by John Helmer, Moscow

@bears_with

It has never happened before among the world’s diamond-producing and diamond-processing countries.

Meeting together last month in Zimbabwe in what is called the Kimberley Process (KP), the 57-member states refused to agree to the US and European Union (EU) attempt to exclude Russia, producer of half the diamonds in global trade. To camouflage the outcome of the fight, the KP delegates decided not to issue a communiqué. Without that, the rules of the meeting nullified all points of agreement which the Kimberley Process states had accepted during their two-day sessions.

This dramatic collapse of the Kimberley Process happened in Harare on November 10. The disagreement and deadlock came over a letter from the Kiev regime, backed by the US, the EU, Japan, and Canada (the G7 member states) to impose a full ban on the trade in Russian diamonds. The Ukrainian attempt was backed by intense pressure from the US State Department and by Jewish diamantaires in New York for the international diamond trade to accept the US Diamond Protocol, a scheme of registration, inspection, auditing, and certification enforced by US intelligence and Treasury agents, to prevent any Russian-mined diamond from entering the international diamond jewellery market.

Instead, what has happened is that the global diamond industry has been cracked in half by the sanctions war. The defeat of the so-called “western bloc” in Zimbabwe is big news in Africa and India. It has not been reported in the New York and London financial press.

Diamonds are now likely to follow oil, gas, coal, gold, and other commodities into parallel and competing global market operations. In the diamond war, however, the outcome is also going to backfire on the Israeli diamond industry and the traditional Jewish centres in Antwerp, Belgium, and New York City, which have combined to take sides against Russia. In time, they will be replaced by the Arabs, Indians, and perhaps the Chinese.

The Israelis don’t think so. They are calculating that in the short run they will gain from the recovery of diamond prices when the shortage of Russian supplies hits much harder than it has to date. A source in Antwerp reports “absolutely no backlash [against the Gaza war] here from any of the five main diamond communities including the Lebanese. The Israeli industry has been declining for many years anyway, especially manufacturing – it’s uncompetitive with the Indians — but also trading. There is no diamantaire sympathy with any Arab country (or Iran). I hope and believe business rises above the political nonsense.”

The Kimberley Process, first created in 2003 to stop “blood diamonds” from entering the market from the genocidal wars of western Africa, is about to be confronted by blood diamonds from Israel.

The story of the US attempt to start sanctions against Russian diamonds from the US and its allies began here when the Belgian government was resisting to save the multi-billion dollar Antwerp diamond business.

Source: https://johnhelmer.net/.

Belgium, which has taken part in most NATO schemes against Russia, including the fabricated MH17 trial and the engagement of Belgian judges in European Court cases against Russia, has tried to protect its multi-billion dollar stake in the diamond industry since the first sanctions scheme was debated n 2015

The most detailed account of the defeat of the US diamond sanctions at the Kimberley Process (KP) meeting in Harare last month can be followed here. This puts the diamond industry, particularly the diamond miners, at loggerheads with the US and NATO governments, with the US-dominated jewellery business, and with the processing and marketing roles played by the Arabs in Dubai, Indians in Mumbai, and Chinese in Shanghai.

The US and the EU have followed with a defiant announcement yesterday, December 6. They are proceeding, they say, with their scheme of “staged embargoes… The G7, whose leaders were set to meet virtually on Wednesday, will agree to ban imports of non-industrial diamonds from Russia starting on January 1 2024. A ban on the stones processed in third countries will also be introduced from March 1 and a full traceability system for rough diamonds traded in G7 nations from September 1, according to people briefed on the contents of a draft joint statement. [The G7] will continue consultations . . . with other partners including [diamond] producing countries as well as manufacturing countries [to implement the traceability measures]”, according to the Financial Times.

The newspaper, owned by Japan and directed by an Arab editor, editorialised in favour of the new attempt. “The diamond ban is a welcome sign of support from western allies as Ukraine has recently become increasingly anguished by the failure of the EU and the US to commit to long-term financial and military support and as its counteroffensive against Russian troops has largely failed to make significant gains on the ground.” The US and Israel claim that Hezbollah has been using the diamond trade to finance its military operations.

“To further the effectiveness of these measures, those G7 members who are major importers of rough diamonds will establish a robust traceability-based verification and certification mechanism for rough diamonds within the G7 by September 1, 2024, and we will continue to consult with partners, including producing and manufacturing countries on its design and implementation. We will continue consultations among G7 members and with other partners including producing countries as well as manufacturing countries for comprehensive controls for diamonds produced and processed in third countries on measures for traceability.”

The African diamond producers – representing all the continent’s diamond production states – led the attack on the Europeans in the battle over Russian diamond sanctions. The recent KP plenary “became hostage to the desire of an aggressive minority to politicize the meeting’s agenda and include geopolitical issues that go beyond the KP mandate,” the African Diamond Producers Association (ADPA) announced it a statement. The African diamond producers account for 51% of global diamond output by weight, 66% by value.

The Indians at the KP meeting remained “neutral, waiting to see who would win”, according to one source.

Ironically, the Russian Finance Ministry representatives said in Zimbabwe, if the sanctions plan is adopted, what will happen next year is that there will be a shortage of genuine diamonds so synthetic diamonds will flood into the market, destroying the market pricing of diamonds for the long term. “This shows how high the tensions are in the diamond industry at the moment,” commented Rapnet, the Israeli-American diamond source run by Martin Rapaport.

The defeat by the African alliance with Russia has struck directly at Rapaport and his US and Israeli government prompters. Rapaport has personally called for tightening the sanctions against Russian diamonds in an open letter to the EU on November 16: “The Rapaport Group supports the implementation of effective restrictive measures in order to reduce the revenues that Russia extracts from the export of diamonds.”

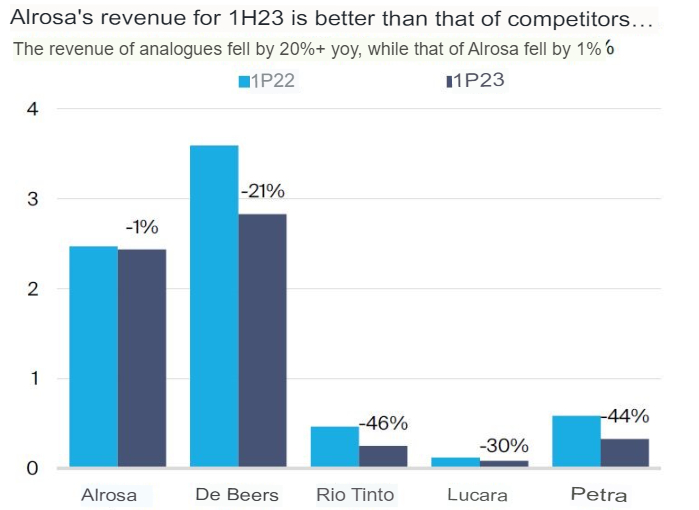

Rapaport is backing the new sanctions regime to close the “loophole [which] allows for the continued flow of Russian rough diamonds to India, where they are polished and exported to the US as ‘Indian origin’ polished diamonds. Money moves unimpaired from the US to India and then on to Russia. The net result is that there is no reduction in revenue to Russia. In fact, Alrosa’s revenue for H1 2023 was the same $1.9 billion as H1 2022.”

Rapaport has also been backing greater US government intervention in the diamond trade to stop the “whitewashing system, whereby self-interested international trade organisations replace the role of government regulatory agencies charged with the enforcement of sanctions against Russian diamonds… The numerous conflicts of interest render the WDC [World Diamond Council]protocol’s auditing system unacceptable.”

Rapaport has his own interest in cutting the Russian diamond supply and increasing US dominance of the global trade. “There is no doubt”, according to an independent North American diamantiare, “that the diamond market would be weaker if more Russian goods had been exported, and that benefits everyone, including Martin Rapaport. In the last few weeks, the markets do seem to have bottomed out and are rising again a little. But the lack of Russian material is only responsible for a small part of that uptick – seasonal factors, De Beers cutting right back, the voluntary import restrictions which the Indians have adopted, etc., are all playing a bigger role.”

“Next year will be a different story”, African miners and Dubai diamond market sources believe. If the diamond market cracks in half, as the oil market has done, the value of market price-setters like Rapaport’s Rapnet will be erased. No one in the trade is ready to predict with confidence what the alternative diamond trade will look like, and what impact it will have on diamond pricing.

The Rapaport assessment is that the market crisis caused by the over-supply of mined rough and synthetics, and weak consumer demand in China, Europe and the US cannot get much worse.

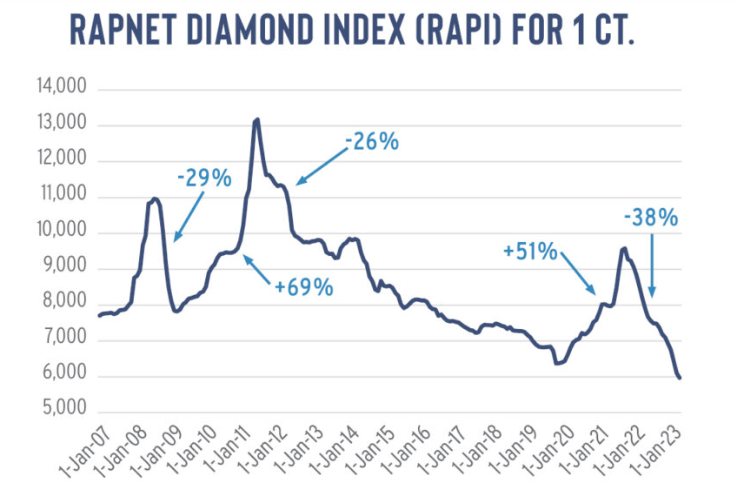

The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet. Source: https://rapaport.com/

“Polished prices have seen their sharpest drop in recent memory. The RapNet Diamond Index (RAPI) fell 38% from April 2022 to November 1, after sharp increases recorded in the post-pandemic years of 2021 and 2022. Twice before in the past decade and a half has the RAPI index seen a similar diamond industry pattern. Pre-2008, the market was on a strong upward trajectory before the financial crisis. When the markets crashed the 1-carat RAPI fell 29% from its peak in August 2008 to its bottom in April 2009. The retail expansion in China then drove a recovery, fueling prices to rise sharply until mid-2011. The index subsequently slumped 26% between July 2011 and December 2012, with the decline continuing at a more gradual pace until the pandemic hit and the market froze in 2020. The diamond industry recovered from the Covid-19 crisis, with the 1-carat RAPI rallying 51% between April 2020 and April 2022, before its subsequent downtrend. Based on those metrics, the current slide is worse than 2008 and the initial slump of 2011.”

The solution, according to Rapaport, is war against Russia. “Regulatory and compliance requirements have become even more important and broader in scope. These now include considerations relating to sustainability, which encompasses environmental, social and governance (ESG) concerns. Additional source-verification requirements are being considered by the Group of Seven (G7) nations in response to Russia’s war in Ukraine… But as the industry finds its supply-demand balance in the current fourth quarter, it has an opportunity at least to address the inefficiencies that have plagued the market in the past 15 years. Keeping supply in check will empower the industry to focus on the more important task of stimulating demand and inspiring a sustainable recovery in the long term.”

In Russia, concern about the impact of the new sanctions is being expressed by the officials and the press in the eastern Siberian republic of Sakha (Yakutia) where the Russian state diamond miner Alrosa [acronym from the Russian for “Diamonds of Russia”] is based, and where most of Russia’s diamonds are mined. More than 40% of the republic’s budget revenues come from Alrosa’s operations. In addition, Alrosa has transferred one billion rubles to the Trust Fund for Future Generations of Yakutia to finance social and infrastructure projects.

Alrosa is also the main employer in the western regions of the republic. The company employs related enterprises, river and road transport, builders, and entrepreneurs. And as a city-forming enterprise, Alrosa is the foundation and driver of the public sector. “Any failure, therefore, in the work of such a company will bring huge problems for the budget of the republic, which cannot be estimated only in money,”, a source has warned in the region media platform, Yakutia.info.

For the archive on Alrosa and the Russian diamond sector since 2001, click to read.

Top, left, President of Sakha Republic since 2018, Aisen Nikolayev; right, CEO of Alroa, Pavel Marynichev, appointed in May 2023, succeeding Sergei Ivanov, who has been on US and NATO sanctions lists since February 2022.

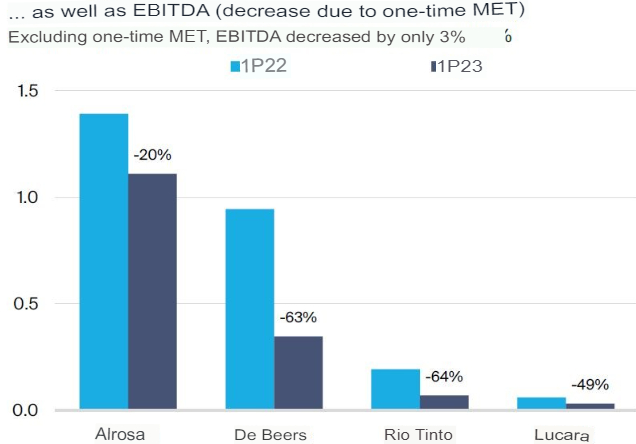

Alrosa’s financial report for the first half of 2023 indicates its sales have been holding firm, although profit and earnings (Ebitda) have been suffering from the global diamond market recession, in common with other international diamond miners. The company’s revenue in the six months to June 30, 2023, amounted to Rb188.2 billion compared to Rb188.9 billion in the same period of 2022, and Rb182 billion in the first half of 2021. Ebitda (earnings before interest, taxes, depreciation, and amortisation) also remained virtually unchanged from last year.

As the two following charts show, the decline in Alrosa’s financial position has been relatively smaller than for its international peers. One reason for this is that Alsoa has been transferring diamonds it cannot sell abroad in the export market to the Russian state stockpile, Gokhran, and increasing its own unsold reserves of stones.

Source: BKS Mir in https://rough-polished.expert/

Lucara Diamond is a diamond mining company established in Canada, listed on several stock exchanges, and operating in Botswana. Petra Diamonds is a London-listed diamond miner working in South Africa and Tanzania.

The published estimate of the company’s diamond reserves has increased by more than 7.5 times in a year and a half, from Rb6.12 billion in estimated value to Rb46.8 billion rubles, although it has decreased by 11% since the beginning of 2023.

Experts quoted in Sakha media are anticipating a fall in Alrosa’s sales revenues to follow the new sanctions next year. “Sanctions will complicate sales, workarounds will be found, but this will still reduce revenue. And the costs will grow. Potentially, the budget revenues may be reduced by 20-30 billion rubles because of this. This is a lot,” a source told Yakutia.info late last month.

This republic publication also reports a negative outlook for the region from another source. “The accounts payable are growing, which is transferred by the chain to energy companies, gas companies and further. These same companies are now in a difficult situation with a sharp increase in bank interest on loans, and it is also not possible to shift additional costs by increasing tariffs for consumers. A vicious cycle. By April-May of next year, the republic will face a shortage of funds. It will become difficult to fulfill budget obligations…In the future, the reduction of production in the diamond industry and the maintenance cost of some of the most capital-intensive, costly facilities, will lead to an outflow of the population from western Yakutia, so unemployment and discontent of the population will increase – everything is very bleak, the expert concludes.” The timing of this publication should be understood as the presidential re-election gets under way.

Russian financial analysts covering Alrosa are more optimistic. “The company’s financial indicators for the first half of 2023 were better than the analysts’ forecasts. A strong cash position and negative net debt allow the company to share profits with shareholders for the first time since the autumn of 2021. The interim dividends recommended by the Supervisory Board for the first half of 2023 turned out to be conservative, but this is not a bad option if we take into account that the vast majority of Russian representatives of the metals and mining sector, including companies not affected by sanctions, have refused to pay any dividends.”

“Alrosa is too large a supplier of diamonds on the world market to be excluded from it, Boris Krasnozhenov from Alfa Bank believes. “ ‘The company will find ways to optimise the financial component, as well as sales logistics,’ he believes, recalling the underlying positive conditions. ‘The market is on track to face a shortage of rough diamonds in the medium term, as demand is growing and the largest deposits around the world are being depleted. Industry sources predict a 25% drop in rough diamond production by the end of the decade,’ Krasnozhenov told the Russian industry bible, Rough-Polished.Expert.ru.

Russian diamond expert Sergei Goryainov warns that Rapaport and the Israelis are miscalculating if they expect the new sanctions to raise diamond prices and their profits to grow. The reverse will happen, according to Goryainov. “Due to sanctions on the largest producer, 30% of the diamond market is going to enter the ‘gray zone’. You can also figure that Alrosa will be forced to dump, because only by introducing dumping prices can you compensate for the risks which customers who cooperate with a company listed in the SDN-list fall under.”

Other Moscow sources agree that dumping will be a Russian tactic for the very short term, as it has been in the Russian oil export trade. In that case, the discounts have gradually dwindled as the ineffectiveness of the sanctions became obvious and demand has pushed the commodity price upward. The Moscow sources add they expect a combination of state support for Alrosa, the Gokhran stocking mechanism, new trade logistic arrangements, and secret deals with the UAE, India and China will take the Americans and the Israelis by surprise.

For the time being, no one in Moscow, Dubai, or in the African capitals wants to say what the impact on the diamond business will be as the US-Israeli war against Palestine becomes a protracted military failure against Hamas and an obvious genocide against the Palestinians. For the time being, a source close to the Jewish diamantaires in Tel Aviv, Antwerp and New York is confident. “There is no likelihood of a campaign happening to drive the Israelis out [of the diamond business], in my view. Who would start such a campaign and why?”

Leave a Reply