By John Helmer, Moscow

Mikail Shishkhanov (lead image, left and right) is the chief executive and control shareholder of B&N Bank (Бинбанк, BiNbank), one of the fastest growing banks in Russia today. What is driving that growth, however, is a combination of state money and influence in circumstances open to challenge from government regulators for the bank’s lack of transparency.

Four recent transactions by the bank and related-party companies involving Shishkhanov have drawn a warning from Central Bank first deputy governor, Sergei Shvetsov, that cash from the Central Bank and from privately subscribed pension funds is what is driving B&N Bank’s growth, and not too prudently or lawfully. “Shareholders are trying,” said Shvetsov, “to use the resources of pension funds not only for public investment in public instruments, but also to finance projects, fully or partially affiliated with the shareholders themselves”. To secure against conflict of interest and insider dealing, Shvetsov proposed to exercise “strict supervision.”

Shvetsov is head of financial market regulation at the Central Bank of Russia (CBR). His role, according to the bank, includes “countering malpractice in the financial market, including regulation and control over the observance of the requirements of Russian Federation legislation on countering the illegal use of insider information and market manipulation.”

This week the CBR was asked to clarify whether it is investigating related-party dealings in the sale of $150 million worth of B&N Bank bonds to the Safmar pension fund group, both controlled by Shishkhanov; the sale to Safmar of Rb3.2 billion ($44 million) in shares of Evroplan, a leasing company also controlled by Shishkhanov; the sale to Shishkhanov companies of Rb32.4 billion ($500 million) in shares of Russneft, the oil company controlled by Shishkhanov’s uncle, Mikhail Gutseriev; and finally, B&N Bank’s role in underwriting the sale of $60 million in fraudulent Tatfondbank bonds, weeks before the Central Bank imposed bankruptcy administration on Tatfondbank. The CBR would neither confirm nor deny, explaining “we don’t comment on actions connected with active banks.”

When the Federal Service for Financial Markets (FSFM), the formerly independent financial regulator now part of the CBR organization and directed by Shvetsov, was asked the same question, it replied: “We don’t comment on active banks and companies.”

A Russian oil industry banker says “it’s clear from Russneft’s share trading record since last November’s IPO that there is almost no sale volume. Also, the share price isn’t responding to the price of oil or to the movement of the other Russian oil companies. That means Russneft is closely held. There’s a fake float, not a free float.”

A reporter who has investigated some of the transactions says she has been told there are Central Bank investigations, but she doesn’t know the outcome.

Analysts from several investment houses and brokerages in the Russian market know the details of the four transactions. So do the ratings agencies in Moscow which have issued recent upgrades in outlook for Russneft. One analyst issues a caution that there is no genuine market demand for the oil company’s shares: “BIN bank hasn’t purchased Russneft shares, at least directly,” said the source requesting anonymity, “because in this case it would have been shown in their reports. Of course, the companies affiliated to BIN and Safmar group could have taken part in this deal, but we have no exact information about it, and we can’t disclose the information we actually have.”

Left: Sergei Shvetsov; right, Mikhail Gutseriev.

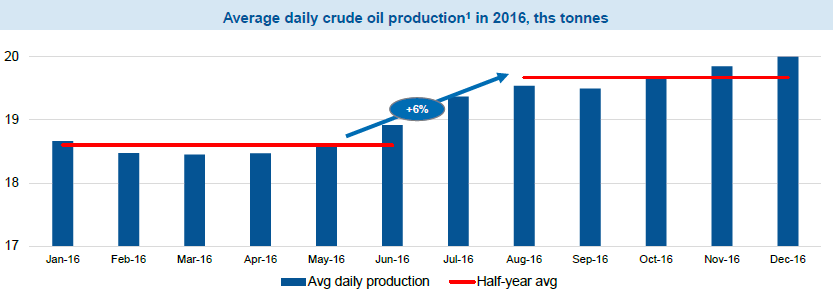

Late last month the Moody’s ratings agency issued a pale green light for Russneft, saying “the outlook on the ratings was changed to positive from stable. Our decision to upgrade RussNeft’s ratings reflects continued efforts by the company’s shareholders and management to reduce leverage and financing costs and extend debt maturity profile. We also recognize an improvement in RussNeft’s operating profile, resulting in reversal of the falling production trend since H2 2016. ”

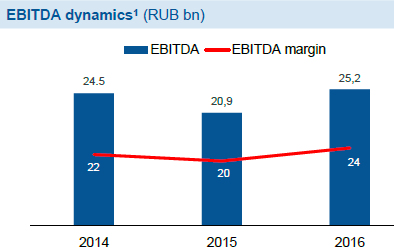

The lift in oil output looks like this, according to a Russneft presentation in April.

However, because the gain in the crude oil price which Glencore obtains for Russneft as its principal trader is small, on measures of sale revenues which have been dropping, and earnings (Ebitda) which have recovered to their 2014 level, the improvement for Russneft’s balance-sheet has been modest.

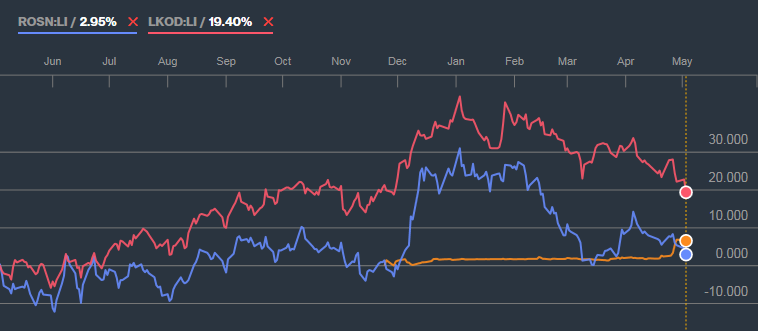

The stock market has not been impressed — to tell from the flat line in the Russneft share price from the Initial Public Offering (IPO) in November last year to late April of this year.

SHARE PRICE TRAJECTORIES OF RUSSNEFT, ROSNEFT AND LUKOIL

ONE-YEAR SHARE PRICE TRAJECTORY – RUSSNEFT FAILS TO MOVE

Key: yellow=Russneft; blue=Rosneft; pink=LUKoil. Source: https://www.bloomberg.com/quote/RNFT:RM

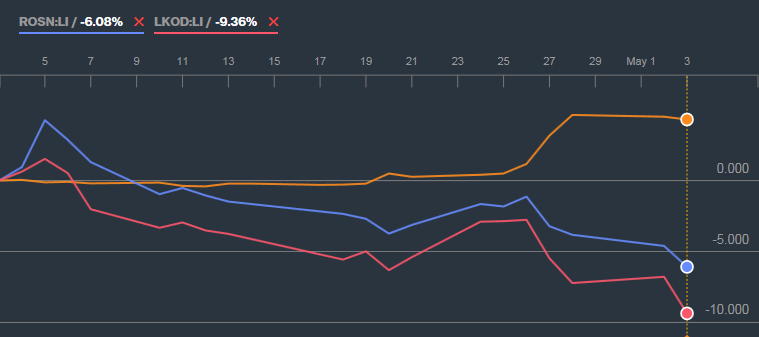

The abrupt move upwards of the Russneft share price on April 26 occurred without significant news from the company itself. The oil price at that moment was headed downwards, and so were the share prices of Rosneft and LUKoil, the Russian oil sector leaders.

ONE-MONTH SHARE PRICE TRAJECTORY – RUSSNEFT UP WHEN OTHERS FALL

Key: yellow=Russneft; blue=Rosneft; pink=LUKoil. Source: https://www.bloomberg.com/quote/RNFT:RM

So what was the reason for the pick-up? Russneft was asked this question, and replied: “The interest of the investors has risen after the close of the deal with the M-Video company. Companies affiliated to Safmar Group or B&N Bank didn’t take part in the purchasing of [Russneft] shares. Individual persons could buy some, but their amount is minor.”

Market sources say this is misleading. The M-Video acquisition, announced in mid-December 2016, was for the Gutseriev group to take a 58% stake in the Russian electronics retailer for $727 million. At that time the Russneft share price remained flat. The M-Video deal was subsequently approved by the Federal Antimonopoly Service in March of this year. Then on April 28 Safmar announced it was buying for Gutseriev, and was adding a tender offer to buy up all 42% of the M-Video shares outstanding. This Safmar offer didn’t lift M-Video’s share price to the level it had reached on the initial deal announcement in December.

Market sources believe the Safmar-M-Video deal by the Gutseriev group buys a cash cow from which Gutseriev and Shishkhanov can draw quickly if Russneft’s performance in the oil market falters, or if B&N Bank runs short of liquidity. They have bought dominance in a retail market segment much more cheaply than is possible in food retailing, like supermarkets, where competition is tougher and the market capitalization of the leaders more expensive. Also, the recent history of other cash cows in the Russian retail market – shoes, hot drinks – has revealed shareholder and bank loan fraud, which have destroyed investor confidence. For details, read the TsentrObuv story, and this tale of Shokoladnitsa.

Moscow and London sources explain that both the flat line of Russneft’s share price since November and the April 26 jump in share price have nothing to do with market demand for Russneft shares – because there is none. These sources claim Russneft sold its shares in the IPO to companies associated with Russneft, B&N Bank, Safmar, Gutseriev and Shishkhanov.

Officially, the Russneft announcement of the IPO explains who sold, but not who bought. “Following the IPO in late November, the Gutseriev family owns 60% of the charter capital (47% of the ordinary shares), Glencore plc trader controls 25% of the capital (33% of the ordinary shares), with the remaining 20% of the ordinary shares (15% of the charter capital) in free float. In late November 2016, Belyrian Holdings Limited and its subsidiaries in beneficial ownership of the Gutseriev family sold 20% of PJSC ‘RussNeft’ ordinary shares (15% of the charter capital) at the Moscow Exchange. In particular, Belyrian Holdings Ltd sold 6.41% of the ordinary shares which it owned directly. Its subsidiaries Bradinor Holdings Ltd (5.426%) and Cromeld Management Ltd (7.48%) also acted as sellers and are no longer shareholders of PJSC ‘RussNeft’. Neither the company, nor the deal makers disclosed the buyers’ identities.”

No Moscow analyst will speak on the record about what happened. The silent consensus is that the IPO was rigged by insiders.

Official statements issued by Glencore and Russneft imply the IPO valuation for Russneft shares was significantly higher than the one agreed earlier between Glencore and the Gutseriev family. According to this unusual press release issued by Glencore on March 13, 2015, to correct a statement by Gutseriev, “the Glencore group holds large minority interests in production subsidiaries of Russneft. Glencore confirms that it has agreed to a share exchange whereby Glencore would exchange these minority interests for a 49% shareholding in Russneft’s holding company. Completion of this share-for-share exchange remains outstanding. Also, contrary to certain media reports, no conversion has taken place of any of Russneft’s outstanding loan commitments to Glencore.”

Nine months later, Russneft reported there had been a debt repayment to Glencore,  as well as a debt-for-share swap which gave Russneft some Glencore-owned shares, but left Glencore with the remainder. “Acquisitions of non-controlling interests in subsidiaries in 2015 –” said Russneft in March 2017, “the Company acquired non-controlling interests in the production subsidiaries from the related parties of the Glencore Group as part of the transactions to convert promissory notes payable to the Glencore Group. The total amount of the transactions is USD 85 million or RUB 5,552 million at the exchange rate at the date of the transaction. The transactions were fully paid in cash in 2015 in the amount of RUB 5,454 million at the exchange rate at the date of the payment. The difference of RUB 19,453 million between the consideration and the carrying amount of the acquired interests was recognized in equity.” On the current Russneft board Glencore’s Alex Beard (above) holds one of Glencore’s two seats; the Gutseriev group occupies seven seats.

as well as a debt-for-share swap which gave Russneft some Glencore-owned shares, but left Glencore with the remainder. “Acquisitions of non-controlling interests in subsidiaries in 2015 –” said Russneft in March 2017, “the Company acquired non-controlling interests in the production subsidiaries from the related parties of the Glencore Group as part of the transactions to convert promissory notes payable to the Glencore Group. The total amount of the transactions is USD 85 million or RUB 5,552 million at the exchange rate at the date of the transaction. The transactions were fully paid in cash in 2015 in the amount of RUB 5,454 million at the exchange rate at the date of the payment. The difference of RUB 19,453 million between the consideration and the carrying amount of the acquired interests was recognized in equity.” On the current Russneft board Glencore’s Alex Beard (above) holds one of Glencore’s two seats; the Gutseriev group occupies seven seats.

Russneft’s annual report for 2015, issued in Russian (only) on March 31, 2016, disclosed something more. “In the 4th quarter 2015 the Group according to agreement reached earlier with the Glencore group has finished converting the current debt on the bills issued to the Interseal Ltd company into the stock of the Parent company. As a result of the completed transactions the related company with the Glencore group has received 46% in the share capital of the Parent company… At the same time the related companies of the Glencore group have sold the shares in subsidiaries of Group of the Parent company. The parent company has completely repaid the debt on bill obligations to the Glencore Group.”

Elsewhere in the 2015 Russneft report, it was disclosed that Russneft had paid Glencore’s entity Interseal an accumulated debt plus interest of $1.3 billion, and continued to hold 46% of Russneft’s capital through an entity called Rambero AG.

The difference between the 49% shareholding Glencore claimed it owned in Russneft in March 2015; the 46% of capital Russneft said Glencore owned at the end of 2015; and the 33% shareholding (25% of share capital) Russneft reports Glencore has held since the IPO suggests that Glencore and Russneft have been trading money for shares at a discount of about 25% to the Rb550 per share price reportedly fixed at the IPO. The difference – call it the discount agreed between Glencore and Russneft, or the premium attributed in the market capitalization — appears to be price support from the Gutseriev group, B&N Bank, and Safmar.

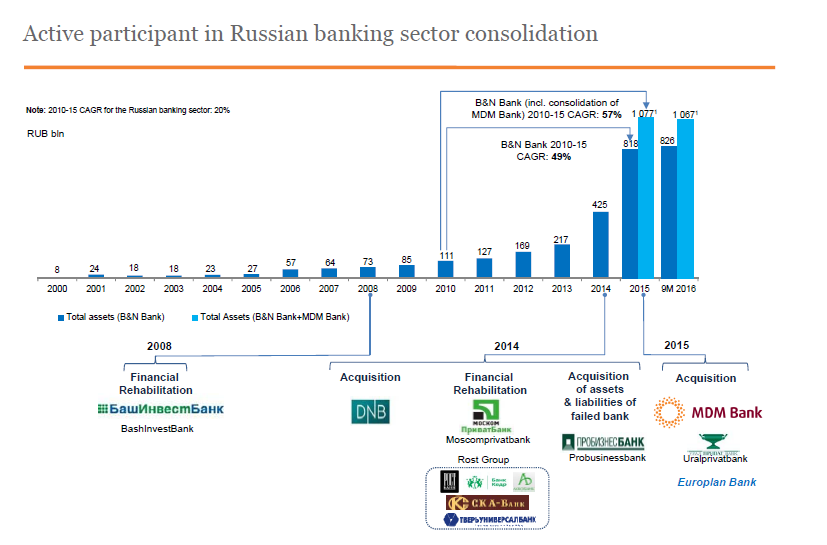

Shishkhanov and Gutseriev have publicized their bank acquisitions as a case of the Good Samaritan. “Meet the Russian Billionaire Who’s Buying Up His Country’s Banks” was the headline of a promo published eighteen months ago by Bloomberg. “Russia’s economic crisis has put dozens of banks out of business this year and is threatening many more. PJSC B&N Bank, founded by Mikhail Gutseriev, the billionaire owner of OAO Russneft, is one of the beneficiaries. In recent months, the company has gobbled up a string of troubled lenders to become one of Russia’s largest private banks.”

Two Bloomberg journalists report being feted “in a conference room on the top sixth floor of its headquarters in Moscow, [with] free cigarettes — the old-fashioned kind as well as the electronic variety — and to company-branded chocolates.” Shishkhanov, the reporters noted, “said he is seeking to take advantage of what he sees as Russia’s undervalued assets to expand in banking, real estate and natural resources…’We aren’t earning as much as we planned, but we have the possibility to grow through acquisitions.’ ” Shishkhanov didn’t say much; he wasn’t asked much either.

“’Sanctions didn’t open any doors per se. Rather, new possibilities appeared as a private organization,’ Shishkhanov told Bloomberg. ‘ B&N has for years aspired to become a nationally important lender. After its acquisitions, it has more assets than some of the 10 banks already considered systemically important. That means that it may be eligible for more government support. ‘Once all the assets have been incorporated and we get everything in order, we’ll have a seat at that table’, Shishkhanov said.”

By that table, Shishkhanov meant the Central Bank feeding-trough. The transaction record he has made over the past year reveals to Russian bank analysts that Shishkhanov’s strategy is to channel large amounts of state cash from the CBR on to the books of his bank; and then to lend the money out to enterprises and transactions in which Shishkhanov, the Gutseriev family, and their companies are the beneficiaries.

ASSETS UNDER SHISHKHANOV’S MANAGEMENT

Source: https://www.binbank.ru/upload/eng/Investor%20Presentation_December_ENG.pdf

A presentation to investors last month by B&N shows the bank growing out of a cash management pocket of the Gutseriev group with the injection of Central Bank loans to cover the takeover and rehabilitation of bankrupt or distressed banks. The apparently cashless merger with MDM Bank is described in B&N’s report for 2016 as a conversion of shares finalized on November 16, 2016.

Click on chart to enlarge

Source: https://eng.binbank.ru/upload/docs/rates/B&N%20Bank%20Investor%20Presentation%20(April%202017).pdf For more details of the transaction history from the Russian bank sector publication, Banki.ru, click to read.

No public record from B&N or MDM, nor press or ratings agency reports, has been found for the transaction value or cash equivalent of the MDM deal. If MDM control shareholder, Sergei Popov. received money from Gutseriev and Shishkhanov for taking MDM’s liabilities off his hands, the evidence is missing.

A Moscow bank analyst comments: “In 2015 it was B&N Bank’s consolidation of MDM and a row of [Central Bank] sanitations [rehabilitations] of small banks which created the bank’s current size. During the sanitation process B&N has taken the assets and liabilities of these banks. That’s why its capitalization rose so rapidly. The sanitation bank receives a credit from the Central Bank to clear the balance-sheet of the sanitized banks at a very small percentage interest rate — almost without interest — for five to ten years. As usual, the sanitizing bank must report about its actions on the sanitized banks to the CBR. But in fact these banks can become ‘dead souls’, and the money can be removed. It’s a very difficult operation, but it’s possible.”

The process has expanded B&N’s assets and capital, but apparently not its international creditworthiness. The only bank bond issued on the international market by B&N, managed by recognized international banks, occurred in 2006. The $200 million bond managers then were Commerzbank (Germany) and Merrill Lynch (Bank of America), with London as the trading floor. No international bank has since accepted B&N bond mandates.

Instead, in March 2016 the bank issued $150 million in 3-year paper through the Hong Kong market with small Hong Kong managers, SC Lowy and Xiaxin Securities. Here is the bank’s announcement. International banking sources familiar with the Russian market believe Safmar and other Shishkhanov pension funds bought the bonds. According to regulations of the Federal Service for Financial Markets (FSFM), while the ownership of pension funds by banks is permitted, conflicts of interest in transactions between banks and the pension funds they own are not allowable. So far there has been no Russian enforcement.

In another case reported in the Russian business press on February 8, 2016, conflict of interest concerns were raised publicly when Shishkhanov sold a 25% shareholding in his Europlan leasing company to pension funds he controlled. The transaction was worth about Rb3.3 billion (about $44 million). Analysts at Sberbank were quoted as warning: “Such investments are not optimally equitable for the interests of clients, and the signs are visible of the conflict of interests between the clients and the owners of the pension funds. The Central Bank has to toughen requirements for investment into projects affiliated with the owners of the pension funds because this practice hurts the reputation of the funded pension system.”

In fact, the Europlan share sale has gone unregulated. The Shishkhanov pension funds were accumulating illiquid and untradeable liabilities – for the benefit of Shishkhanov. The Central Bank refused to answer reporters’ questions.

Another of B&N’s transactions last year has raised concerns of malpractice, though not yet in the Russian market media. This was B&N’s underwriting of a $60 million bond issue for Tatfondbank, a well-known Tatarstan regional bank, in November 2016. SC Lowy and Xiaxin Securities were also involved with B&N Bank as lead managers of the bond issue registered in Ireland. Click to read the official announcement. The name of Merdeka Capital identified in this announcement is the new name Xiaxin Securities took for itself starting on August 30, 2016.

In less than six weeks after the bond sale, Tatfondbank was put into bankruptcy administration by the CBR. The parlous financial condition of Tatfondbank was widely believed in the market before the bond sale. Subsequently, this report of March 17, 2017, revealed the fraud involved in the transaction because Tatfondbank was collapsing at the time the bonds were placed, and because the bond sale proceeds disappeared immediately. By then arrests of Tatfondbank executives had commenced. London sources are convinced Shishkhanov must have known the condition of Tatfondbank at the time B&N sold the bonds. Central Bank first deputy governor Dmitry Tulin has claimed: “I didn’t think [Tatfondbank had] placed Eurobonds since May. If they did, it means we didn’t have a legal justification to forbid it. But we had a very open dialogue with them.”

Left: Deputy chairman of the board at Tatfondbank, Vadim Merzlyakov, in Kazan's Sovetsky District Court charged with embezzlement, February 10, 2017. Right: CBR first deputy governor Dmitry Tulin, January 13, 2017.

Last week Shishkhanov’s spokesman at the bank was asked to respond to questions about the four transactions: was there conflict of interest in Safmar buying Europlan shares? Was there conflict of interest and violations of banking practice when Safmar bought B&N Bank bonds? Why did B&N Bank fail to inform investors in the selling of Tatfondbank bonds that the bank was operating in insolvency? Did B&N Bank or any unit of the Safmar group or associated entities buy Russneft shares at last November’s IPO? The bank has not replied.

Last October, just before the Russneft and Tatfondbank issues, Shishkhanov told an interviewer from RBC: “We want to be transparent and clear to the regulator and investors.”

Leave a Reply