By John Helmer, Moscow

Gold reserves are handy in wartime, especially when your enemies are the United States Government and the US dollar banking system operating worldwide.

So, since the war to overthrow President Vladimir Putin began in 2014, the Central Bank of Russia has accelerated its purchases of gold bullion by more than double, becoming the largest gold buyer among the world’s central banks, and the holder of the sixth largest gold reserve. Roughly half the volume of this gold has been bought by the Central Bank from Russian goldmines.

Putin has also decided to start digging out Sukhoi Log, in Irkutsk region. That’s the largest unmined gold deposit in Russia, and one of the biggest proven reserves of mineable gold in the world.

For the past quarter of a century, the Kremlin has been unwilling to decide who, if anybody, will be permitted to mine Sukhoi Log. That decision was finally made last week, when Prime Minister Dmitry Medvedev confirmed the award of the licence to mine Sukhoi Log to a special purpose company formed by Russian Technologies (Rostec, Ростех, RT) and Polyus Gold. Together, they are paying Rb9.406 billion (about $162 million) for the licence. “According to the Governmental order affirming the results of the auction, SL Gold Limited Liability Company…, a company established by JSC Polyus and LLC RT Business Development [Rostec], will be granted the right to develop Sukhoi Log for the exploration works and extraction of gold and silver…Subject to obtaining the license, the Company intends to conduct additional exploration works and a feasibility study, which is expected to last for approximately three to four years, supported by international mining and engineering consultants. Based on the results of that study, the Company will evaluate options to initiate construction activities at the Sukhoi Log.”

What this means is that Rostec and Polyus Gold are promising to take up to four years to re-read the mountain of geological, metallurgical and engineering studies, reports and plans compiled on Sukhoi Log for 25 years by every major Russian and international mine consultancy, including the leading goldminers of Canada, Australia, South Africa, and the UK. Then, when the re-reading is done, Rostec and Polyus Gold aren’t promising to produce any gold at all. On this undertaking, they have borrowed state bank cash in order to pay the state budget a licence fee. This looks like a privatization, but it is a phantom.

Rostec is a state conglomerate run by Sergei Chemezov (lead image, right), whose mining units operate the titanium mining and refining group known as VSMPO , and a platinum mining project in Zimbabwe. Rostec has also promised to buy a share in the Udokan copper mining project in Irkutsk, but decided against doing so, and persuaded the Kremlin to postpone the project altogether.

Polyus Gold is a private shareholding company controlled by Suleiman Kerimov (lead image, centre), whose son Said – out of short pants but still a student – and daughter Gulnara (right), sit on the board, along with two veteran employees of Kerimov’s Nafta Moskva asset holding; plus a former Moscow bank analyst who covered Polyus Gold when it was listed on the London Stock Exchange and other Kerimov transactions.

whose son Said – out of short pants but still a student – and daughter Gulnara (right), sit on the board, along with two veteran employees of Kerimov’s Nafta Moskva asset holding; plus a former Moscow bank analyst who covered Polyus Gold when it was listed on the London Stock Exchange and other Kerimov transactions.

The record Kerimov has made in mining is one of short-term profit-taking above ground and highly leveraged wagering inside the stock markets, with capital spending plans either cut or postponed. VSMPO remains the titanium producer it was in Soviet days. The dominant mine in the Polyus Gold portfolio is Olimpiada, in Krasnoyarsk, which was built long before Kerimov came along; Olimpiada provides roughly three out of every four bars of gold the company produces. Before Chemezov and Kerimov combined, most of the Russian oligarchs have attempted to bid for Sukhoi Log, adding a state bank or state company like Rostec or Alrosa, the diamond miner, for lobbying clout. They include Vladimir Potanin (Norilsk Nickel), Mikhail Prokhorov (Polyus Gold), Roman Abramovich (Highland Gold), Alexei Mordashov (Nordgold), Alexander Nesis (Polymetal), Oleg Deripaska (Base Element), and Victor Vekselberg (Renova).

THE TOP-20 RUSSIAN GOLDMINERS

Source: Ernst & Young, http://investinrussia.com/data/files/sectors/0_EY-gold-mining-industry-in-russia.pdf

Just as Chemezov has failed to deliver on his promise of Udokan copper, Kerimov has failed to deliver on promised gold from mines at Natalka in Magadan region, and Nezhdaninskoye in Yakutia. In his last financial report, Kerimov’s board revealed the company is so heavily indebted at $4.9 billion (net $3.24 billion), and the price of gold so uncertain, the board can’t predict for how long it will stay solvent. “In the event of certain reasonably possible adverse pricing and forex scenarios and the risks and uncertainties below”, conceded the company’s last financial report, signed by Deloitte & Touche, and issued on November 7, “management has within its control the option of deferring uncommitted capital expenditure, or managing the dividend payment profile to maintain the Group’s funding position. Having examined all the scenarios, the Directors concluded that no covenants will be breached in any of these adverse pricing scenarios for at least the next 12 months from the date of signing the condensed consolidated interim financial statements. Accordingly, the Board is satisfied that the Group’s forecasts and projections, having taken into account reasonably possible changes in trading performance, show that the Group has adequate resources to continue in operational existence for at least the next 12 months.”

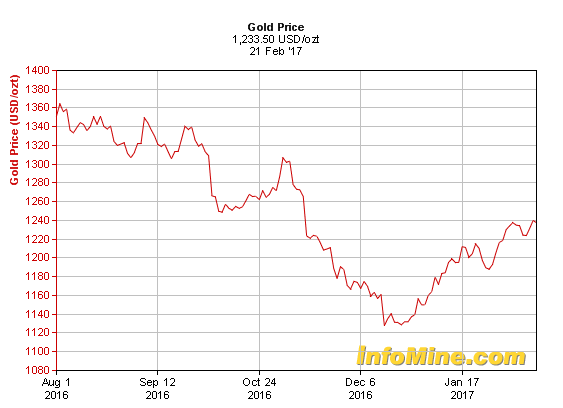

SIX-MONTH TRAJECTORY OF THE GOLD PRICE

How is it possible for Rostec and Polyus Gold, Chemezov and Kerimov, to undertake capital spending of $1.5 billion – the minimum required according to the feasibility studies to date — to bring Sukhoi Log into production? The short answer, acknowledged by miners and mining analysts speaking anonymously in Moscow, is that they can’t. What requirement then has Rosnedra, the federal government’s mine licensing agency, imposed on Rostec and Polyus Gold for investing in Sukhoi Log; what is the required date for first gold production; and when must the mine be ready to operate at full capacity? Short answer: no requirement at all.

The licence award announcement reports the gold reserves of Sukhoi Log, according to the State Commission on Mineral Reserves, come to 63 million troy ounces. Unofficial mine consultancy estimates put the reserves figure at more than 90 million oz. Polyus Gold calculates that at the moment, without Sukhoi Log, the proven reserves of its mines and alluvial operations total 46 million oz, with another 58 million oz “measured and indicated”.

Rosnedra refused this week to clarify the terms of investment and the schedule and targets of gold production in the licensing agreement for Sukhoi Log. The Irkutsk regional administration said on Tuesday it has not been informed yet by Rosnedra what the terms of the licensing agreement are.

IRKUTSK REGION ON THE MAP OF RUSSIA; BODAYBO IN IRKUTSK

The history of Sukhoi Log is so long and well-recorded, the failure of Rosnedra to come up with answers this month can be contrasted to the terms agreed by Rosnedra in 2004. Then, among the announced conditions of the proposed auction for Sukhoi Log, I reported that the winner would be obliged within four years to produce not less than 10 metric tonnes (320,151 oz) of gold, and in three further years to ramp production up to 25 tonnes per annum (804,000 oz).

Five years later, in 2009, the Central Geological Research Institute for Nonferrous and Precious Metals (TsNIGRI) in Moscow, the research branch of Rosnedra, reported that in the fourth year of the mine, gold production should be about 225,000 oz. At full capacity another four years later, TsNIGRI’s production estimate was 1.3 million oz annually.

TsNIGRI first started its research on Sukhoi Log with Polyus Gold in 2006. The current management of Polyus Gold doesn’t need another four years to read the TsNIGRI studies. It simply picks them up from its own basement, and from the archives of its subsidiary Lenzoloto. “In four weeks, not four years,” claims a Russian goldmining analyst, “it will have all the information required for re-calculating the costs and other financial parameters of the project.”

The reason for the difference between the technical reports and mine feasibility studies is that the gold is distributed under the surface in such a way that, depending on the availability of cash, bank credit, and the sale price of gold, the mine licence holder could opt to dig one very large open pit, or several smaller pits. The very first licence holder for Sukhoi Log, Star Mining of Australia, with financing from Standard Bank of South Africa, and a licence signed by then-acting prime minister Yegor Gaidar, proposed a mine plan concentrating the initial pit excavation at the site of the highest-grade ore, and using the initial gold sale proceeds to move across the vast tract of the deposit to the lower-grade ore bodies, keeping the costs down. One of the biggest up-front costs, however, remained the infrastructure of power and roads, which the site at Bodaybo, north of Lake Baikal, lacks. For details of the Sukhoi Log story from the beginning, in 1993, start here. For Star Mining’s study of the core and peripheral gold deposits at Sukhoi Log, published by geologist Bryce Wood in 2006, click to open.

Left: Bryce Wood with Ian MacNee, Star Mining’s control shareholder, in Bodaybo in 1992; right, Gaidar in Moscow, 1992.

The publication appeared almost a decade after Gaidar’s licence had been cancelled, and Star Mining eliminated by its Russian partner Lenzoloto – then a state entity — and driven into bankruptcy. The prime mover of that operation was Boris Yatskevich, the Moscow official in charge of mine licensing and also a board director of Lenzoloto, until he was sacked in the first months of Putin’s first term. Yatskevich’s role was reported here.

Chemezov and Kerimov aren’t saying whether they have already agreed with the federal government on state financing for the infrastructure costs of the Sukhoi Log project. Russian mining sources believe the reason for their reticence, and also for the omission of investment and production obligations in the Rosnedra agreement, is that there is no confidence there will be enough federal funds for this – at least not within the next four years.

Kerimov is a senator representing his natal region of Dagestan in the Federation Council. He doesn’t speak as a senator. Also, he doesn’t respond to questions about his business. His shareholding of Polyus Gold is entrusted to family nominees and trusts so as to comply with Russian law. Kerimov’s record for trust operations can be followed here.

Polyus Gold management was asked to clarify whether, when the company made the down payment in December of Rb8.5 billion for the Sukhoi Log licence, the sum was paid out of the company’s free cash, or was it drawn from available Sberbank credit lines? How much of the total did Polyus pay, how much Rostec? And what investment obligations, production schedule, and gold output targets are set down in the licence agreement?

The company said the only reply it can give is the press release and “nothing more”. In January, the company told the Financial Times slightly more. “Polyus hopes to produce 2.7m ounces of gold by 2020 from 1.97m ounces produced in 2016. That will generate enough free cash flow to spend on developing Sukhoi Log, the company has said.” In 2016 Polyus Gold reports it produced 1.97 million oz of gold. It also reported that the 2.7 million oz target in four years’ time entirely depends on whether enough investment is spent to bring the Natalka mine on line. According to last month’s operations report, “the Company anticipates the commissioning of Natalka by the end of 2017.” Even if this new mine materializes and adds a production increment of 730,000 oz per annum by 2020, that would be worth only $892 million, at the current gold price. Then, too, the company will be facing a peak in debt repayments of almost $4.8 billion between 2019 and 2023.

Russian mining analysts are sceptical of the promise of Natalka. “Natalka has been a disaster in many people’s view,” says one. “Refractory ore, poor geology, low grade, difficult to mine, Soviet reserves reduced by 50-60% — that’s another story! Polyus may need Sukhoi Log to keep its reserve numbers up.”

Rostec has lobbied hard for several years to have itself ruled into the contest for Sukhoi Log – and to make sure there was no contest at all. In the process Chemezov discussed partnering with several of the commercial goldminers to act as mine builders and operators. Most were uninterested, although when asked this week they are reluctant to say why. The Rostec executive in charge of the Sukhoi Log project has been Andrei Korobov.

In December 2015, Korobov (right) was talkative. He told Bloomberg: “we will tender for Sukhoi Log alone. We’ll make a proposal to a wide range of gold-mining companies to swap this asset for a stake in a large producer on market terms.” But Korobov didn’t mean alone, at least not operationally, and probably not financially either. Several years earlier Chemezov had agreed with Igor Sechin, then the deputy prime minister in charge of mining and metals, to establish a special purpose vehicle for mining Sukhoi Log with Lenzoloto, standing operationally outside Polyus Gold.

We’ll make a proposal to a wide range of gold-mining companies to swap this asset for a stake in a large producer on market terms.” But Korobov didn’t mean alone, at least not operationally, and probably not financially either. Several years earlier Chemezov had agreed with Igor Sechin, then the deputy prime minister in charge of mining and metals, to establish a special purpose vehicle for mining Sukhoi Log with Lenzoloto, standing operationally outside Polyus Gold.

By the time last month when Polyus Gold announced it had won Sukhoi Log with Rostec, it was clear Korobov and Chemezov had accepted a junior role in the project, and a minority shareholding in the project company, SL Gold. Polyus Gold, the company announced, “will be responsible in SL Gold for developing and operating the Sukhoi Log deposit, as well as procuring funding for the development of the Sukhoi Log project.”

In shareholding, Polyus Gold has started with 51% of SL Gold; Rostec, 49%. But Polyus controls the appointment of the chief executive, and occupies three of the four seats on the SL board. This means that Chemezov and Kerimov agreed some time ago that Rostec would sell down to just 25%. According to the Polyus Gold announcement, “JSC Polyus expects to acquire an additional 23.9 per cent stake in SL Gold from RT [Rostec] following the obtaining of the license for a total consideration of approximately USD 141 million , paid in instalments over the next 5 years (with the right to accelerate the acquisition process).”

Korobov was asked this week to clarify how much of the Rb9.4 billion licensing fee has been paid by Rostec. He was also asked what obligations the licensing agreement imposes for investments in the mine, gold production targets, and the schedule of mine performance. He replied through a spokesman with a copy of the same press language released by Polyus Gold. Chemezov is quoted in the release as claiming the project will “strengthen the corporation’s positions in mining equipment markets… The Polyus company, which has extensive experience in the industry, will be our strategic and technological partner in the deposit development.” Korobov refuses to give more details.

According to one Russian mining source, “the cost of the development of Sukhoi Log is estimated as significantly more than the value of all Polyus’s current assets. So the question is, does Kerimov have enough funds to develop the deposit? Polyus’s ambition to increase its controlling interest in SL Zoloto [Gold] by purchasing 23.9% of equity from Rostec looks rather unexpected, given the size of the remaining costs of development of Natalka. Is Polyus facing bankruptcy and is the acquisition of Sukhoi Log a means to avoid it? Some experts believe that to find a way out of the mess, SL Zoloto will try to attract foreign investors by re-selling some of their equity. But the likelihood of a large foreign company to enter the project is low: Chinese companies are very careful when it comes to green field projects while American companies may not want to be minority shareholders, taking into account the country risks.”

A London mining market source comments: “Kerimov is gambling again with state bank money. He has borrowed on a bet that when the gold price starts up again he can almost double Polyus Gold’s gold reserves with the Sukhoi Log’s reserves, and then re-list Polyus shares at a whopping multiple to the price he paid for them. He’ll pay out his bank loans and pocket the profit. If he plays true to form, he won’t invest. He will help himself to as large a dividend as Polyus can afford. There will be no goldmine. Now why would the Kremlin agree to such a scheme?”

Leave a Reply