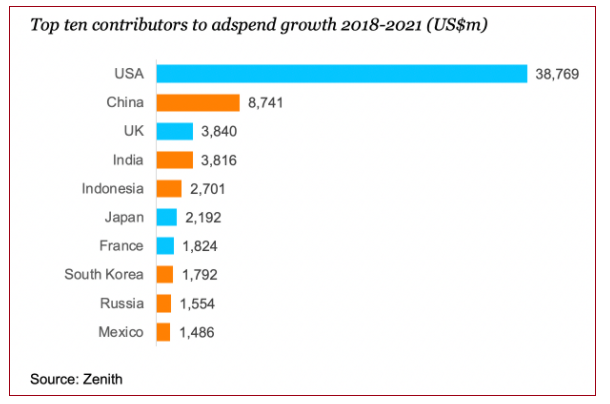

Source: https://www.campaignasia.com/

Country totals for advertising expenditure differ significantly between the main data sources, but the relative positions of the countries to each other and to the global aggregate are the same between sources.

According to Sergei Veselov, AKAR’s vice president and head of its research and audit committee, “the Covid crisis was largely man-made and administrative in nature, so it began to manifest itself due to the administrative prohibitions – to sit at home, not to drive cars, to ban restaurants and entertainment events, to sharply restrict trade, to work remotely, etc. This had a very direct impact on the state of the economy and on the income of the population, which significantly reduced the advertising activity of companies. At the same time, the lifting of the pandemic restrictions in the summer did not automatically revive the economy and serious efforts have had to be made to revive it.”

“The Russian advertising market went through a difficult Covid year much better than the vast majority of foreign advertising markets: with the global advertising market falling, according to Zenith, by 7.5%, the Russian market declined by only 4%. At the same time, the markets of Western Europe lost on average about 12% of advertising budgets; India, Brazil and Mexico, 10%-17%, Japan, 8%.”

For the Zenith report, click to read.

“The various categories of advertised goods and services,” explained Veselov, “both under the influence of specific industry restrictions and due to the decline in consumer activity of the population, suffered in different degrees during this crisis. More than others, companies operating in the entertainment and tourism industries, in the markets of passenger cars, mobile phones, cosmetics and perfumes, and traditional retail trade decreased their activity in the advertising market. At the same time, by contrast, certain segments in the crisis increased their advertising and marketing budgets – these include primarily online commerce, various internet services, hygiene products, pharmaceuticals, and food.”

“In all the previous crises there were no radical changes in the media preferences of the audience. But this time, in the middle of the crisis, there was a serious redistribution of the audience and, as a result, advertising budgets between media segments. Quite understandably, the audience figures for television and the internet increased, as people were forced to stay at home. But in all other segments, there was a decrease. The press suffered greatly because the number of outlets where newspapers and magazines were sold decreased significantly due to the pandemic restrictions. In actuality, two-thirds of the radio audience listen in the car, but with the restriction of automobile movement, the audience also fell significantly. Traffic in outdoor advertising in some months decreased by 3-4 times.”

“All segments of the advertising market were affected during the pandemic, but to varying degrees. The internet in the Russian market reduced advertising budgets; in the second quarter they fell by 11%. But at the end of the year internet advertising spend still came out in the positive zone. Television has relatively successfully overcome the crisis year and for the first time since 2009 increased its share in the advertising market, showing a 5% growth in the last quarter of 2020.”

“The advertising budgets of outdoor advertising, radio and the press were reduced by two to three times in some months, but by the end of the year the situation gradually began to improve. At the same time, the total share of radio, press and outdoor advertising in the Russian advertising market contracted by almost one and a half times – from 15.2% to 10.8%.”

“The quarterly dynamics of the Russian advertising market for the year give some hope that in the future the situation will improve. In the second quarter of 2020, the Russian advertising market has fallen by 23%; in the third quarter its dynamics reached the level of minus 4%; and in the last quarter of the year, due to television and the internet, the domestic advertising market showed growth of plus 4%.”

RUSSIA’S TOP-10 ADVERTISERS IN 2020

(As percentage of total advertising expenditure, excluding the internet)

Advertisers which have moved into the top-10 but were not there in the year earlier are highlighted. Source: https://www.akarussia.ru/

For the broad picture of how US newspaper advertising has been changing over the past 20 years, click to read.

For the failure of the Bezos Post to make gains against the New York Times, and also against Rupert Murdoch’s Wall Street Journal and Fox News online, click on the annual digital news reports of the Reuters Institute for the Study of Journalism – 2019, 2020. These reports are also paid for by George Soros, Google, and the Dutch government’s Commissariaat voor de media.

By the way, there is no evidence that the non-advertising based alternative media, marketing platforms like Substack and medium.com, and special topic aggregators have managed to make a dent in reader numbers or trust in the Times and Post. Instead, they are consolidating non-paying minority audiences into paying ones, and multiplying earnings for a handful of reporters; for them, war against Russia is not much of an earner one way or the other. As usual, war against Russia pays reporters better if they are employed – the trade term is embedded – in info-warfare units like think-tanks, universities, intelligence agencies, or armies.

Leave a Reply